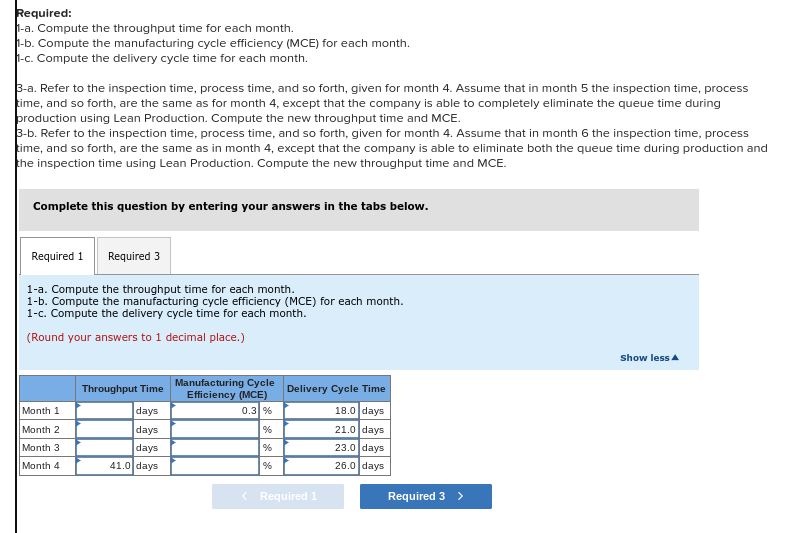

Question: Required: 1-a. Compute the throughput time for each month. 1-b. Compute the manufacturing cycle efficiency (MCE) for each month. 1-c. Compute the delivery cycle time

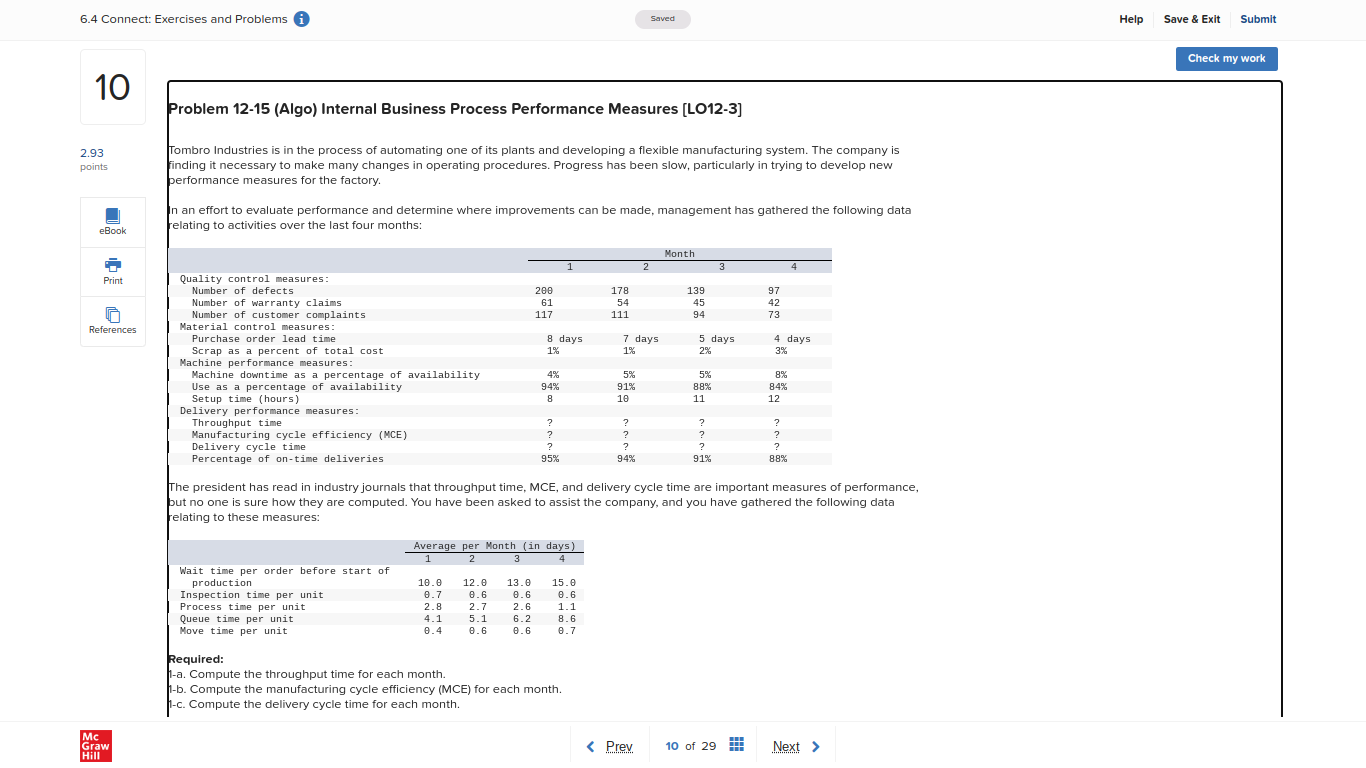

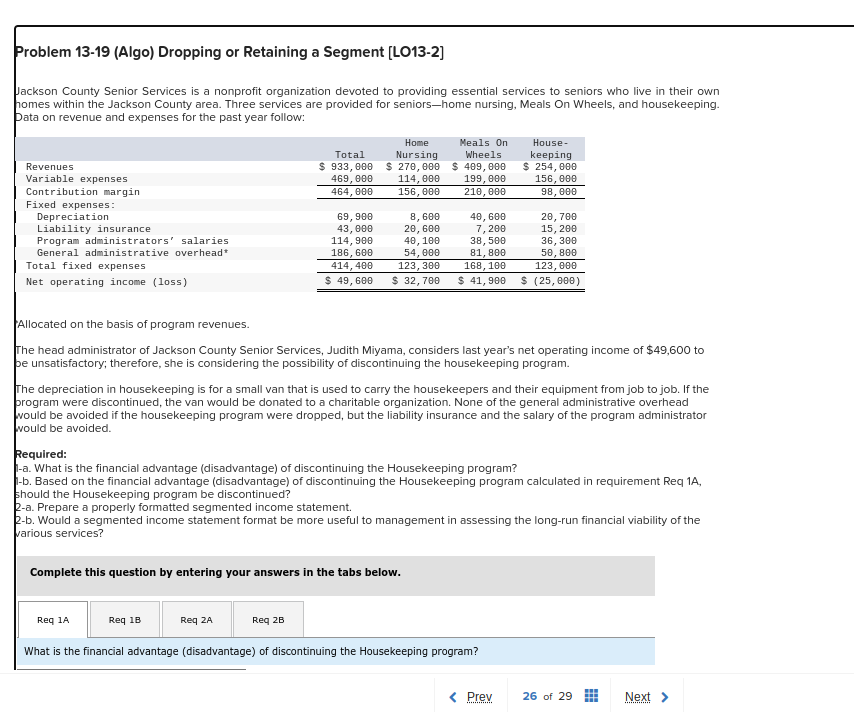

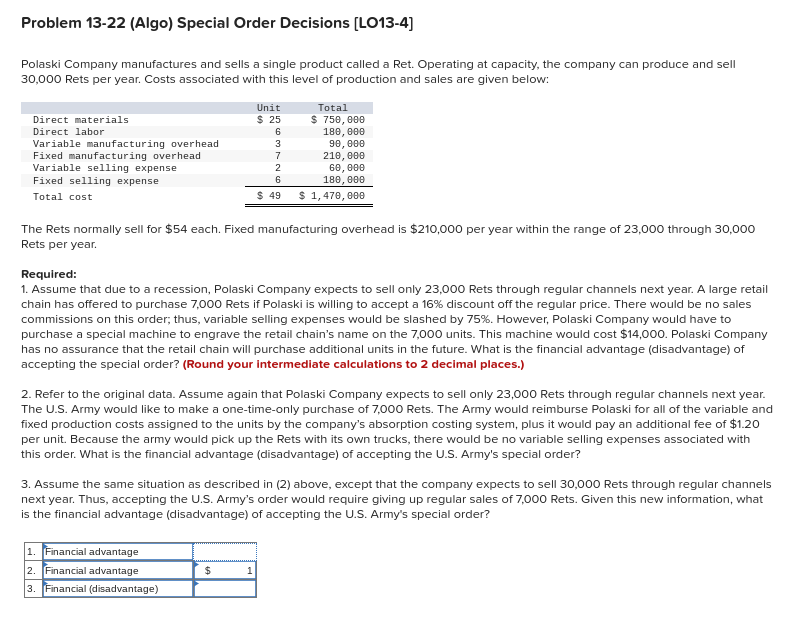

Required: 1-a. Compute the throughput time for each month. 1-b. Compute the manufacturing cycle efficiency (MCE) for each month. 1-c. Compute the delivery cycle time for each month. 3-a. Refer to the inspection time, process time, and so forth, given for month 4. Assume that in month 5 the inspection time, process time, and so forth, are the same as for month 4, except that the company is able to completely eliminate the queue time during production using Lean Production. Compute the new throughput time and MCE. 3-b. Refer to the inspection time, process time, and so forth, given for month 4. Assume that in month 6 the inspection time, process time, and so forth, are the same as in month 4, except that the company is able to eliminate both the queue time during production and the inspection time using Lean Production. Compute the new throughput time and MCE Complete this question by entering your answers in the tabs below. Required 1 Required 3 1-a. Compute the throughput time for each month. 1-b. Compute the manufacturing cycle efficiency (MCE) for each month. 1-c. Compute the delivery cycle time for each month. (Round your answers to 1 decimal place.) Show less A Throughput Time Manufacturing Cycle Efficiency (MCE) Delivery Cycle Time Month 1 days 0.3% 18.0 days Month 2 days 21.0 days Month 3 days 23.0 days Month 4 41.0 days 26.0 days 6.4 Connect: Exercises and Problems i Saved Help Save & Exit Submit Check my work 10 Problem 12-15 (Algo) Internal Business Process Performance Measures [LO12-3] 2.93 Tombro Industries is in the process of automating one of its plants and developing a flexible manufacturing system. The company is points inding it necessary to make many changes in operating procedures. Progress has been slow, particularly in trying to develop new performance measures for the factory. In an effort to evaluate performance and determine where improvements can be made, management has gathered the following data Book elating to activities over the last four months: Month Print Quality control measures: Number of defects 280 178 139 97 Number of warranty claims 61 54 45 42 Number of customer complaints 117 111 94 73 References Material control measures: Purchase order lead time 8 days 7 days 5 days 4 days Scrap as a percent of total cost 1% 1% 3% Machine performance measures: Machine downtime as a percentage of availability 4% 5% 5% 8%% Use as a percentage of availability 94% 91% 88% 84% Setup time (hours) 10 11 12 Delivery performance measures: Throughput time ? ? Manufacturing cycle efficiency (MCE) ? Delivery cycle time Percentage of on-time deliveries 95% 94% 91% 88% The president has read in industry journals that throughput time, MCE, and delivery cycle time are important measures of performance, but no one is sure how they are computed. You have been asked to assist the company, and you have gathered the following data elating to these measures: Average per Month (in days ) 3 Wait time per order before start of production 10.0 12.0 13.0 15.0 Inspection time per unit 0.7 0.6 0.6 0.6 Process time per unit 2.8 2 . 7 2.6 1.1 Queue time per unit 4.1 5.1 6.2 Move time per unit 8 .6 0 .6 B . 7 Required: -a. Compute the throughput time for each month. -b. Compute the manufacturing cycle efficiency (MCE) for each month. -c. Compute the delivery cycle time for each month. Mc Graw Problem 13-19 (Algo) Dropping or Retaining a Segment [LO13-2] Jackson County Senior Services is a nonprofit organization devoted to providing essential services to seniors who live in their own homes within the Jackson County area. Three services are provided for seniors-home nursing, Meals On Wheels, and housekeeping. Data on revenue and expenses for the past year follow: Home Meals On House - Total Nursing Wheels keeping Revenues $ 933, 080 $ 270,000 $ 409, 000 808 '+97 $ Variable expenses 469, 080 114, 080 080 '66T 156, 080 Contribution margin 464, 080 156, 080 210, 080 98, 080 Fixed e Depreciation 806 65 8, 680 809 0+ Liability insurance 43, 008 20, 608 7, 208 15, 208 Program administrators' salaries 806 '+TT 40, 100 38, 580 BBE '9E General administrative overhead* 186, 606 54, 080 81, 808 808'05 Total fixed expenses 414, 408 123, 308 BOT. '891 123, 080 Net operating income (loss) $ 49, 600 $ 32, 700 $ 41, 908 $ (25, 080) Allocated on the basis of program revenues. The head administrator of Jackson County Senior Services, Judith Miyama, considers last year's net operating income of $49,600 to be unsatisfactory; therefore, she is considering the possibility of discontinuing the housekeeping program. The depreciation in housekeeping is for a small van that is used to carry the housekeepers and their equipment from job to job. If the program were discontinued, the van would be donated to a charitable organization. None of the general administrative overhead would be avoided if the housekeeping program were dropped, but the liability insurance and the salary of the program administrator would be avoided. Required: a. What is the financial advantage (disadvantage) of discontinuing the Housekeeping program? -b. Based on the financial advantage (disadvantage) of discontinuing the Housekeeping program calculated in requirement Req 1A, should the Housekeeping program be discontinued? 2-a. Prepare a properly formatted segmented income statement. 2-b. Would a segmented income statement format be more useful to management in assessing the long-run financial viability of the various services? Complete this question by entering your answers in the tabs below. Req 1A Req 18 Req 2A Req 28 What is the financial advantage (disadvantage) of discontinuing the Housekeeping program? Problem 13-22 (Algo) Special Order Decisions [LO13-4] Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 30,000 Rets per year. Costs associated with this level of production and sales are given below: Unit Total Direct materials $ 25 750, 080 Direct labor 6 180, 080 Variable manufacturing overhead 90, 080 Fixed manufacturing overhead 800 'OTZ Variable selling expense 800 '89 Fixed selling expense 180, 080 Total cost $ 49 $ 1, 470, 008 The Rets normally sell for $54 each. Fixed manufacturing overhead is $210,000 per year within the range of 23,000 through 30,000 Rets per year. Required: 1. Assume that due to a recession, Polaski Company expects to sell only 23,000 Rets through regular channels next year. A large retail chain has offered to purchase 7,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company would have to purchase a special machine to engrave the retail chain's name on the 7,000 units. This machine would cost $14,000. Polaski Company has no assurance that the retail chain will purchase additional units in the future. What is the financial advantage (disadvantage) of accepting the special order? (Round your intermediate calculations to 2 decimal places.) 2. Refer to the original data. Assume again that Polaski Company expects to sell only 23,000 Rets through regular channels next year. The U.S. Army would like to make a one-time-only purchase of 7,000 Rets. The Army would reimburse Polaski for all of the variable and fixed production costs assigned to the units by the company's absorption costing system, plus it would pay an additional fee of $1.20 per unit. Because the army would pick up the Rets with its own trucks, there would be no variable selling expenses associated with this order. What is the financial advantage (disadvantage) of accepting the U.S. Army's special order? 3. Assume the same situation as described in (2) above, except that the company expects to sell 30,000 Rets through regular channels next year. Thus, accepting the U.S. Army's order would require giving up regular sales of 7,000 Rets. Given this new information, what is the financial advantage (disadvantage) of accepting the U.S. Army's special order? 1. Financial advantage 2. Financial advantage $ 3. Financial (disadvantage)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts