Question: Required: (A. & B.) A. Prepare the appropriate consolidation entry or entries needed to prepare a consolidated balance sheet as of December 31, 20X3. Record

Required: (A. & B.)

A. Prepare the appropriate consolidation entry or entries needed to prepare a consolidated balance sheet as of December 31, 20X3.

- Record the basic consolidation entry.

- Record the excess value (differential) reclassification entry.

- Record the optional accumulated depreciation consolidation entry.

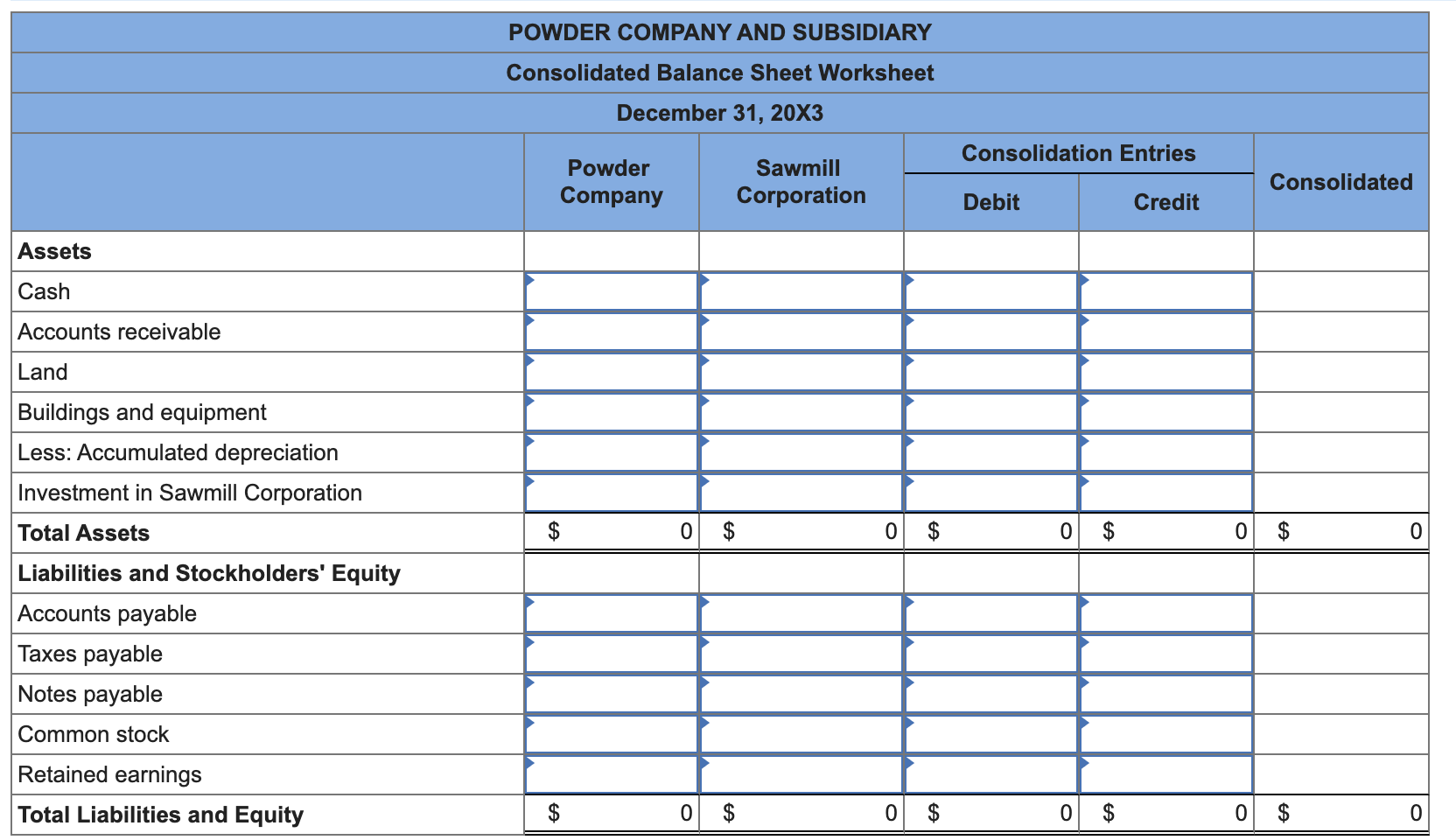

B. Prepare a consolidated balance sheet worksheet as of December 31, 20X3.

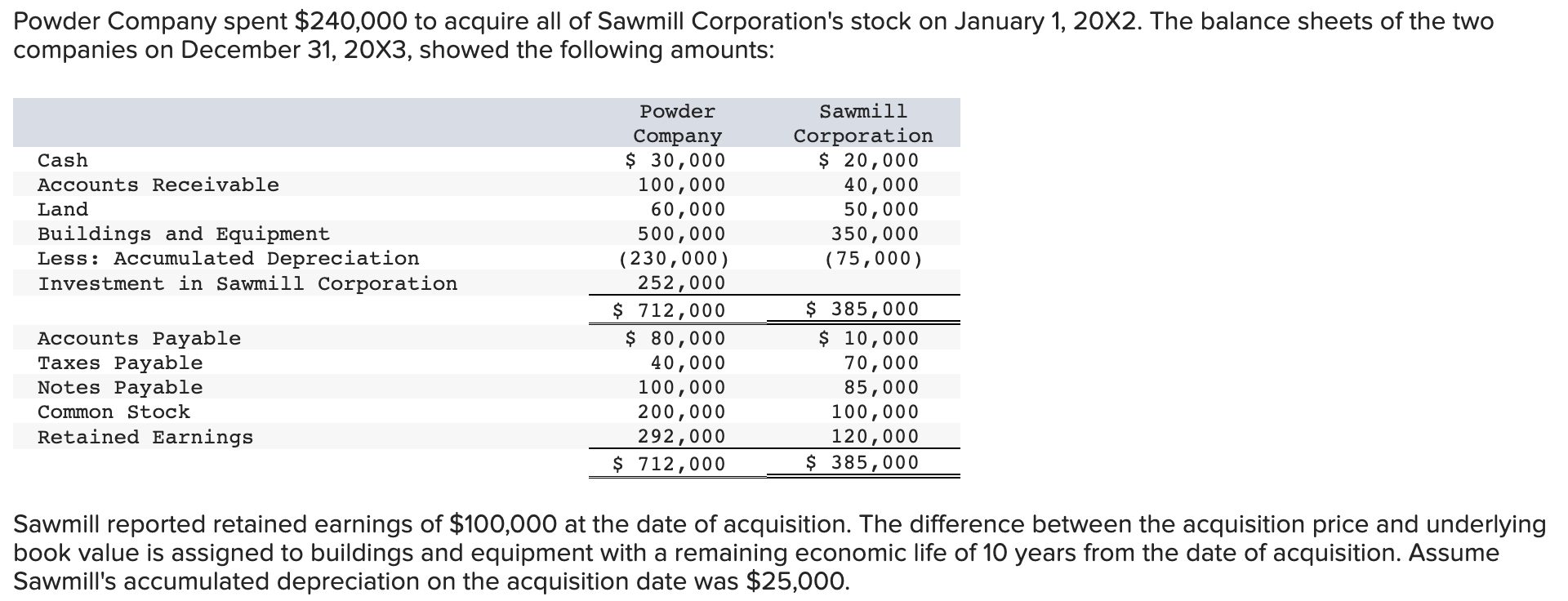

Powder Company spent $240,000 to acquire all of Sawmill Corporation's stock on January 1,202. The balance sheets of the two companies on December 31, 20X3, showed the following amounts: Sawmill reported retained earnings of $100,000 at the date of acquisition. The difference between the acquisition price and underlying book value is assigned to buildings and equipment with a remaining economic life of 10 years from the date of acquisition. Assume Sawmill's accumulated depreciation on the acquisition date was $25,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts