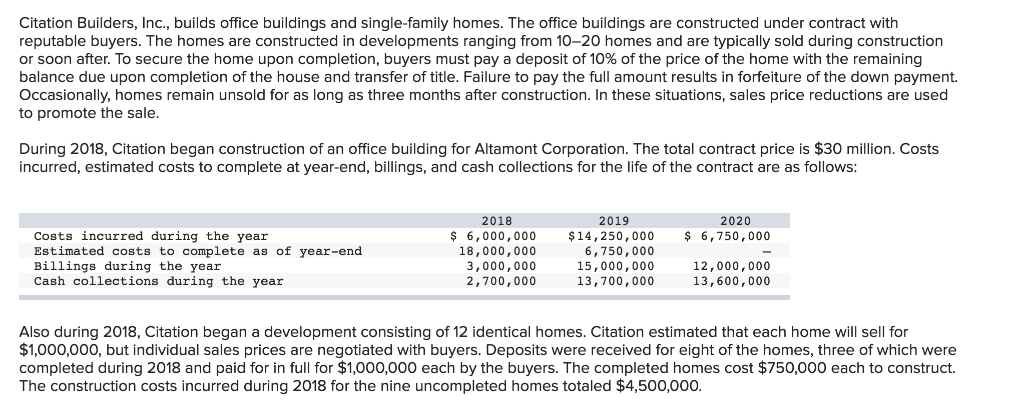

Question: Required: 1. Which method is most equivalent to recognizing revenue at the point of delivery? 2. Answer the following questions assuming that Citation uses the

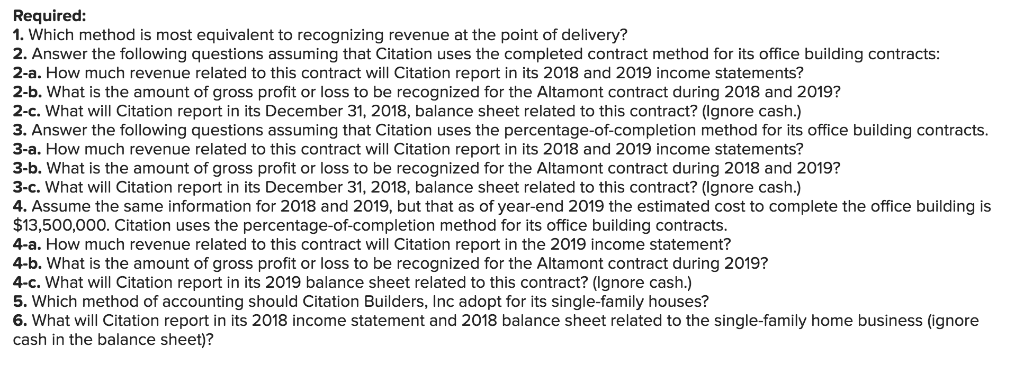

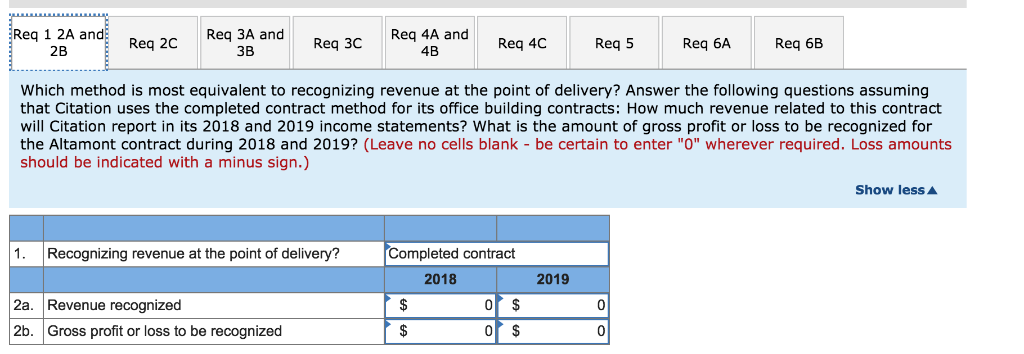

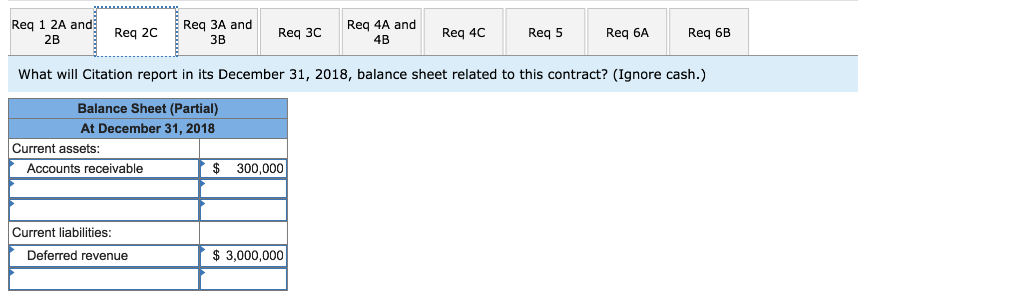

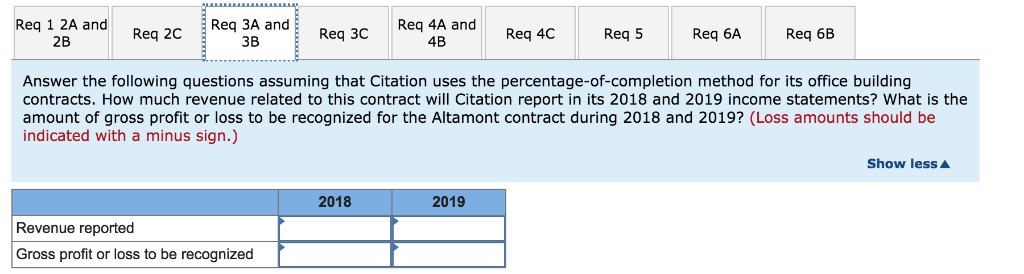

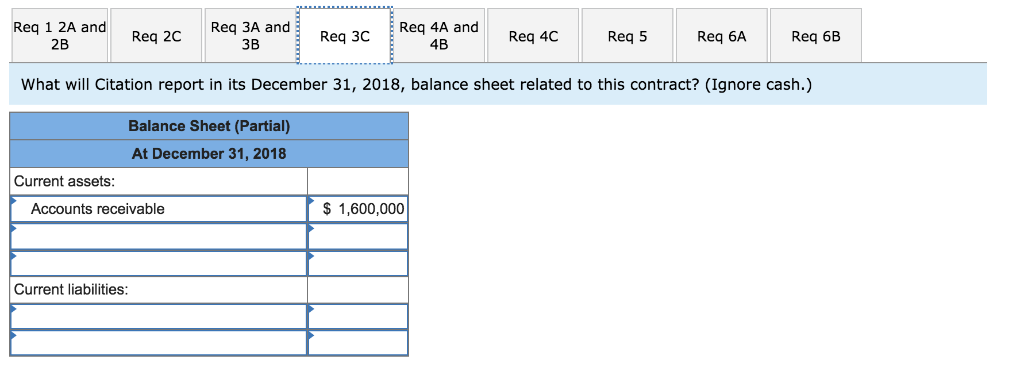

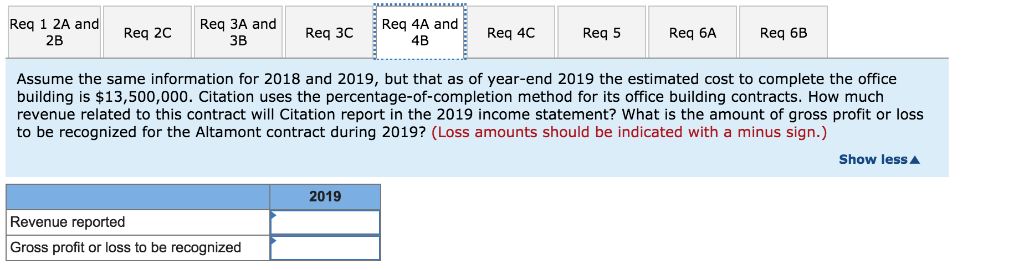

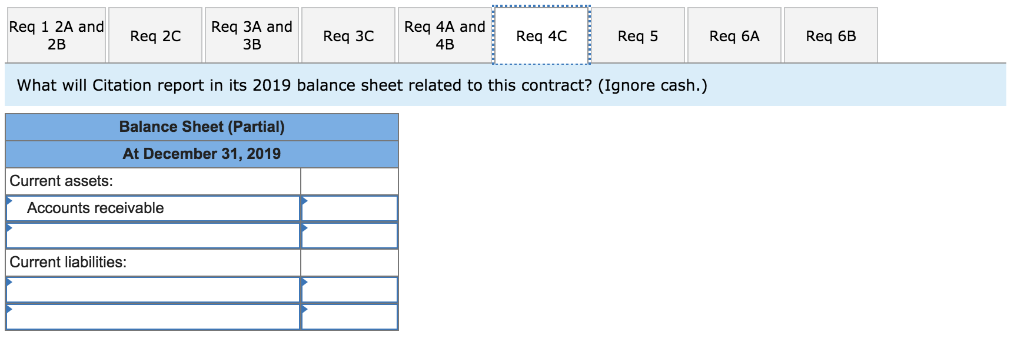

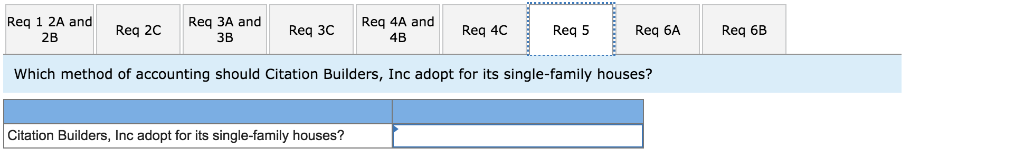

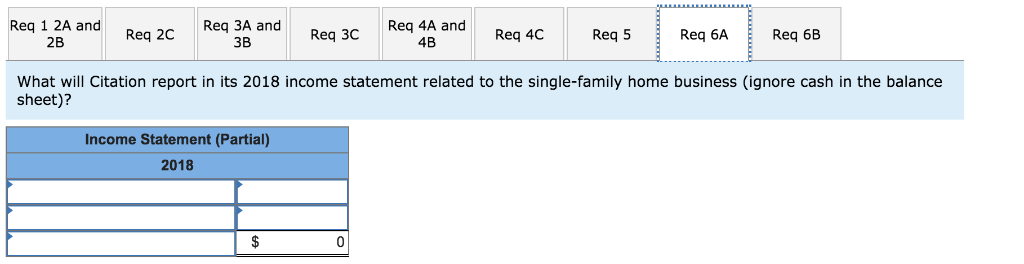

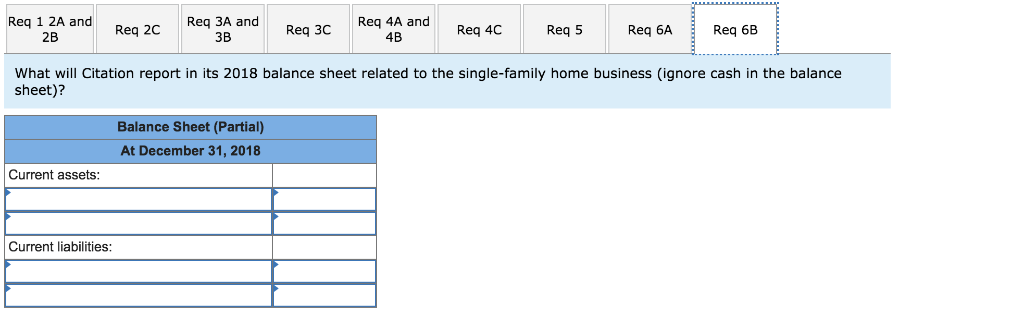

Required: 1. Which method is most equivalent to recognizing revenue at the point of delivery? 2. Answer the following questions assuming that Citation uses the completed contract method for its office building contracts 2-a. How much revenue related to this contract will Citation report in its 2018 and 2019 income statements? 2-b. What is the amount of gross profit or loss to be recognized for the Altamont contract during 2018 and 2019? 2-c. What will Citation report in its December 31, 2018, balance sheet related to this contract? (Ignore cash.) 3. Answer the following questions assuming that Citation uses the percentage-of-completion method for its office building contracts 3-a. How much revenue related to this contract will Citation report in its 2018 and 2019 income statements? 3-b. What is the amount of gross profit or loss to be recognized for the Altamont contract during 2018 and 2019? 3-c. What will Citation report in its December 31, 2018, balance sheet related to this contract? (Ignore cash.) 4. Assume the same information for 2018 and 2019, but that as of year-end 2019 the estimated cost to complete the office building is $13,500,000. Citation uses the percentage-of-completion method for its office building contracts 4-a. How much revenue related to this contract will Citation report in the 2019 income statement? 4-b, what is the amount of gross profit or loss to be recognized for the Altamont contract during 2019? 4-c. What will Citation report in its 2019 balance sheet related to this contract? (Ignore cash.) 5. Which method of accounting should Citation Builders, Inc adopt for its single-family houses? 6. What will Citation report in its 2018 income statement and 2018 balance sheet related to the single-family home business (ignore cash in the balance sheet)? Req 1 2A and 2B Req 3A and 3B Req 4A and 4B Req 2C Req 3C Req 4C Req 5 Req 6A Req 6B Which method is most equivalent to recognizing revenue at the point of delivery? Answer the following questions assuming that Citation uses the completed contract method for its office building contracts: How much revenue related to this contract will Citation report in its 2018 and 2019 income statements? What is the amount of gross profit or loss to be recognized for the Altamont contract during 2018 and 2019? (Leave no cells blank - be certain to enter "O" wherever required. Loss amounts should be indicated with a minus sign.) Show less 1. Recognizing revenue at the point of delivery? ompleted contract 2018 2019 or s 2a. Revenue recognized 2b. Gross profit or loss to be recognized 0 0 Req 4A and 4B Req 3C Req 4C Req 5 Req 6A Req 6B 2B What will Citation report in its December 31, 2018, balance sheet related to this contract? (Ignore cash.) Balance Sheet (Partial) At December 31, 2018 Current assets Accounts receivable $ 300,000 Current liabilities: Deferred revenue $3,000,000 Req 1 2A and 2B Req 3A and 3B Req 4A and 4B Reg 2C Req 3c Req 4C Req 5 Req 6A Req 6B anee statementsh ouhna be Answer the following questions assuming that Citation uses the percentage-of-completion method for its office building contracts. How much revenue related to this contract will Citation report in its 2018 and 2019 income statements? What is the amount of gross profit or loss to be recognized for the Altamont contract during 2018 and 2019? (Loss amounts should be indicated with a minus sign.) Show less 2018 2019 Revenue reported Gross profit or loss to be recognized Req 1 2A and 2B Req 2C Req 3A and Req 4CReq 5 Req 6AReq 6B 3BReq 3C Req 4A and 4B What will Citation report in its December 31, 2018, balance sheet related to this contract? (Ignore cash.) Balance Sheet (Partial) At December 31, 2018 Current assets Accounts receivable $1,600,000 Current liabilities: Req 1 2A andReq 2C Req 3A and 3B Req 4A and 4B Req 4C Req 3C Req 5 Req 6A Req 6B 2B Assume the same information for 2018 and 2019, but that as of year-end 2019 the estimated cost to complete the office building is $13,500,000. Citation uses the percentage-of-completion method for its office building contracts. How much revenue related to this contract will Citation report in the 2019 income statement? What is the amount of gross profit or loss to be recognized for the Altamont contract during 2019? (Loss amounts should be indicated with a minus sign.) Show less 2019 Revenue reported Gross profit or loss to be recognized Req 1 2A and 2B Req 3A and 3B Req 4A and 4B Req 2C Req 3c Req 4C Req 5 Req 6A Req 6B What will Citation report in its 2019 balance sheet related to this contract? (Ignore cash.) Balance Sheet (Partial) At December 31, 2019 Current assets: Accounts receivable Current liabilities: Req 1 2A and 2B Req 3A and 3B Req 4A and 4B Req 2C Req 3C Req 4C Req 5 Req 6A Req 6B Which method of accounting should Citation Builders, Inc adopt for its single-family houses? Citation Builders, Inc adopt for its single-family houses? Req 1 2A andReq 2C Req 3A and 3B Req 4A and 4B Req 4C 2B What will Citation report in its 2018 income statement related to the single-family home business (ignore cash in the balance sheet)? Income Statement (Partial) 2018 0 Required: 1. Which method is most equivalent to recognizing revenue at the point of delivery? 2. Answer the following questions assuming that Citation uses the completed contract method for its office building contracts 2-a. How much revenue related to this contract will Citation report in its 2018 and 2019 income statements? 2-b. What is the amount of gross profit or loss to be recognized for the Altamont contract during 2018 and 2019? 2-c. What will Citation report in its December 31, 2018, balance sheet related to this contract? (Ignore cash.) 3. Answer the following questions assuming that Citation uses the percentage-of-completion method for its office building contracts 3-a. How much revenue related to this contract will Citation report in its 2018 and 2019 income statements? 3-b. What is the amount of gross profit or loss to be recognized for the Altamont contract during 2018 and 2019? 3-c. What will Citation report in its December 31, 2018, balance sheet related to this contract? (Ignore cash.) 4. Assume the same information for 2018 and 2019, but that as of year-end 2019 the estimated cost to complete the office building is $13,500,000. Citation uses the percentage-of-completion method for its office building contracts 4-a. How much revenue related to this contract will Citation report in the 2019 income statement? 4-b, what is the amount of gross profit or loss to be recognized for the Altamont contract during 2019? 4-c. What will Citation report in its 2019 balance sheet related to this contract? (Ignore cash.) 5. Which method of accounting should Citation Builders, Inc adopt for its single-family houses? 6. What will Citation report in its 2018 income statement and 2018 balance sheet related to the single-family home business (ignore cash in the balance sheet)? Req 1 2A and 2B Req 3A and 3B Req 4A and 4B Req 2C Req 3C Req 4C Req 5 Req 6A Req 6B Which method is most equivalent to recognizing revenue at the point of delivery? Answer the following questions assuming that Citation uses the completed contract method for its office building contracts: How much revenue related to this contract will Citation report in its 2018 and 2019 income statements? What is the amount of gross profit or loss to be recognized for the Altamont contract during 2018 and 2019? (Leave no cells blank - be certain to enter "O" wherever required. Loss amounts should be indicated with a minus sign.) Show less 1. Recognizing revenue at the point of delivery? ompleted contract 2018 2019 or s 2a. Revenue recognized 2b. Gross profit or loss to be recognized 0 0 Req 4A and 4B Req 3C Req 4C Req 5 Req 6A Req 6B 2B What will Citation report in its December 31, 2018, balance sheet related to this contract? (Ignore cash.) Balance Sheet (Partial) At December 31, 2018 Current assets Accounts receivable $ 300,000 Current liabilities: Deferred revenue $3,000,000 Req 1 2A and 2B Req 3A and 3B Req 4A and 4B Reg 2C Req 3c Req 4C Req 5 Req 6A Req 6B anee statementsh ouhna be Answer the following questions assuming that Citation uses the percentage-of-completion method for its office building contracts. How much revenue related to this contract will Citation report in its 2018 and 2019 income statements? What is the amount of gross profit or loss to be recognized for the Altamont contract during 2018 and 2019? (Loss amounts should be indicated with a minus sign.) Show less 2018 2019 Revenue reported Gross profit or loss to be recognized Req 1 2A and 2B Req 2C Req 3A and Req 4CReq 5 Req 6AReq 6B 3BReq 3C Req 4A and 4B What will Citation report in its December 31, 2018, balance sheet related to this contract? (Ignore cash.) Balance Sheet (Partial) At December 31, 2018 Current assets Accounts receivable $1,600,000 Current liabilities: Req 1 2A andReq 2C Req 3A and 3B Req 4A and 4B Req 4C Req 3C Req 5 Req 6A Req 6B 2B Assume the same information for 2018 and 2019, but that as of year-end 2019 the estimated cost to complete the office building is $13,500,000. Citation uses the percentage-of-completion method for its office building contracts. How much revenue related to this contract will Citation report in the 2019 income statement? What is the amount of gross profit or loss to be recognized for the Altamont contract during 2019? (Loss amounts should be indicated with a minus sign.) Show less 2019 Revenue reported Gross profit or loss to be recognized Req 1 2A and 2B Req 3A and 3B Req 4A and 4B Req 2C Req 3c Req 4C Req 5 Req 6A Req 6B What will Citation report in its 2019 balance sheet related to this contract? (Ignore cash.) Balance Sheet (Partial) At December 31, 2019 Current assets: Accounts receivable Current liabilities: Req 1 2A and 2B Req 3A and 3B Req 4A and 4B Req 2C Req 3C Req 4C Req 5 Req 6A Req 6B Which method of accounting should Citation Builders, Inc adopt for its single-family houses? Citation Builders, Inc adopt for its single-family houses? Req 1 2A andReq 2C Req 3A and 3B Req 4A and 4B Req 4C 2B What will Citation report in its 2018 income statement related to the single-family home business (ignore cash in the balance sheet)? Income Statement (Partial) 2018 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts