Question: Required: (a) Construct a revised quotation, justifying revisions that you make, and clearly indicating the minimum price that should be charged for Job 210. (b)

Required:

(a) Construct a revised quotation, justifying revisions that you make, and clearly indicating the minimum price that should be charged for Job 210. (b) Explain the implications in using relevant costing to set prices for future work for this customer. Relevant costing principles used in the preparation of the quotation are different from those used in external financial reporting. (c) Explain four (4) differences between management accounting and financial accounting.

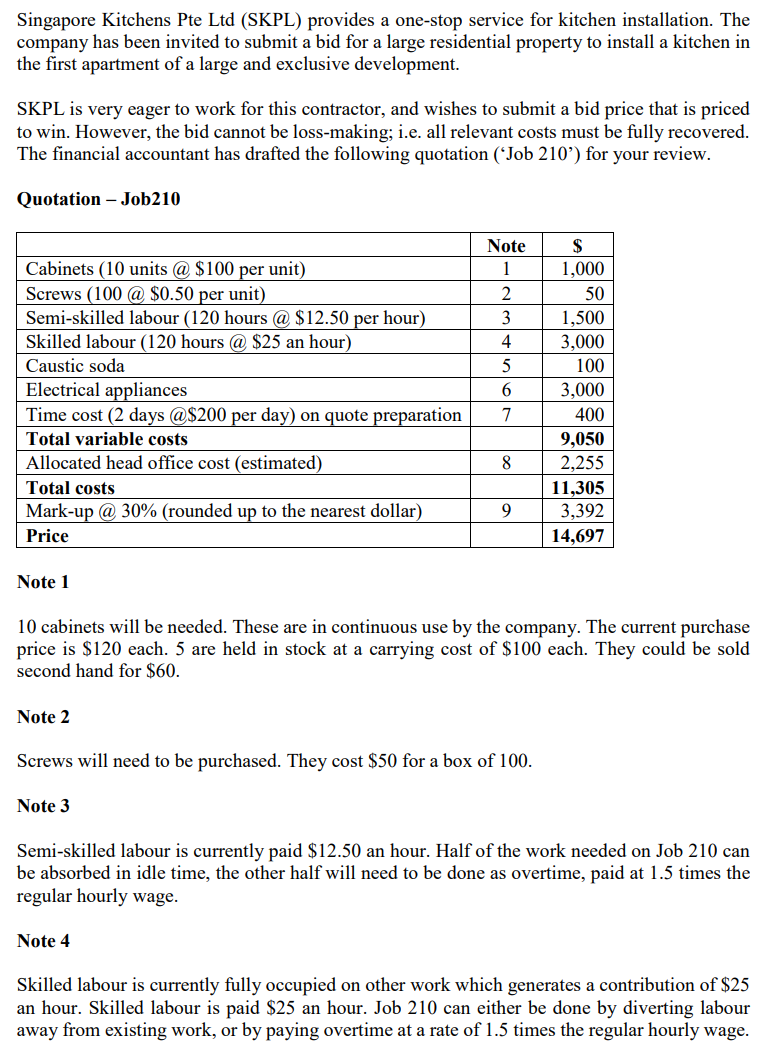

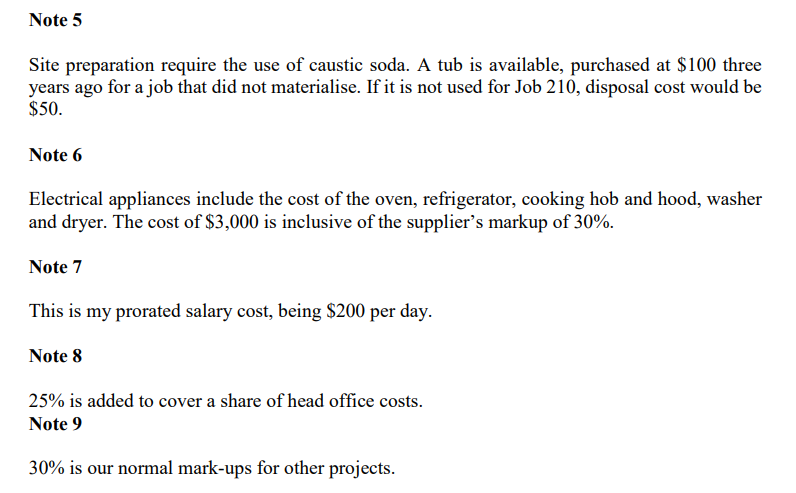

Singapore Kitchens Pte Ltd (SKPL) provides a one-stop service for kitchen installation. The company has been invited to submit a bid for a large residential property to install a kitchen in the first apartment of a large and exclusive development. SKPL is very eager to work for this contractor, and wishes to submit a bid price that is priced to win. However, the bid cannot be loss-making; i.e. all relevant costs must be fully recovered. The financial accountant has drafted the following quotation (*Job 210') for your review. Quotation - Job210 Note 1 2 3 T 4 Cabinets (10 units @ $100 per unit) Screws (100 @ $0.50 per unit) Semi-skilled labour (120 hours @ $12.50 per hour) Skilled labour (120 hours @ $25 an hour) Caustic soda Electrical appliances Time cost (2 days @$200 per day) on quote preparation Total variable costs Allocat head office cost (estimated) Total costs Mark-up @ 30% (rounded up to the nearest dollar) Price 5 6 7 $ 1,000 50 1,500 3,000 100 3,000 400 9,050 255 11,305 3,392 14,697 8 9 Note 1 10 cabinets will be needed. These are in continuous use by the company. The current purchase price is $120 each. 5 are held in stock at a carrying cost of $100 each. They could be sold second hand for $60. Note 2 Screws will need to be purchased. They cost $50 for a box of 100. Note 3 Semi-skilled labour is currently paid $12.50 an hour. Half of the work needed on Job 210 can be absorbed in idle time, the other half will need to be done as overtime, paid at 1.5 times the regular hourly wage. Note 4 Skilled labour is currently fully occupied on other work which generates a contribution of $25 an hour. Skilled labour is paid $25 an hour. Job 210 can either be done by diverting labour away from existing work, or by paying overtime at a rate of 1.5 times the regular hourly wage. Note 5 Site preparation require the use of caustic soda. A tub is available, purchased at $100 three years ago for a job that did not materialise. If it is not used for Job 210, disposal cost would be $50. Note 6 Electrical appliances include the cost of the oven, refrigerator, cooking hob and hood, washer and dryer. The cost of $3,000 is inclusive of the supplier's markup of 30%. Note 7 This is my prorated salary cost, being $200 per day. Note 8 25% is added to cover a share of head office costs. Note 9 30% is our normal mark-ups for other projects. Singapore Kitchens Pte Ltd (SKPL) provides a one-stop service for kitchen installation. The company has been invited to submit a bid for a large residential property to install a kitchen in the first apartment of a large and exclusive development. SKPL is very eager to work for this contractor, and wishes to submit a bid price that is priced to win. However, the bid cannot be loss-making; i.e. all relevant costs must be fully recovered. The financial accountant has drafted the following quotation (*Job 210') for your review. Quotation - Job210 Note 1 2 3 T 4 Cabinets (10 units @ $100 per unit) Screws (100 @ $0.50 per unit) Semi-skilled labour (120 hours @ $12.50 per hour) Skilled labour (120 hours @ $25 an hour) Caustic soda Electrical appliances Time cost (2 days @$200 per day) on quote preparation Total variable costs Allocat head office cost (estimated) Total costs Mark-up @ 30% (rounded up to the nearest dollar) Price 5 6 7 $ 1,000 50 1,500 3,000 100 3,000 400 9,050 255 11,305 3,392 14,697 8 9 Note 1 10 cabinets will be needed. These are in continuous use by the company. The current purchase price is $120 each. 5 are held in stock at a carrying cost of $100 each. They could be sold second hand for $60. Note 2 Screws will need to be purchased. They cost $50 for a box of 100. Note 3 Semi-skilled labour is currently paid $12.50 an hour. Half of the work needed on Job 210 can be absorbed in idle time, the other half will need to be done as overtime, paid at 1.5 times the regular hourly wage. Note 4 Skilled labour is currently fully occupied on other work which generates a contribution of $25 an hour. Skilled labour is paid $25 an hour. Job 210 can either be done by diverting labour away from existing work, or by paying overtime at a rate of 1.5 times the regular hourly wage. Note 5 Site preparation require the use of caustic soda. A tub is available, purchased at $100 three years ago for a job that did not materialise. If it is not used for Job 210, disposal cost would be $50. Note 6 Electrical appliances include the cost of the oven, refrigerator, cooking hob and hood, washer and dryer. The cost of $3,000 is inclusive of the supplier's markup of 30%. Note 7 This is my prorated salary cost, being $200 per day. Note 8 25% is added to cover a share of head office costs. Note 9 30% is our normal mark-ups for other projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts