Question: REQUIRED: a . Discuss whether the Foundation should use the deferral method or the restricted fund method for revenue recognition. Discuss also whether the foundation

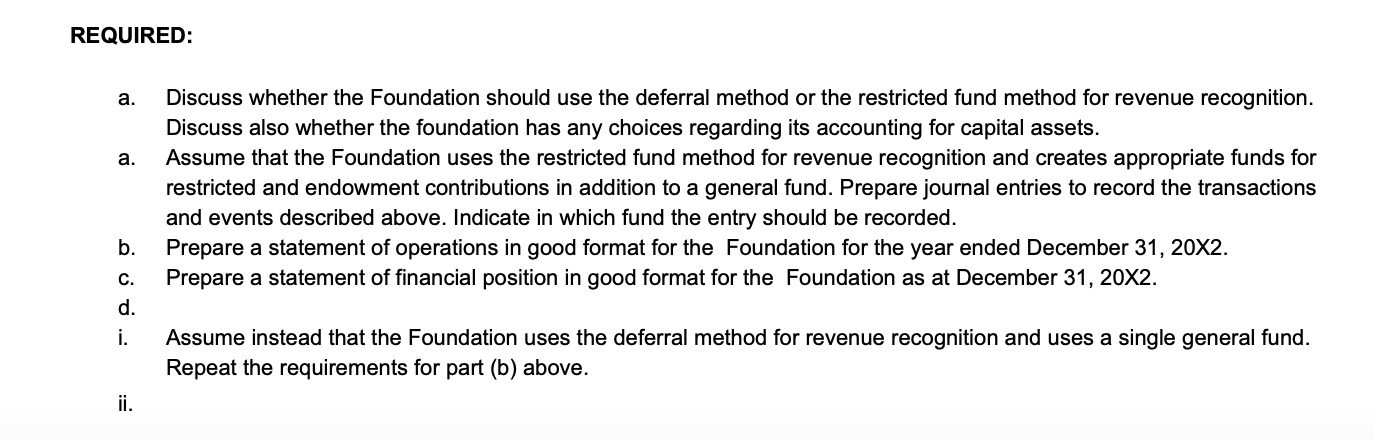

REQUIRED:

a Discuss whether the Foundation should use the deferral method or the restricted fund method for revenue recognition. Discuss also whether the foundation has any choices regarding its accounting for capital assets.

a Assume that the Foundation uses the restricted fund method for revenue recognition and creates appropriate funds for restricted and endowment contributions in addition to a general fund. Prepare journal entries to record the transactions and events described above. Indicate in which fund the entry should be recorded.

b Prepare a statement of operations in good format for the Foundation for the year ended December X

c Prepare a statement of financial position in good format for the Foundation as at December X

d

i Assume instead that the Foundation uses the deferral method for revenue recognition and uses a single general fund. Repeat the requirements for part b above.

ii QUESTION

On January X Luther, a local college professor and philanthropist, started the MLK Foundation, a notforprofit institute designed to help retired adventurers adjust to normal life once their treasurehunting days are over.

During the year, the following transactions took place:

On January Luther donated land with an old building with a market value of $ furniture with a value of $ and cash of $ Mr Luther placed no special restrictions on the use of these assets. The fair value of the land alone was determined to be $ The building required extensive refurbishment.

On February the Foundation received a donation of $ No restrictions were placed on this donation.

On March the Foundation began a monthlong fundraising drive to collect contributions for refurbishment of the building. All donations received from the fundraising campaign were designated for use in refurbishing the building. During March, a total of $ was collected.

The total costs to refurbish the building amounted to $ In addition to the donations raised from the fundraising drive, the Foundation used cash from the unrestricted donations for this purpose. The building was ready for operations by the end of June.

quad On May the Foundation received $ from the estate of Mr J Bond. In his will, Mr Bond indicated that the donation was not to be used for the daytoday activities of the Foundation but was to be invested in government bonds. The interest earned from the bonds could be used as the Foundation chose. Accordingly, the Foundation established an endowment fund for this contribution and invested the cash received in government bonds.

Interest earned for the year ending December on the government bonds amounted to $

During the year ending December the foundation paid the following amounts in cash:

$ Office supplies $ worth remain unused at yearend

$ Utilities the bill for December, $ remained unpaid

$ Salaries for Foundation workers $ remained unpaid at the end of the year

The building is estimated to have a remaining useful life of years, whereas the furniture is expected to last another years. No residual value is expected for either asset.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock