Question: Required: 1. Using the data from this list, calculate the amounts for the following on January 1, 2024. 2. Enter the beginning balances and 2024

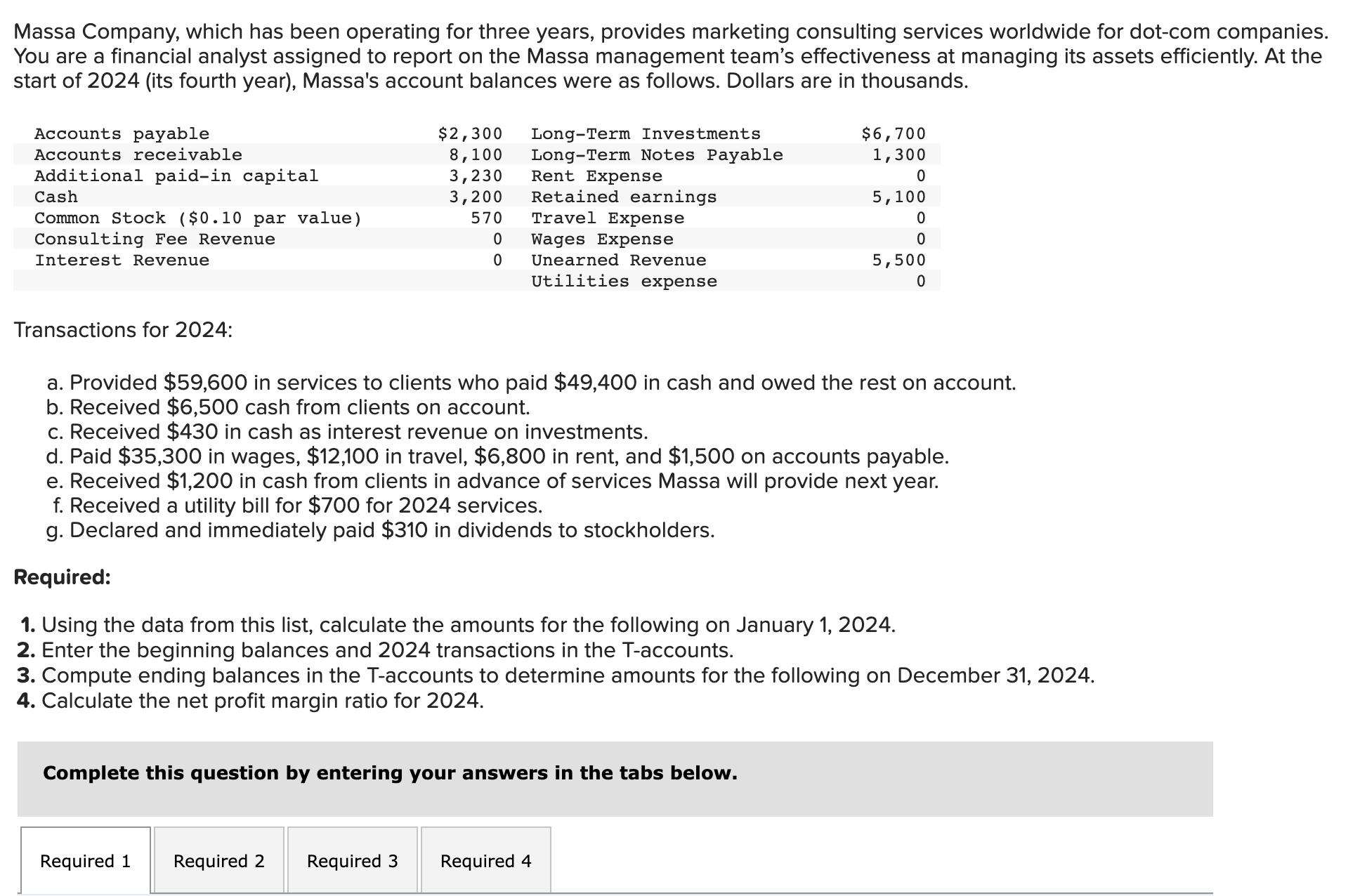

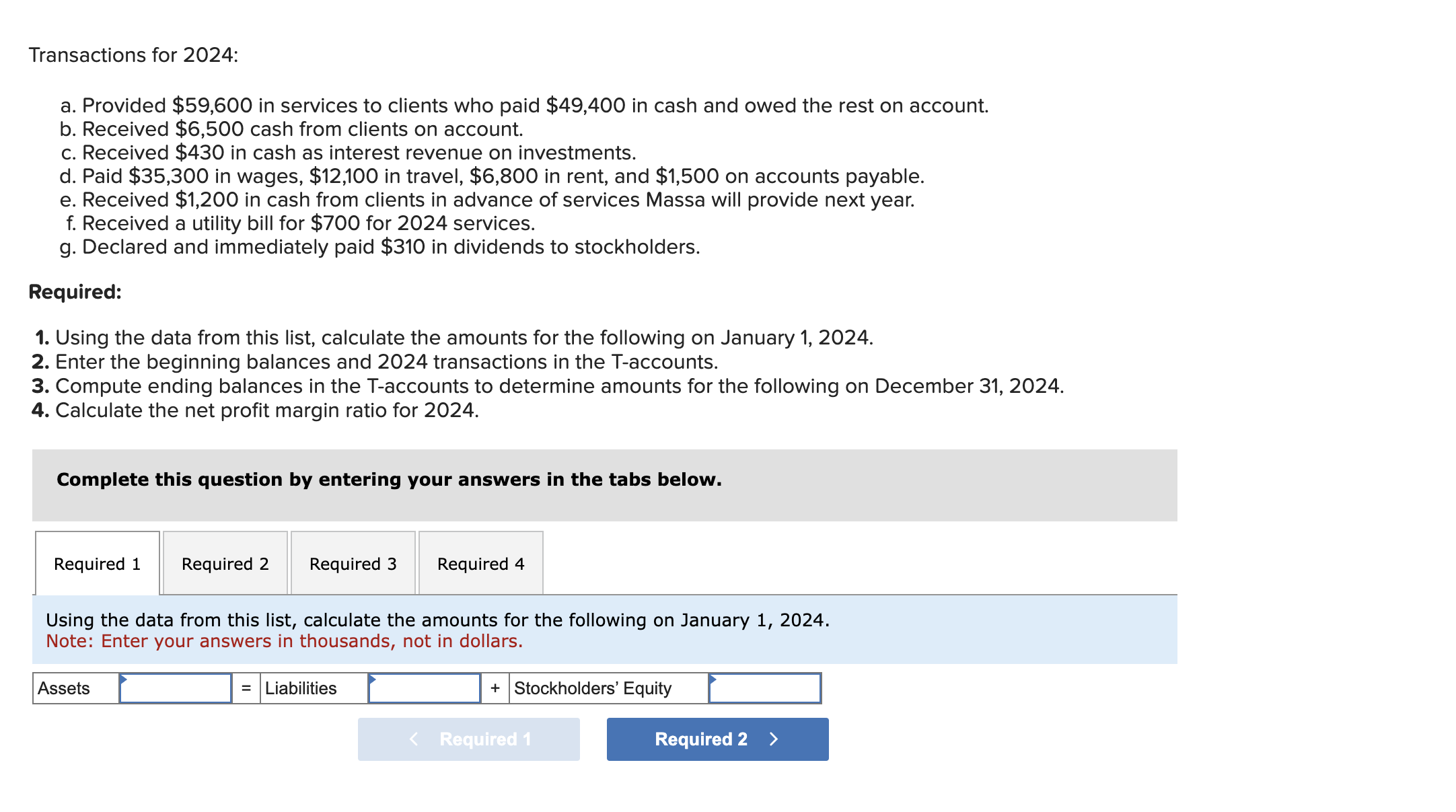

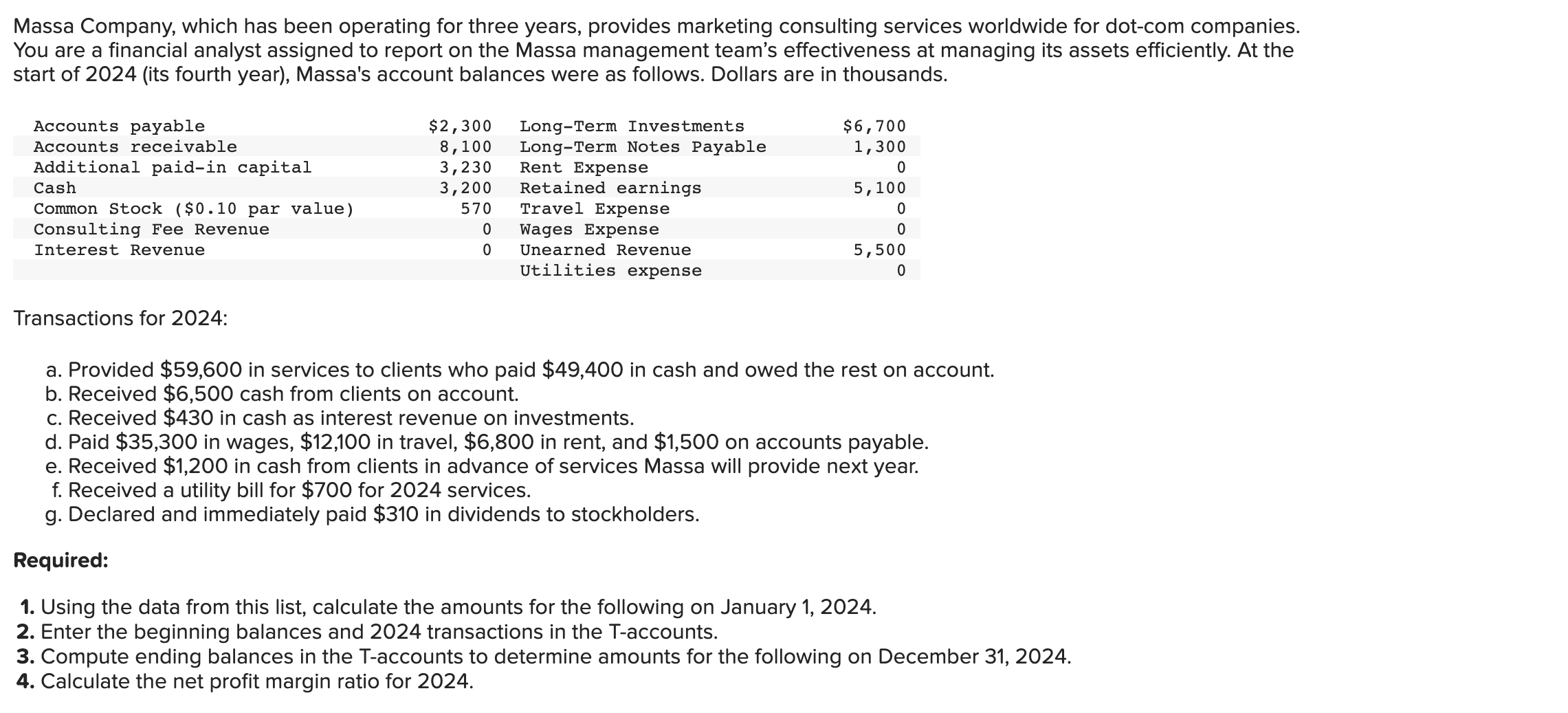

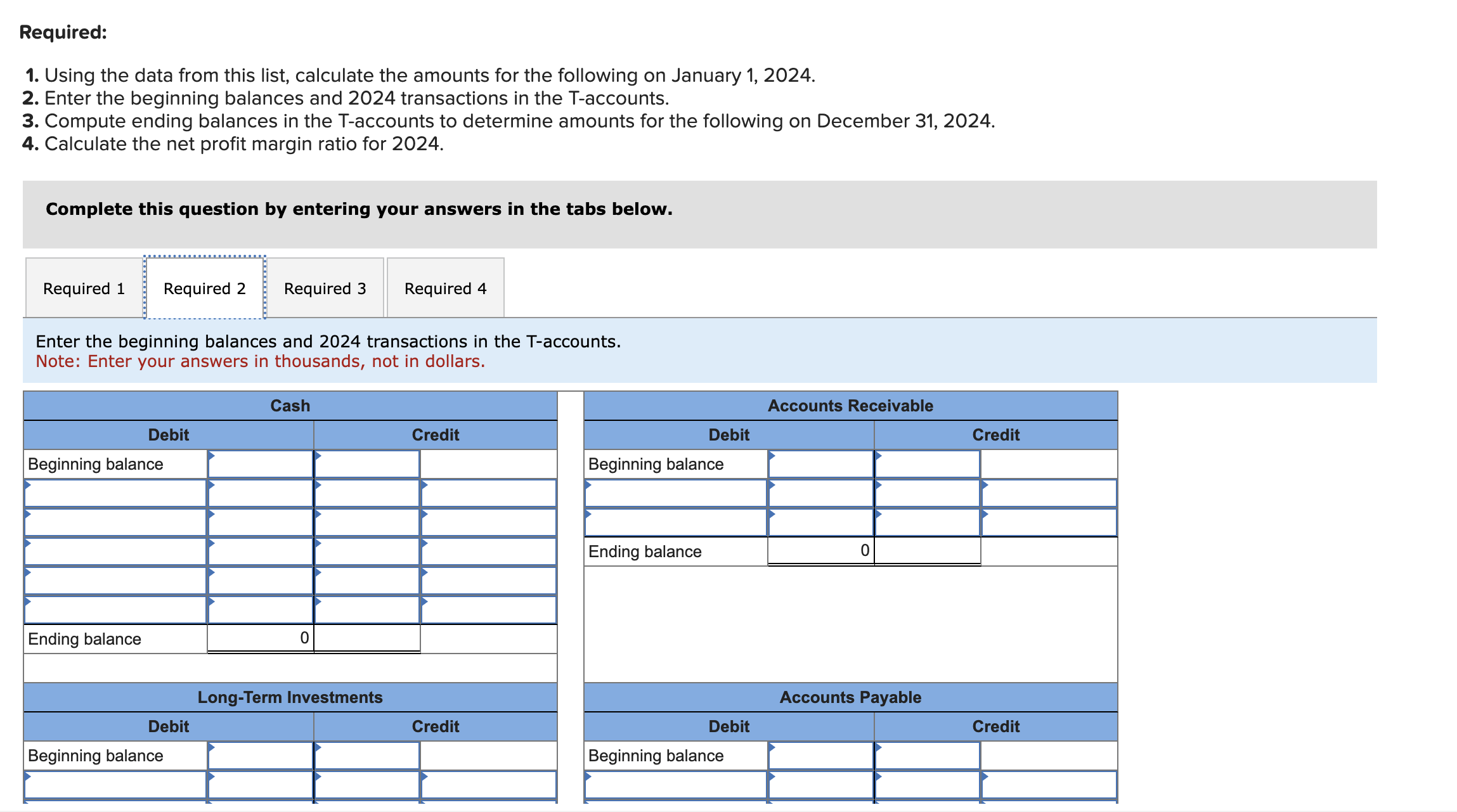

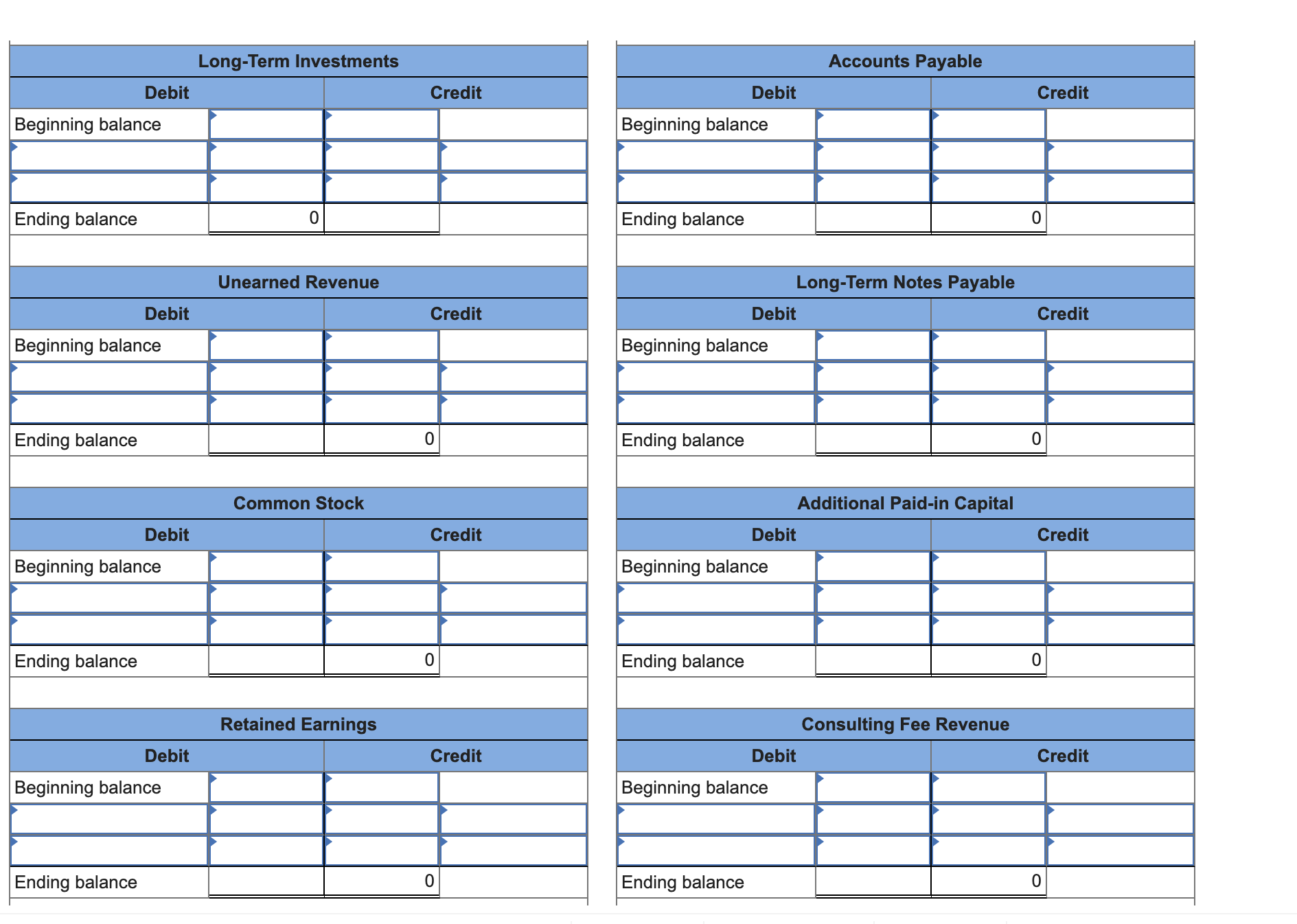

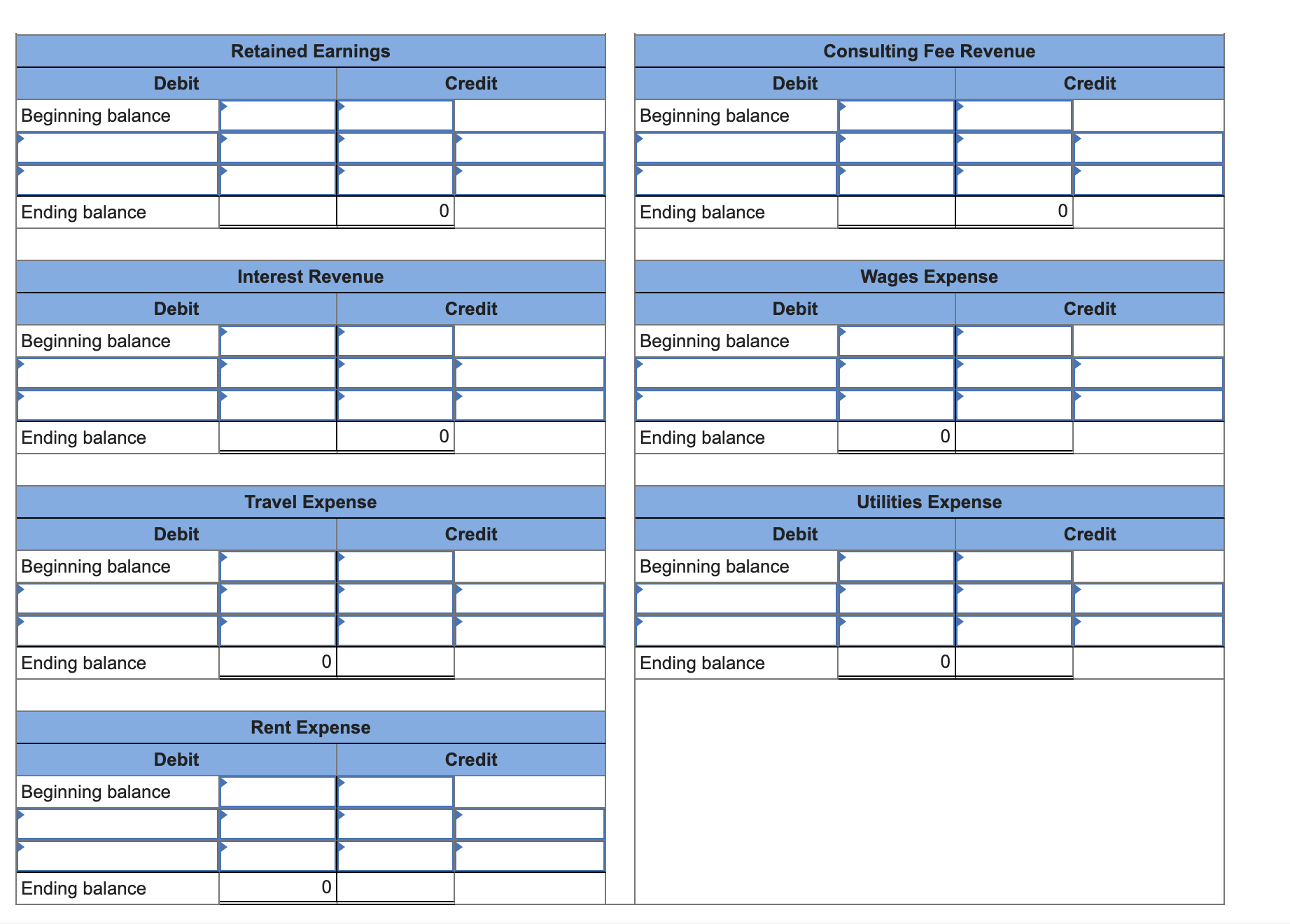

Required: 1. Using the data from this list, calculate the amounts for the following on January 1, 2024. 2. Enter the beginning balances and 2024 transactions in the T-accounts. 3. Compute ending balances in the T-accounts to determine amounts for the following on December 31, 2024. 4. Calculate the net profit margin ratio for 2024 . Complete this question by entering your answers in the tabs below. Enter the beginning balances and 2024 transactions in the T-accounts. Note: Enter your answers in thousands, not in dollars. Massa Company, which has been operating for three years, provides marketing consulting services worldwide for dot-com companies. You are a financial analyst assigned to report on the Massa management team's effectiveness at managing its assets efficiently. At the start of 2024 (its fourth year), Massa's account balances were as follows. Dollars are in thousands. Transactions for 2024: a. Provided $59,600 in services to clients who paid $49,400 in cash and owed the rest on account. b. Received $6,500 cash from clients on account. c. Received $430 in cash as interest revenue on investments. d. Paid $35,300 in wages, $12,100 in travel, $6,800 in rent, and $1,500 on accounts payable. e. Received $1,200 in cash from clients in advance of services Massa will provide next year. f. Received a utility bill for $700 for 2024 services. g. Declared and immediately paid $310 in dividends to stockholders. Required: 1. Using the data from this list, calculate the amounts for the following on January 1, 2024. 2. Enter the beginning balances and 2024 transactions in the T-accounts. 3. Compute ending balances in the T-accounts to determine amounts for the following on December 31, 2024. 4. Calculate the net profit margin ratio for 2024 . Complete this question by entering your answers in the tabs below. Transactions for 2024: a. Provided $59,600 in services to clients who paid $49,400 in cash and owed the rest on account. b. Received $6,500 cash from clients on account. c. Received $430 in cash as interest revenue on investments. d. Paid $35,300 in wages, $12,100 in travel, $6,800 in rent, and $1,500 on accounts payable. e. Received $1,200 in cash from clients in advance of services Massa will provide next year. f. Received a utility bill for $700 for 2024 services. g. Declared and immediately paid $310 in dividends to stockholders. Required: 1. Using the data from this list, calculate the amounts for the following on January 1, 2024. 2. Enter the beginning balances and 2024 transactions in the T-accounts. 3. Compute ending balances in the T-accounts to determine amounts for the following on December 31, 2024. 4. Calculate the net profit margin ratio for 2024 . Complete this question by entering your answers in the tabs below. Using the data from this list, calculate the amounts for the following on January 1, 2024. Note: Enter your answers in thousands, not in dollars. Massa Company, which has been operating for three years, provides marketing consulting services worldwide for dot-com companies. You are a financial analyst assigned to report on the Massa management team's effectiveness at managing its assets efficiently. At the start of 2024 (its fourth year), Massa's account balances were as follows. Dollars are in thousands. Transactions for 2024: a. Provided $59,600 in services to clients who paid $49,400 in cash and owed the rest on account. b. Received $6,500 cash from clients on account. c. Received $430 in cash as interest revenue on investments. d. Paid $35,300 in wages, $12,100 in travel, $6,800 in rent, and $1,500 on accounts payable. e. Received $1,200 in cash from clients in advance of services Massa will provide next year. f. Received a utility bill for $700 for 2024 services. g. Declared and immediately paid $310 in dividends to stockholders. Required: 1. Using the data from this list, calculate the amounts for the following on January 1, 2024. 2. Enter the beginning balances and 2024 transactions in the T-accounts. 3. Compute ending balances in the T-accounts to determine amounts for the following on December 31, 2024. 4. Calculate the net profit margin ratio for 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts