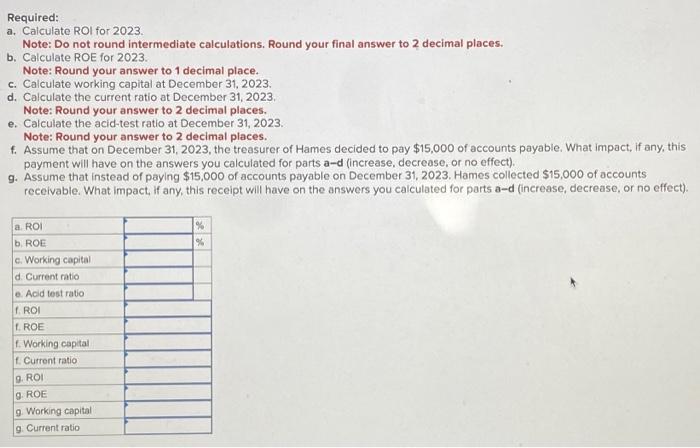

Question: Required: a. Calculate ROI for 2023. Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. b. Calculate ROE for 2023

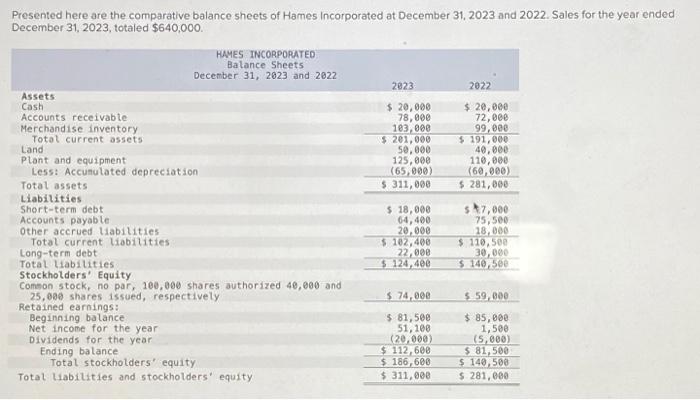

Required: a. Calculate ROI for 2023. Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. b. Calculate ROE for 2023 . Note: Round your answer to 1 decimal place. c. Calculate working capital at December 31,2023. d. Calculate the current ratio at December 31, 2023. Note: Round your answer to 2 decimal places. e. Calculate the acid-test ratio at December 31,2023. Note: Round your answer to 2 decimal places. f. Assume that on December 31,2023 , the treasurer of Hames decided to pay $15,000 of accounts payable. What impact, if any, this payment will have on the answers you calculated for parts a-d (increase, decrease, or no effect). g. Assume that instead of paying $15,000 of accounts payable on December 31,2023 . Hames collected $15,000 of accounts receivable. What impact, if any, this receipt will have on the answers you calculated for parts a-d (increase, decrease, or no effect). Presented here are the comparative balance sheets of Hames incorporated at December 31, 2023 and 2022. Sales for the year ended December 31,2023, totaled $640,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts