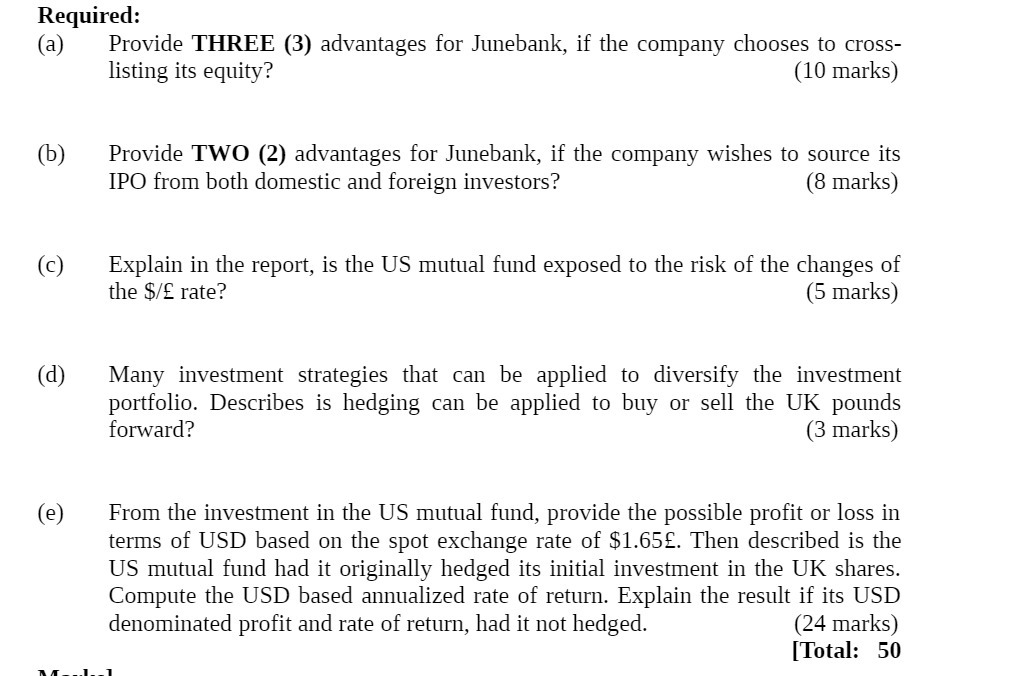

Question: Required: (8) (b) (d) (E) Provide THREE (3) advantages for Junebank, if the company chooses to crossisting its equity? (10 marks) Provide TWO (2) advantages

Required: (8) (b) (d) (E) Provide THREE (3) advantages for Junebank, if the company chooses to crossisting its equity? (10 marks) Provide TWO (2) advantages for Junebank, if the company wishes to source its IPO from both domestic and foreign investors? [8 marks) Explain in the report, is the US mutual fund exposed to the risk of the changes of the $f rate? (5 marks) Many investment strategies that can be applied to diversify the investment portfolio. Describes is hedging can be applied to buy or sell the UK pounds forward? (3 marks) From the investment in the US mutual fund, provide the possible profit or loss in terms of USD based on the spot exchange rate of $1.65E. Then described is the US mutual fund had it originally hedged its initial investment in the UK shares. Compute the USD based annualized rate of return. Explain the result if its USD denominated profit and rate of return, had it not hedged. (24 marks) [Total: 50 Il___l__'l

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts