Question: Required: a. Assuming that the expectations hypothesis is valid, compute the expected price of the four-year zero coupon bond shown below at the end

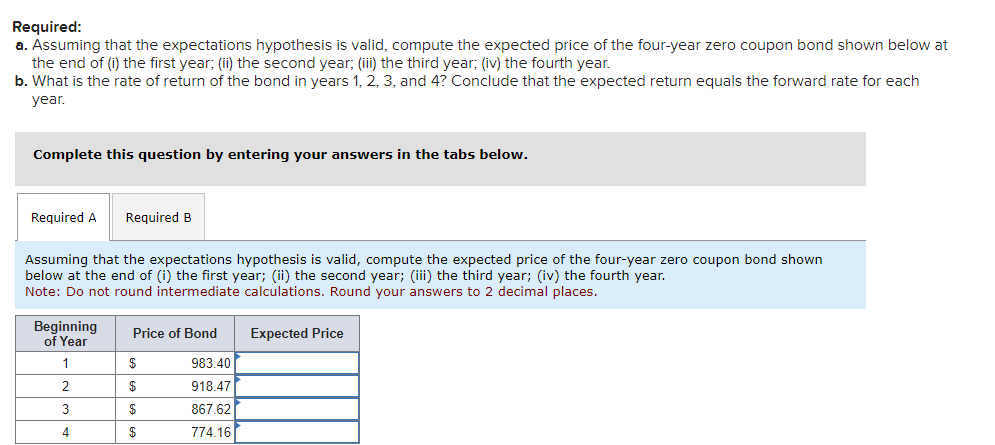

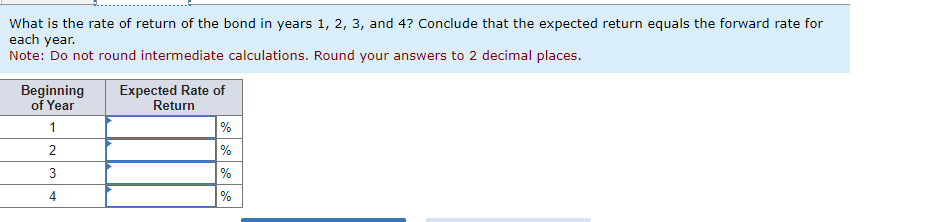

Required: a. Assuming that the expectations hypothesis is valid, compute the expected price of the four-year zero coupon bond shown below at the end of (i) the first year; (ii) the second year; (iii) the third year; (iv) the fourth year. b. What is the rate of return of the bond in years 1, 2, 3, and 4? Conclude that the expected return equals the forward rate for each year. Complete this question by entering your answers in the tabs below. Required A Required B Assuming that the expectations hypothesis is valid, compute the expected price of the four-year zero coupon bond shown below at the end of (i) the first year; (ii) the second year; (iii) the third year; (iv) the fourth year. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Beginning Price of Bond of Year Expected Price 1 $ 983.40 2 $ 918.47 3 $ 867.62 4 $ 774.16 What is the rate of return of the bond in years 1, 2, 3, and 4? Conclude that the expected return equals the forward rate for each year. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Beginning of Year Expected Rate of Return 1 % 2 % 3 % 4 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts