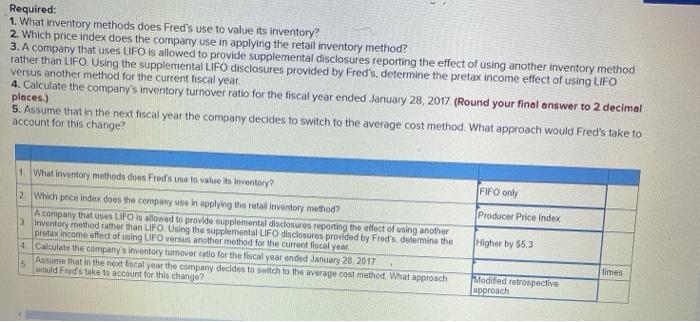

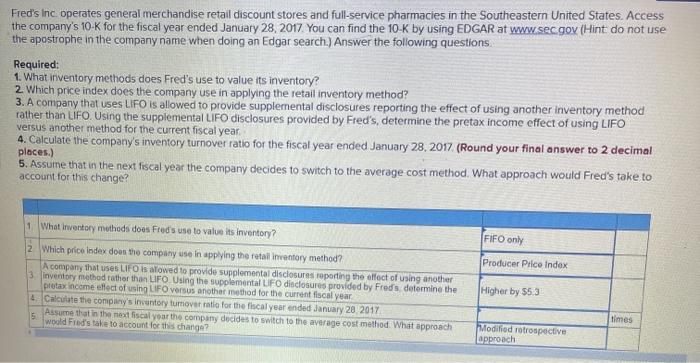

Question: Required: 1. What inventory methods does Fred's use to value its inventory? 2. Which price index does the company use in applying the retail inventory

Required: 1. What inventory methods does Fred's use to value its inventory? 2. Which price index does the company use in applying the retail inventory method? 3. A company that uses LIFO is allowed to provide supplemental disclosures reporting the effect of using another inventory method rather than LIFO. Using the supplemental LIFO disclosures provided by Fred's, determine the pretax income effect of using LIFO versus another method for the current fiscal year, 4. Calculate the company's inventory turnover ratio for the fiscal year ended January 28, 2017 (Round your final answer to 2 decimal places.) 5. Assume that in the next fiscal year the company decides to switch to the average cost method. What approach would Fred's take to account for this change? 1. What inventory methods dous Fred's use to value Inventory? FIFO only Producer Price Index 2 Which price index does the company use in applying the retail inventory method? A company that uses UFO is allowed to provide supplemental disclosures reporting the effect of using another 3 Inventory method rather than LIFO Using the supplemental LIFO disclosures provided by Fred's determine the protax income effect of using UFO versus another method for the current fiscal year 4 Calculate the company's inventory tumover ratio for the fiscal year ended January 28, 2017 Assume that in the next fiscal year the company decides to switch to the average cost method. What approach would Fred's take to account for this change? Higher by $5.3 times Modified retrospective approach Required: 1. What inventory methods does Fred's use to value its inventory? 2. Which price index does the company use in applying the retail inventory method? 3. A company that uses LIFO is allowed to provide supplemental disclosures reporting the effect of using another inventory method rather than LIFO. Using the supplemental LIFO disclosures provided by Fred's, determine the pretax income effect of using LIFO versus another method for the current fiscal year, 4. Calculate the company's inventory turnover ratio for the fiscal year ended January 28, 2017 (Round your final answer to 2 decimal places.) 5. Assume that in the next fiscal year the company decides to switch to the average cost method. What approach would Fred's take to account for this change? 1. What inventory methods dous Fred's use to value Inventory? FIFO only Producer Price Index 2 Which price index does the company use in applying the retail inventory method? A company that uses UFO is allowed to provide supplemental disclosures reporting the effect of using another 3 Inventory method rather than LIFO Using the supplemental LIFO disclosures provided by Fred's determine the protax income effect of using UFO versus another method for the current fiscal year 4 Calculate the company's inventory tumover ratio for the fiscal year ended January 28, 2017 Assume that in the next fiscal year the company decides to switch to the average cost method. What approach would Fred's take to account for this change? Higher by $5.3 times Modified retrospective approach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts