Question: Required 1 Required 2 Required 3 Required 4 Required 5 Complete the merchandise purchases budget and the schedule of expected cash disbursements for merchandise purchases.

Required

Required

Required

Required

Required

Complete the merchandise purchases budget and the schedule of expected cash disbursements for merchandise purchases.

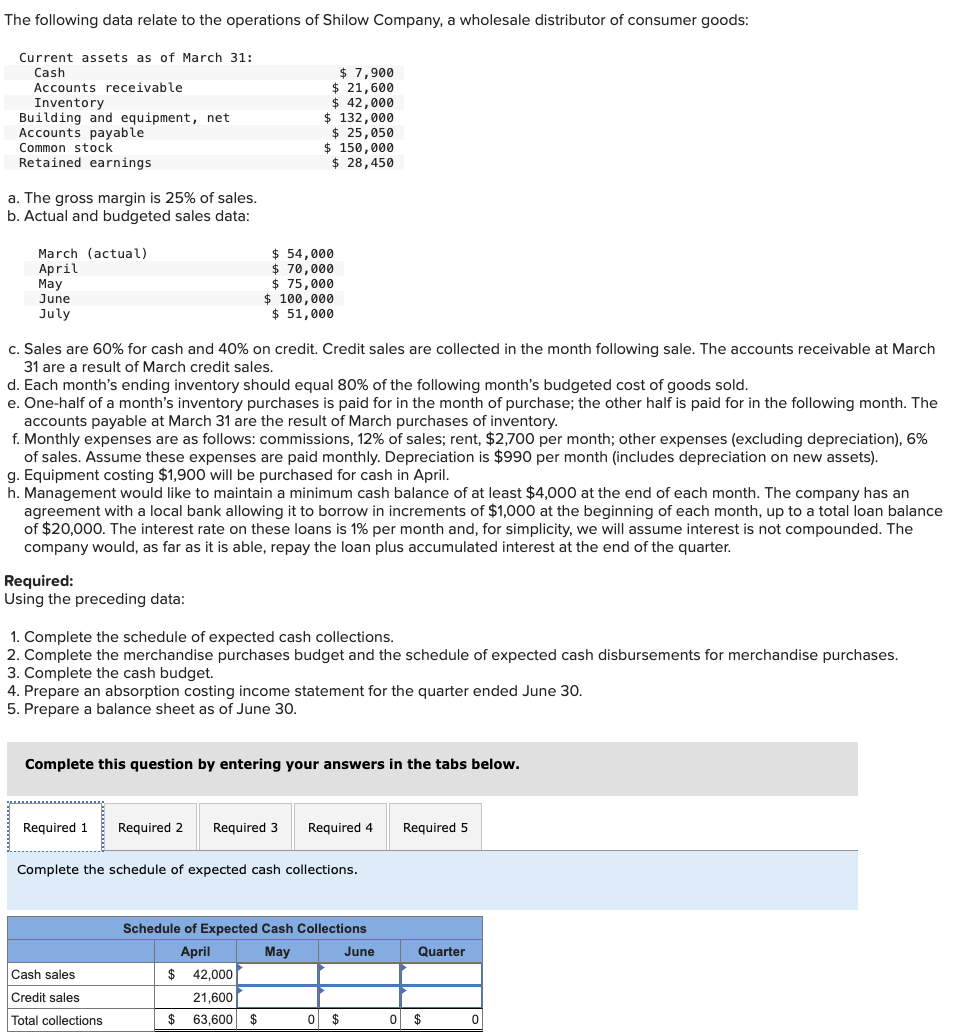

begintabularccccc

hline multicolumncMerchandise Purchases Budget

hline & April & May & June & Quarter

hline Budgeted cost of goods sold & $ & $ & &

hline Add desired ending merchandise inventory & & & &

hline Total needs & & & &

hline Less beginning merchandise inventory & & & &

hline Required purchases & $ & $ & $ & $

hline multicolumnlBudgeted cost of goods sold for April $ sales times $

hline multicolumnlAdd desired ending inventory for April $ times $

hline multicolumncSchedule of Expected Cash DisbursementsMerchandise Purchases

hline & April & May & June & Quarter

hline March purchases & $ & & & $

hline April purchases & & & &

hline May purchases & & & &

hline June purchases & & & &

hline Total disbursements & $ & $ & $ & $

hline

endtabular Required

Required

Required

Required

Complete the cash budget.

Note: Cash deficiency, repayments and interest should be indicated by a minus sign.

begintabularccccc

hline multicolumncShilow Company

hline multicolumncCash Budget

hline & April & May & June & Quarter

hline Beginning cash balance & $ & & &

hline Add collections from customers & & & &

hline Total cash available & & & &

hline Less cash disbursements: & & & &

hline For inventory & & & &

hline For expenses & & & &

hline For equipment & & & &

hline Total cash disbursements & & & &

hline Excess deficiency of cash available over disbursements & & & &

hline Financing: & & & &

hline Borrowings & & & &

hline Repayments & & & &

hline Interest & & & &

hline Total financing & & & &

hline Ending cash balance & $ & $ & $ & $

hline

endtabular Required

Required

Required

Required

Required

Prepare an absorption costing income statement for the quarter ended Jun

Shilow Company

Income Statement

For the Quarter Ended June

begintabularccc

hline F & &

hline Cost of goods sold: & &

hline & &

hline F & &

hline & &

hline P & &

hline P & &

hline Selling and administrative expenses: & &

hline P & &

hline F & &

hline & &

hline & &

hline & P &

hline & &

hline P & &

hline P & &

hline & &

hline

endtabular

Prepare a balance sheet as of June

Shilow Company

Balance Sheet

June

Assets

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock