Question: Required: 1. What is the total cost, in present value terms, of the Solvent-Paint System? 2. What is the total cost, in present value terms,

Required:

1. What is the total cost, in present value terms, of the Solvent-Paint System?

2. What is the total cost, in present value terms, of the Powder-Paint System?

3. What is the most the firm should be willing to pay for the powder-based process?

(For all requirements, Round your answer to the nearest dollar amount.)

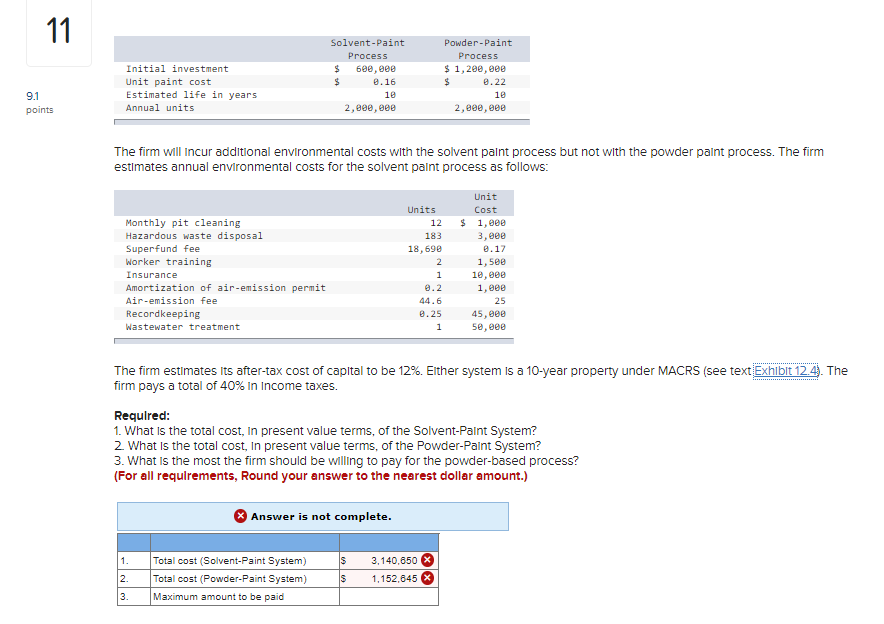

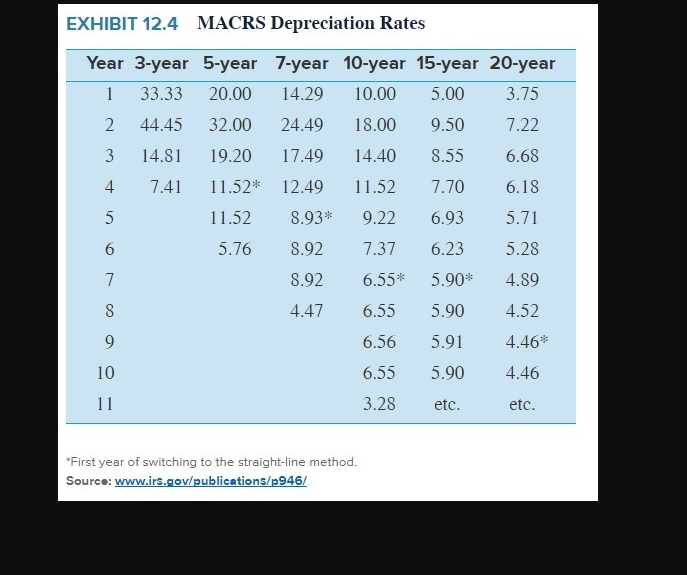

11 Solvent-Paint Process $ 600, eee $ 0.16 10 2,000, eee Initial investment Unit paint cost Estimated life in years Annual units Powder-Paint Process $ 1,200, eee $ 0.22 10 2,800, eee 9.1 points The firm will incur additional environmental costs with the solvent palnt process but not with the powder paint process. The firm estimates annual environmental costs for the solvent paint process as follows: Monthly pit cleaning Hazardous waste disposal Superfund fee Worker training Insurance Amortization of air-emission permit Air-emission fee Recordkeeping Wastewater treatment Units 12 183 18,690 2 1 0.2 44.6 0.25 1 Unit Cost $ 1,200 3, eee 8.17 1,500 10, eee 1, see 25 45,000 5e,eee The firm estimates its after-tax cost of capital to be 12%. Either system is a 10-year property under MACRS (see textExhibit 124. The firm pays a total of 40% In Income taxes. Required: 1. What is the total cost in present value terms of the Solvent-Paint System? 2. What is the total cost, In present value terms of the Powder-Paint System? 3. What is the most the firm should be willing to pay for the powder-based process? (For all requirements, Round your answer to the nearest dollar amount.) Answer is not complete. 1. $ Total cost (Solvent-Paint System) Total cost (Powder-Paint System) Maximum amount to be paid 3.140.650 X 1.152.645 X 2. IS 3. EXHIBIT 12.4 MACRS Depreciation Rates Year 3-year 5-year 7-year 10-year 15-year 20-year 1 33.33 20.00 14.29 10.00 5.00 3.75 2 44.45 24.49 18.00 9.50 7.22 32.00 19.20 3 14.81 17.49 14.40 8.55 6.68 4 7.41 11.52* 12.49 11.52 7.70 6.18 5 11.52 8.93* 9.22 6.93 5.71 6 5.76 8.92 7.37 6.23 5.28 7 8.92 6.55* 5.90* 4.89 8 4.47 6.55 5.90 4.52 9 6.56 5.91 4.46* 10 6.55 5.90 4.46 11 3.28 etc. etc. *First year of switching to the straight-line method. Source: www.irs.gov/publications/p946/ 11 Solvent-Paint Process $ 600, eee $ 0.16 10 2,000, eee Initial investment Unit paint cost Estimated life in years Annual units Powder-Paint Process $ 1,200, eee $ 0.22 10 2,800, eee 9.1 points The firm will incur additional environmental costs with the solvent palnt process but not with the powder paint process. The firm estimates annual environmental costs for the solvent paint process as follows: Monthly pit cleaning Hazardous waste disposal Superfund fee Worker training Insurance Amortization of air-emission permit Air-emission fee Recordkeeping Wastewater treatment Units 12 183 18,690 2 1 0.2 44.6 0.25 1 Unit Cost $ 1,200 3, eee 8.17 1,500 10, eee 1, see 25 45,000 5e,eee The firm estimates its after-tax cost of capital to be 12%. Either system is a 10-year property under MACRS (see textExhibit 124. The firm pays a total of 40% In Income taxes. Required: 1. What is the total cost in present value terms of the Solvent-Paint System? 2. What is the total cost, In present value terms of the Powder-Paint System? 3. What is the most the firm should be willing to pay for the powder-based process? (For all requirements, Round your answer to the nearest dollar amount.) Answer is not complete. 1. $ Total cost (Solvent-Paint System) Total cost (Powder-Paint System) Maximum amount to be paid 3.140.650 X 1.152.645 X 2. IS 3. EXHIBIT 12.4 MACRS Depreciation Rates Year 3-year 5-year 7-year 10-year 15-year 20-year 1 33.33 20.00 14.29 10.00 5.00 3.75 2 44.45 24.49 18.00 9.50 7.22 32.00 19.20 3 14.81 17.49 14.40 8.55 6.68 4 7.41 11.52* 12.49 11.52 7.70 6.18 5 11.52 8.93* 9.22 6.93 5.71 6 5.76 8.92 7.37 6.23 5.28 7 8.92 6.55* 5.90* 4.89 8 4.47 6.55 5.90 4.52 9 6.56 5.91 4.46* 10 6.55 5.90 4.46 11 3.28 etc. etc. *First year of switching to the straight-line method. Source: www.irs.gov/publications/p946/

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts