Question: Required: a. Journalize the transaction for the year. b. Post the journal entries to T-accounts. c. Prepare an unadjusted trial balance as of December 31,

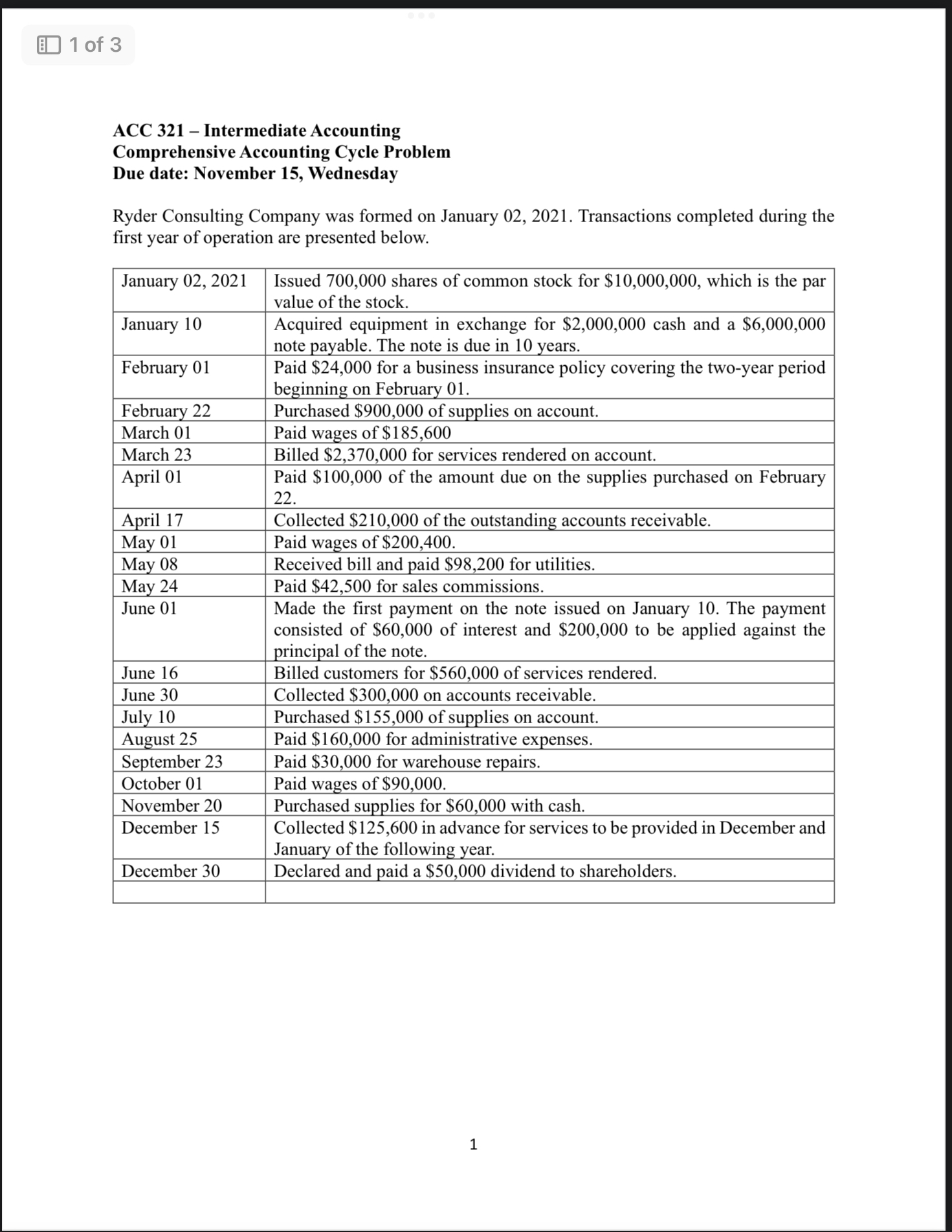

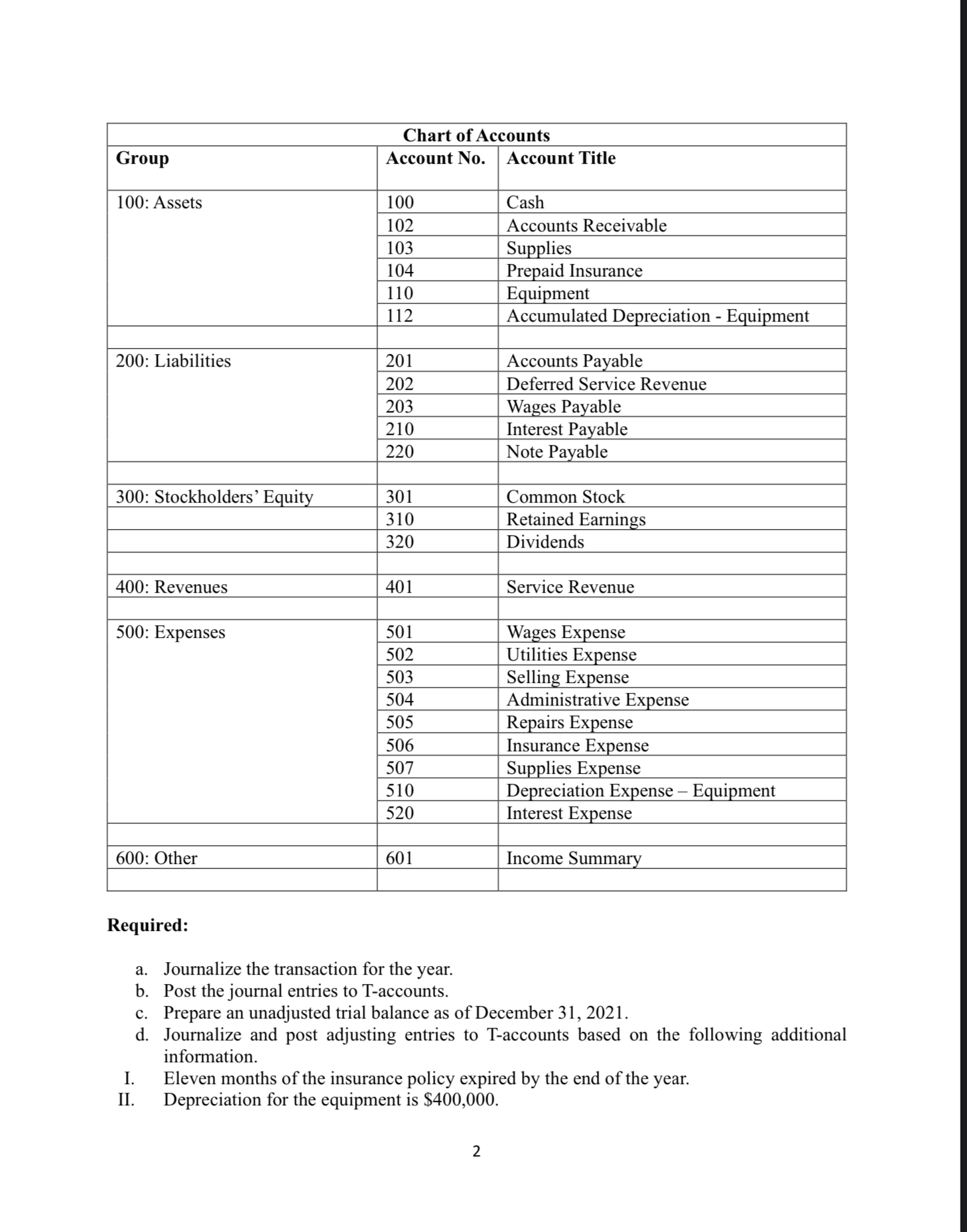

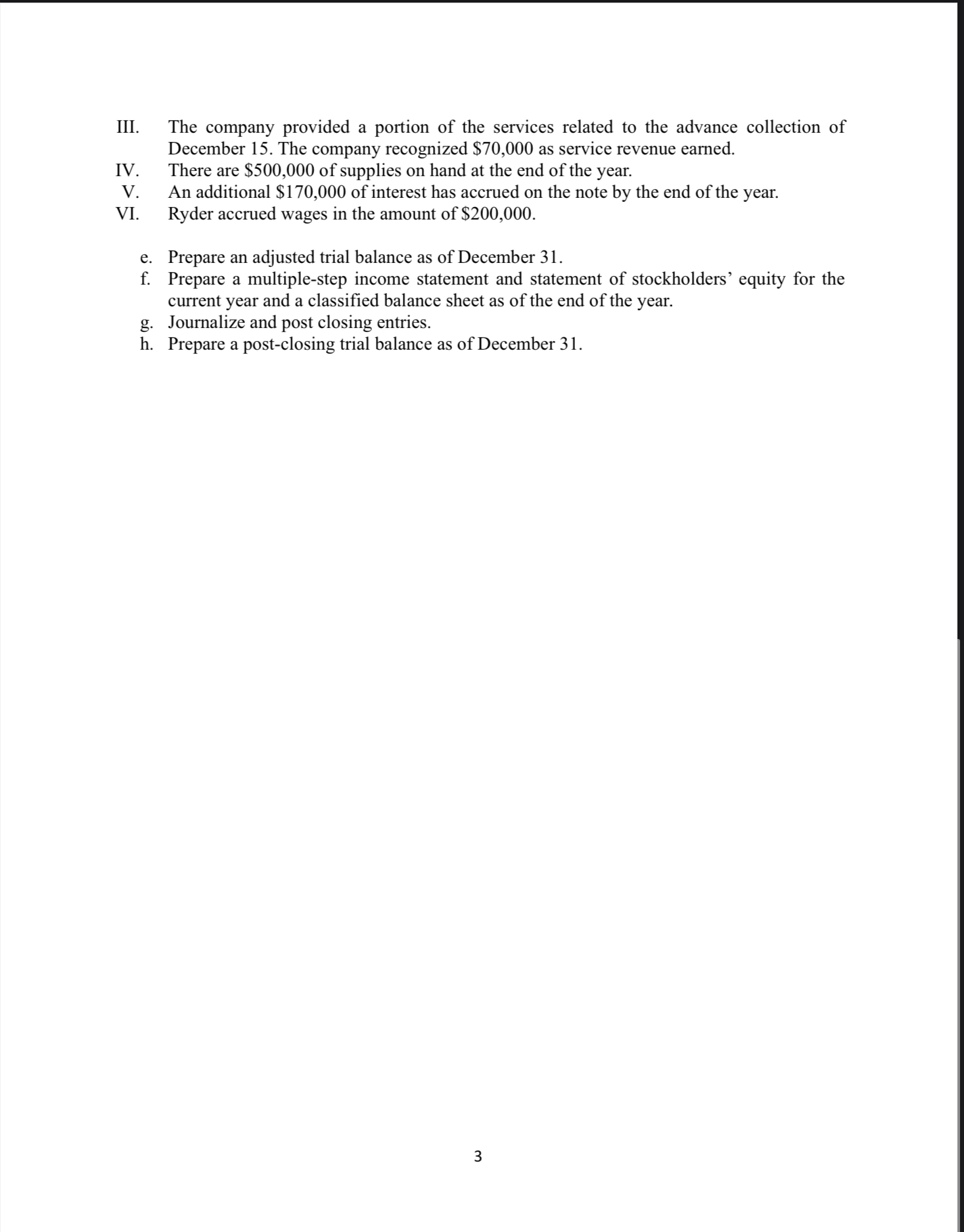

Required: a. Journalize the transaction for the year. b. Post the journal entries to T-accounts. c. Prepare an unadjusted trial balance as of December 31, 2021. d. Journalize and post adjusting entries to T-accounts based on the following additional information. I. Eleven months of the insurance policy expired by the end of the year. II. Depreciation for the equipment is $400,000. ACC 321 - Intermediate Accounting Comprehensive Accounting Cycle Problem Due date: November 15, Wednesday Ryder Consulting Company was formed on January 02, 2021. Transactions completed during the first year of operation are presented below. III. The company provided a portion of the services related to the advance collection of December 15 . The company recognized $70,000 as service revenue earned. IV. There are $500,000 of supplies on hand at the end of the year. V. An additional $170,000 of interest has accrued on the note by the end of the year. VI. Ryder accrued wages in the amount of $200,000. e. Prepare an adjusted trial balance as of December 31 . f. Prepare a multiple-step income statement and statement of stockholders' equity for the current year and a classified balance sheet as of the end of the year. g. Journalize and post closing entries. h. Prepare a post-closing trial balance as of December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts