Question: Required: 1. Using the indirect method, determine the net cash provided by/used in operating activities for this year. (List any deduction in cash and cash

Required:

1. Using the indirect method, determine the net cash provided by/used in operating activities for this year. (List any deduction in cash and cash outflows as negative amounts.)

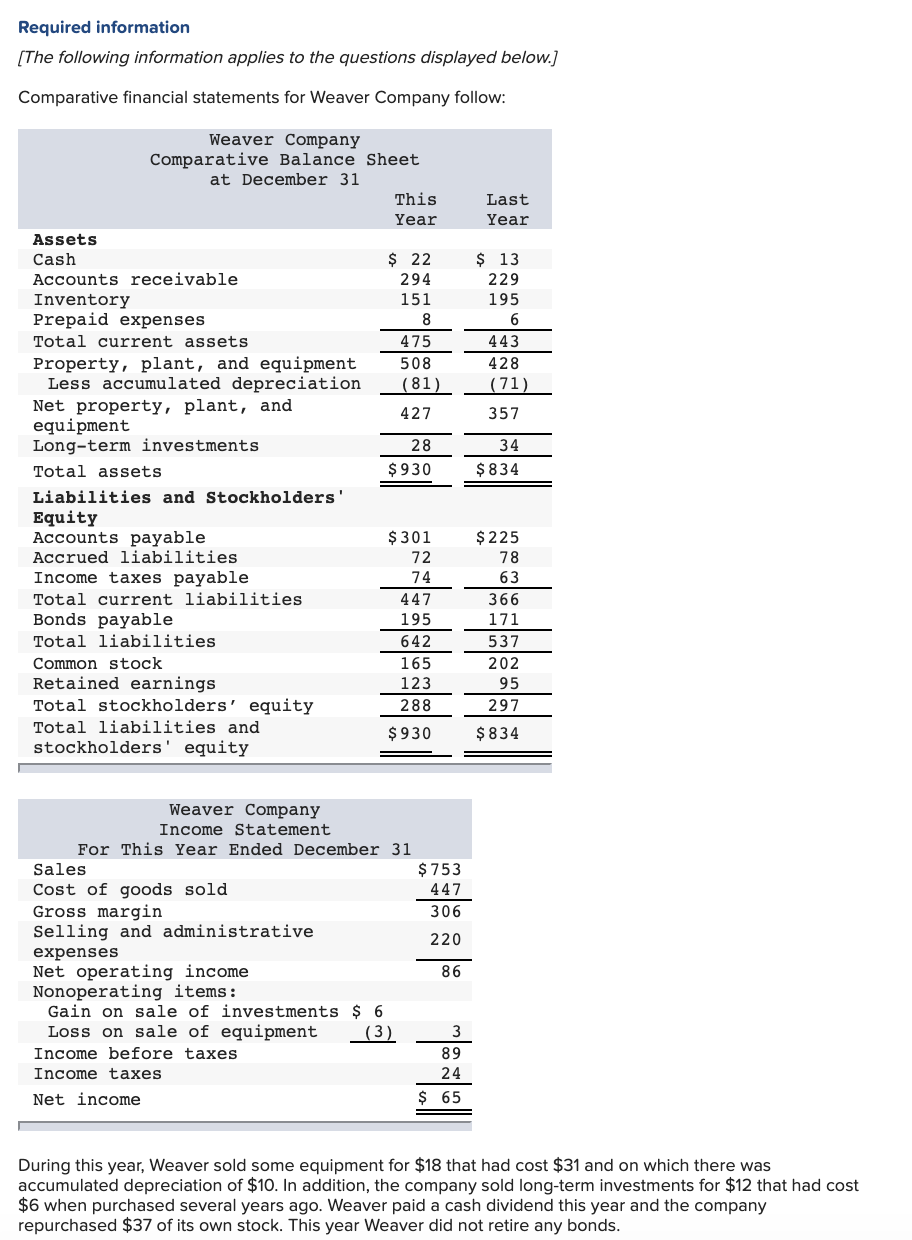

Required information [The following information applies to the questions displayed below.] Comparative financial statements for Weaver Company follow: Last Year $ 13 229 195 6 443 428 (71) 357 Weaver Company Comparative Balance Sheet at December 31 This Year Assets Cash $ 22 Accounts receivable 294 Inventory 151 Prepaid expenses 8 Total current assets 475 Property, plant, and equipment 508 Less accumulated depreciation (81) Net property, plant, and 427 equipment Long-term investments 28 Total assets $ 930 Liabilities and Stockholders' Equity Accounts payable $ 301 Accrued liabilities 72 Income taxes payable 74 Total current liabilities 447 Bonds payable 195 Total liabilities 642 Common stock 165 Retained earnings 123 Total stockholders' equity 288 Total liabilities and $930 stockholders' equity 34 $ 834 $ 225 78 63 366 171 537 202 95 297 $ 834 Weaver Company Income Statement For This Year Ended December 31 Sales $ 753 Cost of goods sold 447 Gross margin 306 Selling and administrative 220 expenses Net operating income 86 Nonoperating items : Gain on sale of investments $ 6 Loss on sale of equipment (3) 3 Income before taxes 89 Income taxes 24 Net income $ 65 la mala During this year, Weaver sold some equipment for $18 that had cost $31 and on which there was accumulated depreciation of $10. In addition, the company sold long-term investments for $12 that had cost $6 when purchased several years ago. Weaver paid a cash dividend this year and the company repurchased $37 of its own stock. This year Weaver did not retire any bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts