Question: Required: (a) Calculate the Net Present Value (NPV) for both warehouses. (b) Calculate the payback period for both warehouses. (c) Which warehouse should Harington Co.

Required:

(a) Calculate the Net Present Value (NPV) for both warehouses.

(b) Calculate the payback period for both warehouses.

(c) Which warehouse should Harington Co. build?

(d) Explain in full two (2) non-financial factors Harington Co. should consider before making the above decision.

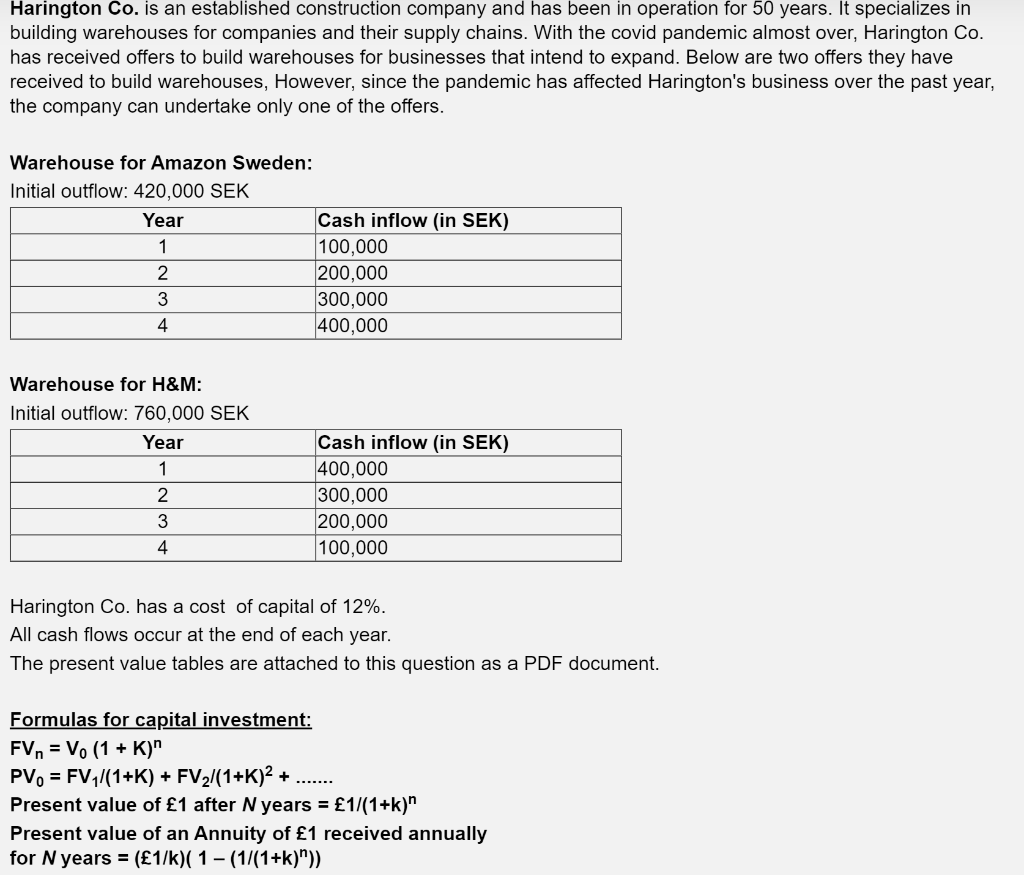

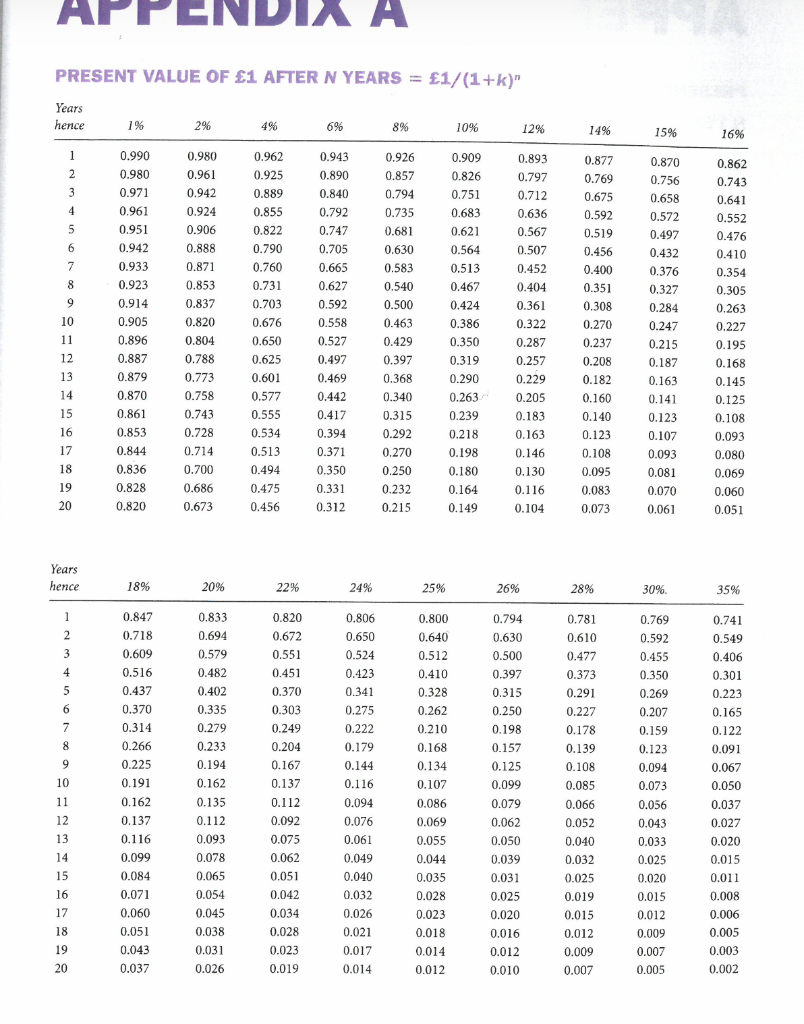

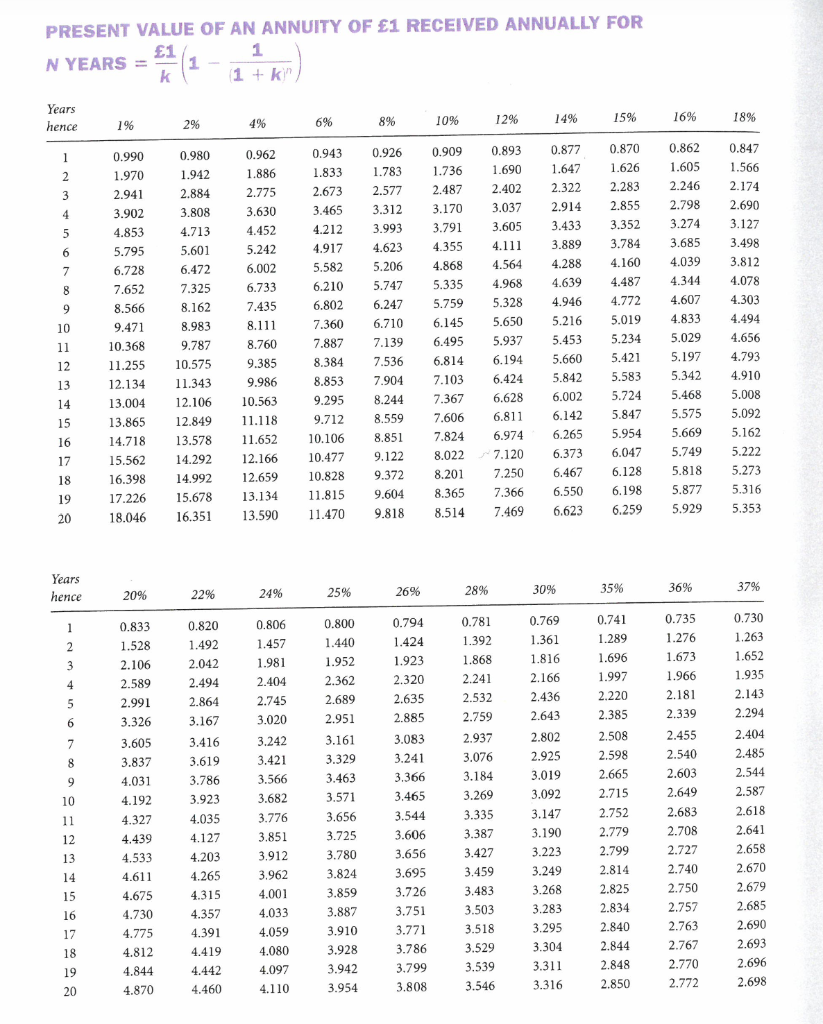

Harington Co. is an established construction company and has been in operation for 50 years. It specializes in building warehouses for companies and their supply chains. With the covid pandemic almost over, Harington Co. has received offers to build warehouses for businesses that intend to expand. Below are two offers they have received to build warehouses, However, since the pandemic has affected Harington's business over the past year, the company can undertake only one of the offers. Warehouse for Amazon Sweden: Initial outflow: 420,000 SEK Year Cash inflow (in SEK) 1 100,000 2 200,000 3 300,000 4 400,000 Warehouse for H&M: Initial outflow: 760,000 SEK Year 1 2 3 Cash inflow (in SEK) 400,000 300,000 200,000 100,000 4 Harington Co. has a cost of capital of 12%. All cash flows occur at the end of each year. The present value tables are attached to this question as a PDF document. Formulas for capital investment: FV, = V. (1 + k)" PV = FV /(1+K) + FV2/(1+K)2 + ....... Present value of 1 after N years = 1/(1+k)" Present value of an Annuity of 1 received annually for N years = (1/k)( 1 - (1/(1+k)")) AL NDIA A PRESENT VALUE OF 1 AFTER N YEARS = 1/(1+k)" Years hence 1% 2% 4% 6% 8% 10% 12% 14% 15% 16% 1 2 3 4 5 6 7 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 8 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 9 10 11 12 13 14 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0.195 0.168 0.145 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.123 0.107 0.093 0.081 0.070 0.061 0.125 15 16 17 18 19 20 0.853 0.844 0.836 0.828 0.820 0.534 0.513 0.494 0.475 0.456 0.108 0.093 0.080 0.069 0.060 0.051 0.083 0.073 Years hence 18% 20% 22% 24% 25% 26% 28% 30% 35% 1 0.781 0.610 2 3 4 0.794 0.630 0.500 0.397 0.315 0.250 0.198 5 6 0.820 0.672 0.551 0.451 0.370 0.303 0.249 0.204 0.167 0.137 0.112 7 8 9 0.157 0.847 0.718 0.609 0.516 0.437 0.370 0.314 0.266 0.225 0.191 0.162 0.137 0.116 0.099 0.084 0.071 0.060 0.051 0.043 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 10 11 12 13 14 15 0.806 0.650 0.524 0.423 0.341 0.275 0.222 0.179 0.144 0.116 0.094 0.076 0.061 0.049 0.040 0.032 0.026 0.021 0.017 0.014 0.800 0.640 0.512 0.410 0.328 0.262 0.210 0.168 0.134 0.107 0.086 0.069 0.055 0.044 0.035 0.028 0.023 0.018 0.014 0.012 0.741 0.549 0.406 0.301 0.223 0.165 0.122 0.091 0.067 0.050 0.037 0.027 0.020 0.015 0.011 0.092 0.769 0.592 0.455 0.350 0.269 0.207 0.159 0.123 0.094 0.073 0.056 0.043 0.033 0.025 0.020 0.015 0.012 0.009 0.007 0.005 0.477 0.373 0.291 0.227 0.178 0.139 0.108 0.085 0.066 0.052 0.040 0.032 0.025 0.019 0.015 0.012 0.009 0.007 0.125 0.099 0.079 0.062 0.050 0.039 0.031 0.025 0.020 0.016 0.012 0.010 0.008 0.075 0.062 0.051 0.042 0.034 0.028 0.023 0.019 16 17 18 0.006 0.005 0.003 19 20 0.037 0.002 PRESENT VALUE OF AN ANNUITY OF 1 RECEIVED ANNUALLY FOR 1 1 N YEARS = 1 k 1 +k" Years hence 2% 8% 4% 10% 6% 12% 16% 14% 15% 1% 18% 0.877 0.980 1.942 0.862 1.605 1 2 3 4 5 0.943 1.833 2.673 2.884 2.246 2.798 3.465 4.212 3.808 4.713 5.601 6.472 6 7 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 4.917 5.582 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 13.865 14.718 15.562 16.398 17.226 18.046 7.325 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 8 9 3.274 3.685 4.039 4.344 4.607 4.833 5.029 10 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.022 8.201 8.365 8.514 0.893 1.690 2.402 3,037 3.605 4.111 4.564 4.968 5.328 5.650 5.937 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.494 4.656 4.793 4.910 5.008 5.092 0.870 1.626 2.283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 5.234 5.421 5.583 5.724 5.847 5.954 6.047 6.128 6.198 6.259 11 12 13 14 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 11.815 11.470 8.162 8.983 9.787 10.575 11.343 12.106 12.849 13.578 14.292 14.992 15.678 16.351 9.986 7.904 6.002 15 10.563 11.118 11.652 12.166 12.659 13.134 13.590 5.162 5.222 16 17 18 5.197 5.342 5.468 5.575 5.669 5.749 5.818 5.877 5.929 8.244 8.559 8.851 9.122 9.372 9.604 9.818 6.142 6.265 6.373 6.467 6.550 6.623 5.273 5.316 5.353 19 20 Years hence 25% 30% 26% 20% 24% 28% 35% 36% 22% 37% 0.730 1 2 0.833 1.528 2.106 2.589 2.991 3.326 3 0.806 1.457 1.981 2.404 2.745 3.020 0.794 1.424 1.923 2.320 2.635 2.885 0.769 1.361 1.816 2.166 2.436 0.735 1.276 1.673 1.966 2.181 2.339 1.263 1.652 1.935 2.143 2.294 4 5 6 2.643 7 8 2.404 2.485 9 0.800 1.440 1.952 2.362 2.689 2.951 3.161 3.329 3.463 3.571 3.656 3.725 3.780 3.824 3.859 2.544 2.587 10 0.820 1.492 2.042 2.494 2.864 3.167 3.416 3.619 3.786 3.923 4.035 4.127 4.203 4.265 4.315 4.357 4.391 4.419 4.442 4.460 3.605 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.844 3.242 3.421 3.566 3.682 3.776 3.851 3.912 3.962 4.001 11 12 0.781 1.392 1.868 2.241 2.532 2.759 2.937 3.076 3.184 3.269 3.335 3.387 3.427 3.459 3.483 3.503 3.518 3.529 3.539 3.546 3.083 3.241 3.366 3.465 3.544 3.606 3.656 3.695 3.726 3.751 3.771 3.786 3.799 3.808 13 0.741 1.289 1.696 1.997 2.220 2.385 2.508 2.598 2.665 2.715 2.752 2.779 2.799 2.814 2.825 2.834 2.840 2.844 2.848 2.850 2.802 2.925 3.019 3.092 3.147 3.190 3.223 3.249 3.268 3.283 3.295 3.304 3.311 3.316 2.455 2.540 2.603 2.649 2.683 2.708 2.727 2.740 2.750 2.757 2.763 2.767 2.770 2.772 14 15 16 2.618 2.641 2.658 2.670 2.679 2.685 2.690 2.693 2.696 2.698 4.033 3.887 17 18 4.059 4.080 4.097 4.110 3.910 3.928 3.942 3.954 19 20 4.870

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts