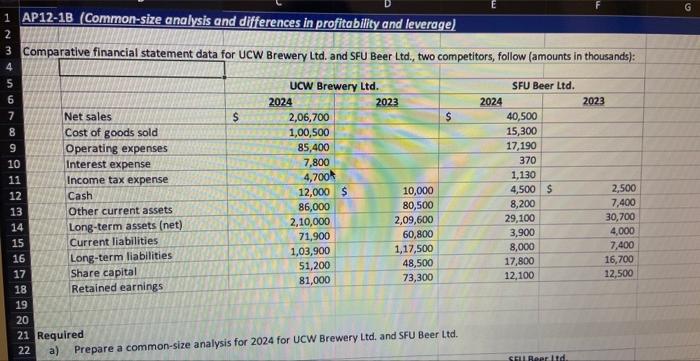

Question: Required a) Prepare a common-size analysis for 2024 for UCW Brewery Ltd. and SFU Beer Ltd. a) Prepare a common-size analysis for 2024 tor UCW

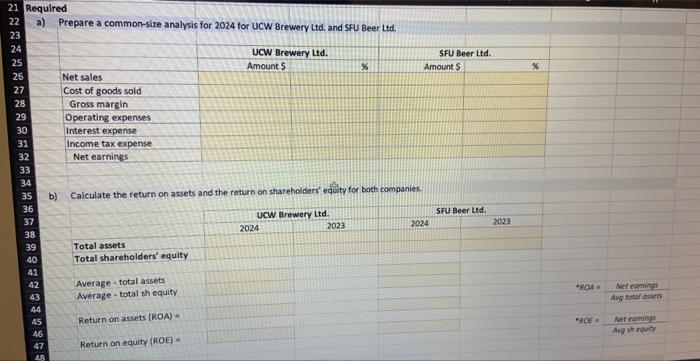

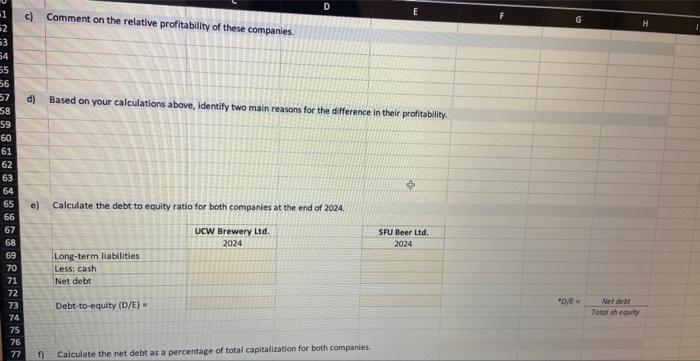

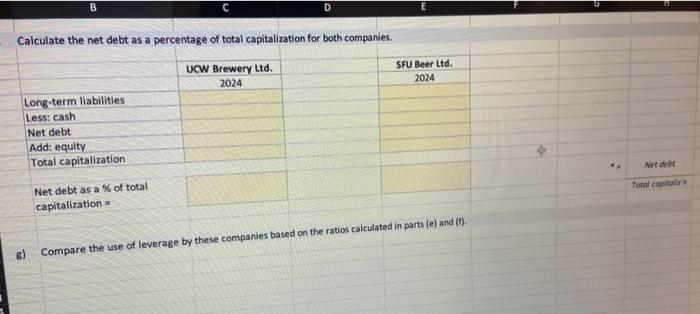

Required a) Prepare a common-size analysis for 2024 for UCW Brewery Ltd. and SFU Beer Ltd. a) Prepare a common-size analysis for 2024 tor UCW Brewery Ltd, and SFU Beer Ltd. b) Calculate the return on assets and the return on shareholdars' eqty for both companies. c) Comment on the relative profitability of these companies. d) Based on your calculations above, identify two main reasons for the difference in their profitability. e) Calculate the debt to equity ratio for both companies at the end of 2024 . SFU Beer Ltd. 2024 Paye Tota/isrqutyNetdebt f) Calculate the net debt as a percentage of total capitalization for both companies. Calculate the net debt as a percentage of total capitalization for both companies. SFU Beer Ltd. 2024 B) Compare the use of leverage by these companies based on the ratios calculated in parts (e) and (t)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts