Question: Required: a Determine the assessable pro ts / adjusted loss for Good BrothersCompany for the year of assessment 2019/20. (25 marks) b Compute the allocation

Required:

-

a Determine the assessable pro ts / adjusted loss for Good BrothersCompany for the year of assessment 2019/20. (25 marks)

-

b Compute the allocation of pro ts to each of the partners and the taxpayable by each partner, if any, for the year of assessment 2019/20.

(12 marks)

-

c Explain the tax treatments you have accorded to the items mentionedin notes (3), (4) and (5) above. (18 marks)

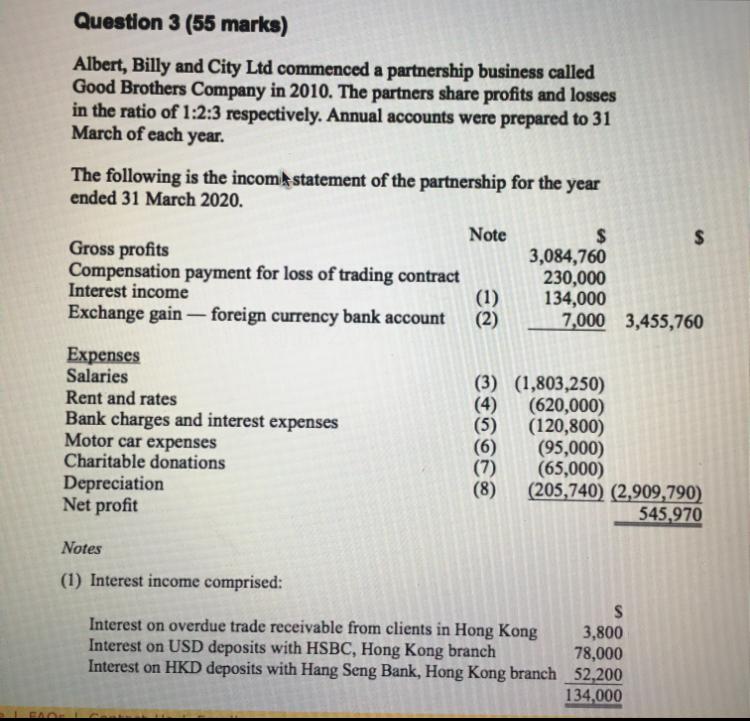

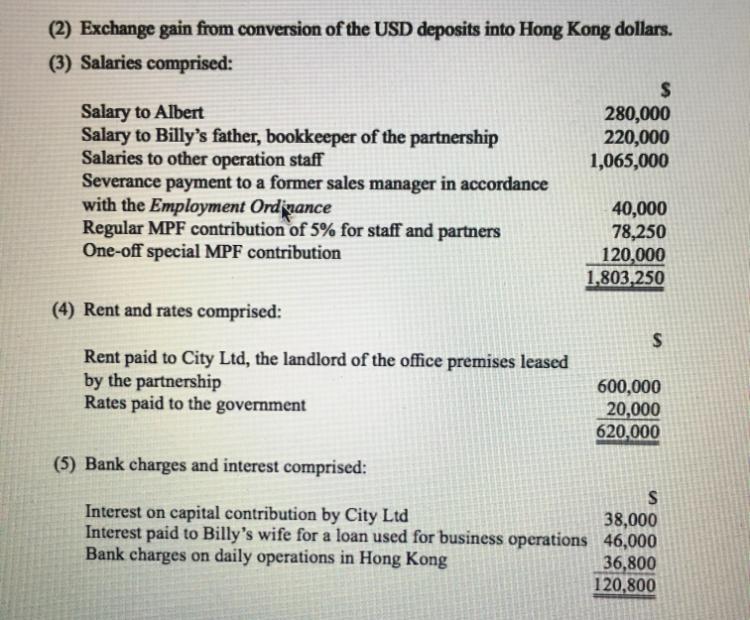

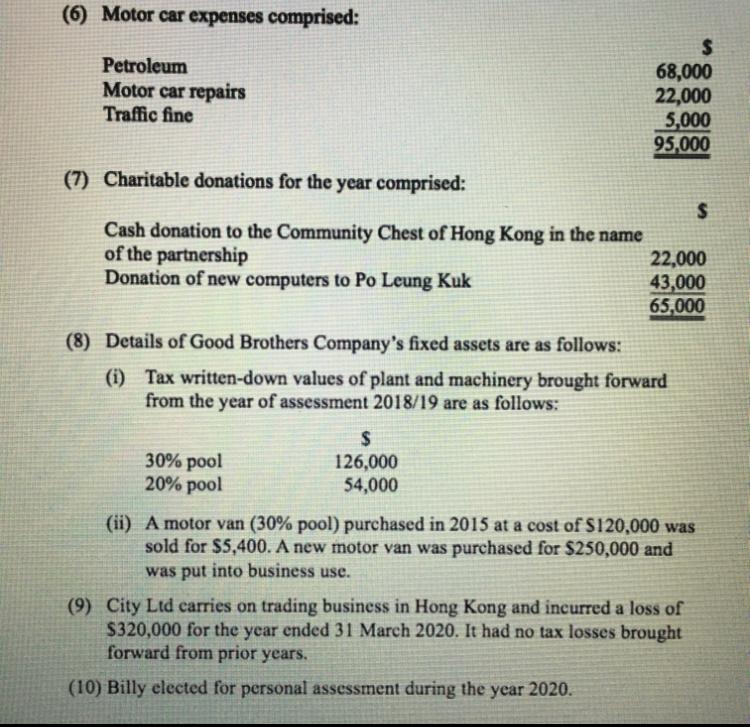

Question 3 (55 marks) Albert, Billy and City Ltd commenced a partnership business called Good Brothers Company in 2010. The partners share profits and losses in the ratio of 1:2:3 respectively. Annual accounts were prepared to 31 March of each year. The following is the income statement of the partnership for the year ended 31 March 2020. Note $ Gross profits 3,084,760 Compensation payment for loss of trading contract 230,000 Interest income (1) 134,000 Exchange gain - foreign currency bank account (2) 7,000 3,455,760 $ Expenses Salaries Rent and rates Bank charges and interest expenses Motor car expenses Charitable donations Depreciation Net profit (3) (1,803,250) (620,000) (5) (120,800) (6) (95,000) (7) (65,000) (8) (205,740) (2,909,790) 545,970 Notes (1) Interest income comprised: S Interest on overdue trade receivable from clients in Hong Kong 3,800 Interest on USD deposits with HSBC, Hong Kong branch 78,000 Interest on HKD deposits with Hang Seng Bank, Hong Kong branch 52,200 134,000 (2) Exchange gain from conversion of the USD deposits into Hong Kong dollars. (3) Salaries comprised: $ Salary to Albert 280,000 Salary to Billy's father, bookkeeper of the partnership 220,000 Salaries to other operation staff 1,065,000 Severance payment to a former sales manager in accordance with the Employment Ordjyance 40,000 Regular MPF contribution of 5% for staff and partners 78,250 One-off special MPF contribution 120,000 1.803,250 (4) Rent and rates comprised: $ Rent paid to City Ltd, the landlord of the office premises leased by the partnership 600,000 Rates paid to the government 20,000 620,000 (5) Bank charges and interest comprised: S Interest on capital contribution by City Ltd 38,000 Interest paid to Billy's wife for a loan used for business operations 46,000 Bank charges on daily operations in Hong Kong 36,800 120,800 (6) Motor car expenses comprised: $ Petroleum 68,000 Motor car repairs 22,000 Traffic fine 5,000 95,000 (7) Charitable donations for the year comprised: $ Cash donation to the Community Chest of Hong Kong in the name of the partnership 22,000 Donation of new computers to Po Leung Kuk 43,000 65,000 (8) Details of Good Brothers Company's fixed assets are as follows: (i) Tax written-down values of plant and machinery brought forward from the year of assessment 2018/19 are as follows: $ 30% pool 126,000 20% pool 54,000 (ii) A motor van (30% pool) purchased in 2015 at a cost of $120,000 was sold for $5,400. A new motor van was purchased for $250,000 and was put into business use. (9) City Ltd carries on trading business in Hong Kong and incurred a loss of $320,000 for the year ended 31 March 2020. It had no tax losses brought forward from prior years. (10) Billy elected for personal assessment during the year 2020. Question 3 (55 marks) Albert, Billy and City Ltd commenced a partnership business called Good Brothers Company in 2010. The partners share profits and losses in the ratio of 1:2:3 respectively. Annual accounts were prepared to 31 March of each year. The following is the income statement of the partnership for the year ended 31 March 2020. Note $ Gross profits 3,084,760 Compensation payment for loss of trading contract 230,000 Interest income (1) 134,000 Exchange gain - foreign currency bank account (2) 7,000 3,455,760 $ Expenses Salaries Rent and rates Bank charges and interest expenses Motor car expenses Charitable donations Depreciation Net profit (3) (1,803,250) (620,000) (5) (120,800) (6) (95,000) (7) (65,000) (8) (205,740) (2,909,790) 545,970 Notes (1) Interest income comprised: S Interest on overdue trade receivable from clients in Hong Kong 3,800 Interest on USD deposits with HSBC, Hong Kong branch 78,000 Interest on HKD deposits with Hang Seng Bank, Hong Kong branch 52,200 134,000 (2) Exchange gain from conversion of the USD deposits into Hong Kong dollars. (3) Salaries comprised: $ Salary to Albert 280,000 Salary to Billy's father, bookkeeper of the partnership 220,000 Salaries to other operation staff 1,065,000 Severance payment to a former sales manager in accordance with the Employment Ordjyance 40,000 Regular MPF contribution of 5% for staff and partners 78,250 One-off special MPF contribution 120,000 1.803,250 (4) Rent and rates comprised: $ Rent paid to City Ltd, the landlord of the office premises leased by the partnership 600,000 Rates paid to the government 20,000 620,000 (5) Bank charges and interest comprised: S Interest on capital contribution by City Ltd 38,000 Interest paid to Billy's wife for a loan used for business operations 46,000 Bank charges on daily operations in Hong Kong 36,800 120,800 (6) Motor car expenses comprised: $ Petroleum 68,000 Motor car repairs 22,000 Traffic fine 5,000 95,000 (7) Charitable donations for the year comprised: $ Cash donation to the Community Chest of Hong Kong in the name of the partnership 22,000 Donation of new computers to Po Leung Kuk 43,000 65,000 (8) Details of Good Brothers Company's fixed assets are as follows: (i) Tax written-down values of plant and machinery brought forward from the year of assessment 2018/19 are as follows: $ 30% pool 126,000 20% pool 54,000 (ii) A motor van (30% pool) purchased in 2015 at a cost of $120,000 was sold for $5,400. A new motor van was purchased for $250,000 and was put into business use. (9) City Ltd carries on trading business in Hong Kong and incurred a loss of $320,000 for the year ended 31 March 2020. It had no tax losses brought forward from prior years. (10) Billy elected for personal assessment during the year 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts