Question: Required: a . Determine the annual amortization ( AMORT ) of the fair value in excess of book value for Parent's acquisition date investment in

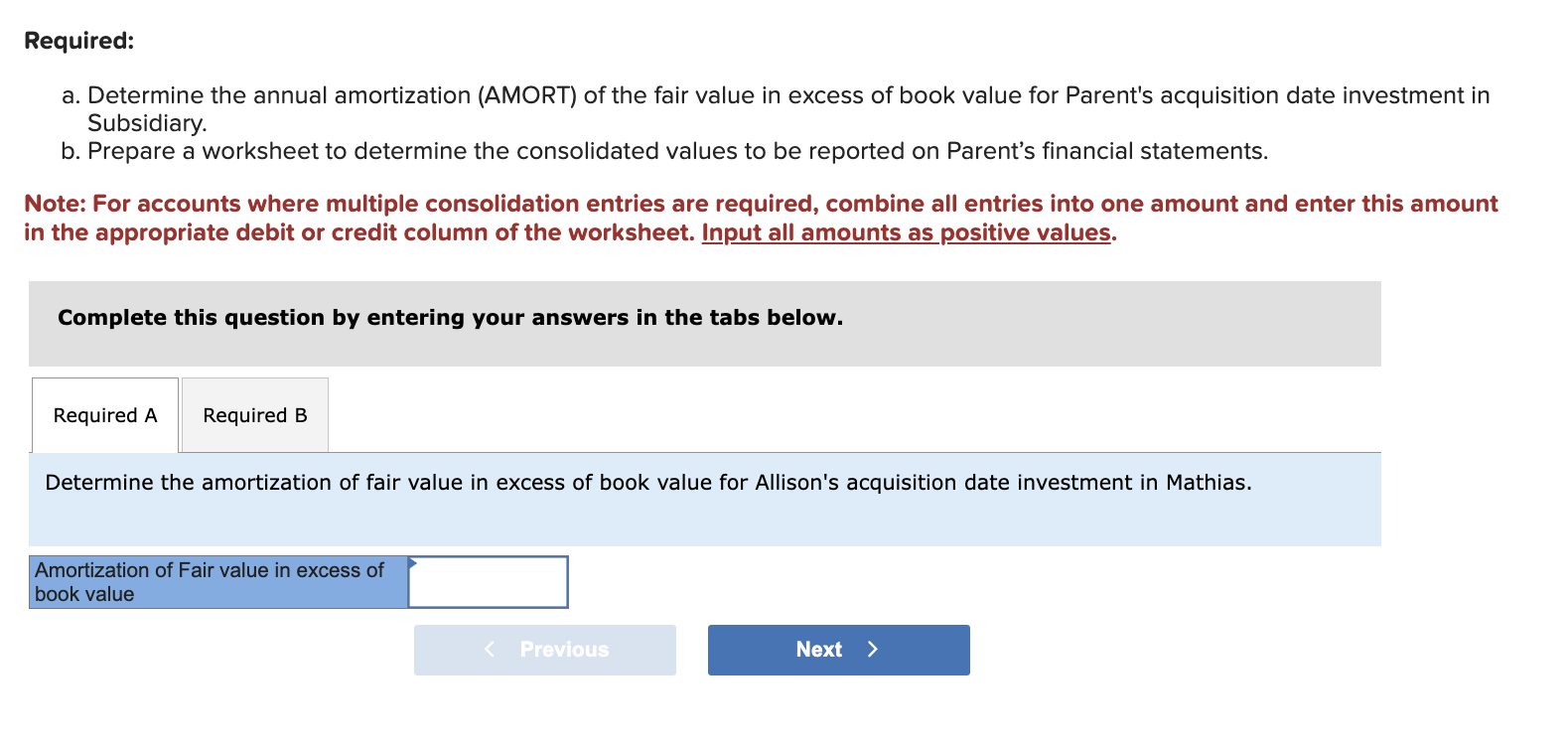

Required:

a Determine the annual amortization AMORT of the fair value in excess of book value for Parent's acquisition date investment in Subsidiary.

b Prepare a worksheet to determine the consolidated values to be reported on Parent's financial statements.

Note: For accounts where multiple consolidation entries are required, combine all entries into one amount and enter this amount in the appropriate debit or credit column of the worksheet. Input all amounts as positive values.

Complete this question by entering your answers in the tabs below.

Determine the amortization of fair value in excess of book value for Allison's acquisition date investment in Mathias.

Amortization of Fair value in excess of book value Prepare a worksheet to determine the consolidated values to be reported on the consolidated financial statements. For accounts where multiple consolidation entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Input all amounts as positive values.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock