Question: Required a. Prepare a contribution income statement for June. b. Determine NYTs monthly break-even point in units. c. Determine NYTs margin of safety for June

Required

a. Prepare a contribution income statement for June.

b. Determine NYTs monthly break-even point in units.

c. Determine NYTs margin of safety for June 2017.

d. Determine the unit sales required for a monthly after-tax profit of $15,000.

e. Prepare a cost-volume-profit graph. Label the horizontal axis in units with a maximum value of

4,000. Label the vertical in dollars with a maximum value of $300,000. Draw a vertical line on

the graph for the current (3,000) unit level and label total variable costs, total fixed costs, and total

before-tax profits at 3,000 units.

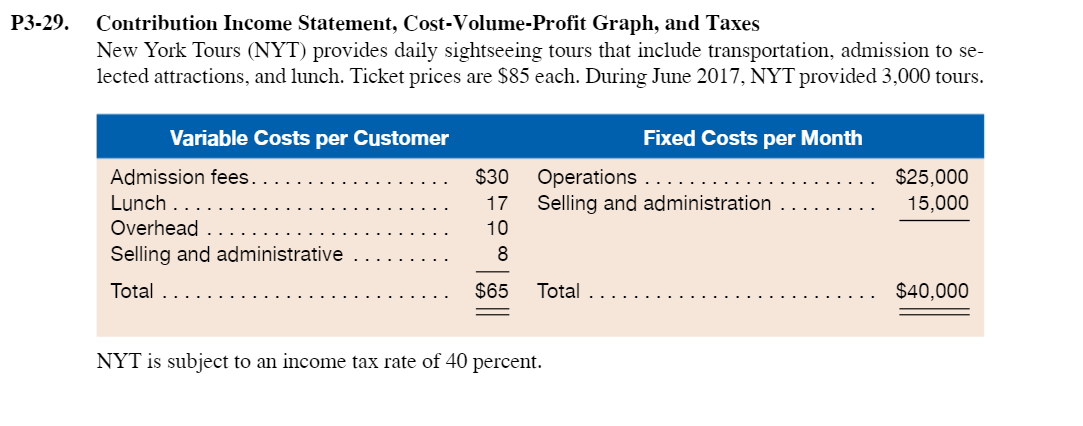

P3-29. Contribution Income Statement, Cost-Volume-Profit Graph, and Taxes New York Tours (NYT) provides daily sightseeing tours that include transportation, admission to se- lected attractions, and lunch. Ticket prices are S85 each. During June 2017, NYT provided 3,000 tours. Variable Costs per Customer Fixed Costs per Month $25,000 15,000 Lunch Overhead Selling and administrative Total Selling and administration 17 10 8 $65 Total NYT is subject to an income tax rate of 40 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts