Question: Required: 1 What are the balances that will be impacted if the company decides to convert to IFRS? 2 What are the journal entries that

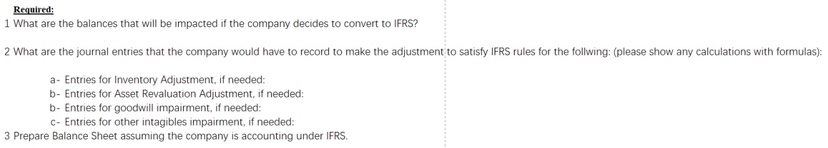

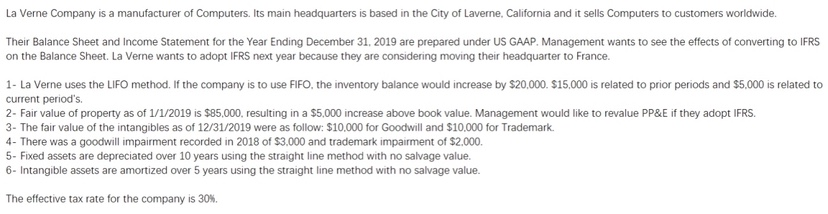

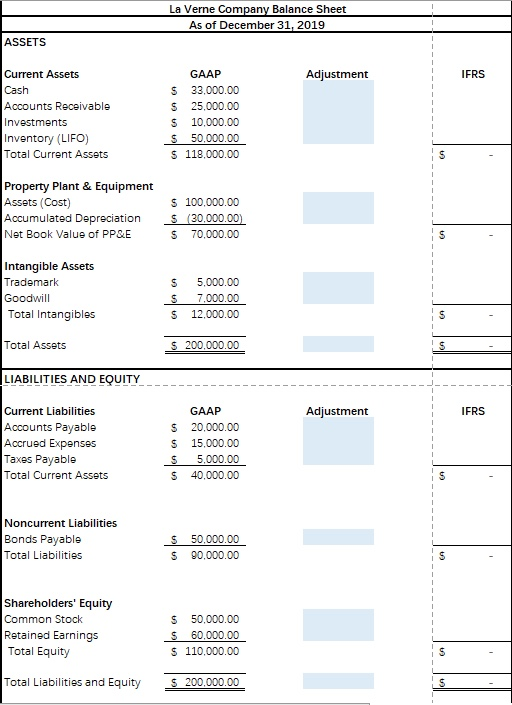

Required: 1 What are the balances that will be impacted if the company decides to convert to IFRS? 2 What are the journal entries that the company would have to record to make the adjustment to satisfy IFRS rules for the follwing: (please show any calculations with formulas): a- Entries for Inventory Adjustment, if needed: b- Entries for Asset Revaluation Adjustment, if needed: b- Entries for goodwill impairment, if needed: C- Entries for other intagibles impairment, if needed: 3 Prepare Balance Sheet assuming the company is accounting under IFRS. La Verne Company is a manufacturer of Computers. Its main headquarters is based in the City of Laverne, California and it sells Computers to customers worldwide. Their Balance Sheet and Income Statement for the Year Ending December 31, 2019 are prepared under US GAAP. Management wants to see the effects of converting to IFRS on the Balance Sheet. La Verne wants to adopt IFRS next year because they are considering moving their headquarter to France. 1- La Verne uses the LIFO method. If the company is to use FIFO, the inventory balance would increase by $20.000. $15,000 is related to prior periods and $5.000 is related to current period's 2- Fair value of property as of 1/1/2019 is $85,000, resulting in a $5,000 increase above book value. Management would like to revalue PP&E if they adopt IFRS. 3- The fair value of the intangibles as of 12/31/2019 were as follow: $10,000 for Goodwill and $10.000 for Trademark. 4- There was a goodwill impairment recorded in 2018 of $3.000 and trademark impairment of $2.000. 5- Fixed assets are depreciated over 10 years using the straight line method with no salvage value. 6- Intangible assets are amortized over 5 years using the straight line method with no salvage value. The effective tax rate for the company is 30%. La Verne Company Balance Sheet As of December 31, 2019 ASSETS Adjustment IFRS Current Assets Cash Accounts Receivable Investments Inventory (LIFO) Total Current Assets GAAP $ 33,000.00 $ 25,000.00 $ 10,000.00 $ 50,000.00 $ 118,000.00 S Property Plant & Equipment Assets (Cost) Accumulated Depreciation Net Book Value of PP&E $ 100,000.00 $ (30.000.00) S 70,000.00 S Intangible Assets Trademark Goodwill Total Intangibles S 5 S 5,000.00 7,000.00 12,000.00 S Total Assets $ 200,000.00 S LIABILITIES AND EQUITY Adjustment IFRS Current Liabilities Accounts Payable Accrued Expenses Taxes Payable Total Current Assets GAAP S 20,000.00 $ 15,000.00 S 5.000.00 $ 40,000.00 S Noncurrent Liabilities Bonds Payable Total Liabilities $ 50,000.00 $ 90,000.00 S Shareholders' Equity Common Stock Retained Earnings Total Equity $ 50,000.00 $ 60.000.00 $ 110,000.00 S Total Liabilities and Equity $ 200,000.00 S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts