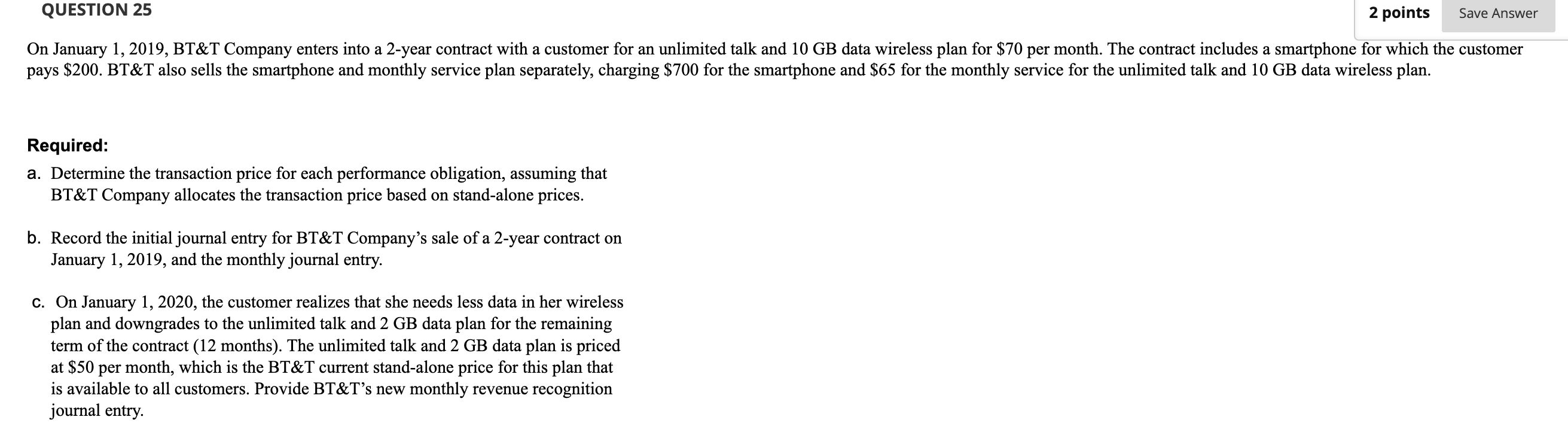

Question: Required: a. Determine the transaction price for each performance obligation, assuming that BT&T Company allocates the transaction price based on stand-alone prices. b. Record the

Required: a. Determine the transaction price for each performance obligation, assuming that BT\&T Company allocates the transaction price based on stand-alone prices. b. Record the initial journal entry for BT\&T Company's sale of a 2-year contract on January 1, 2019, and the monthly journal entry. c. On January 1, 2020, the customer realizes that she needs less data in her wireless plan and downgrades to the unlimited talk and 2GB data plan for the remaining term of the contract (12 months). The unlimited talk and 2 GB data plan is priced at $50 per month, which is the BT\&T current stand-alone price for this plan that is available to all customers. Provide BT\&T's new monthly revenue recognition journal entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts