Question: Required: a) Prepare a multiple step income statement in good form for the year ended 12/31/18. b) Prepare a separate statement of retained earnings for

Required:

a) Prepare a multiple step income statement in good form for the year ended 12/31/18.

b) Prepare a separate statement of retained earnings for the same period.

c) Prepare a classified balance sheet at 12/31/18 in good form.

please answer all parts

type your response

Problem 2 (25%):

Lanister Corporations capital structure consists solely of shares of common stock, 50,000 shares of which have been authorized. At 12/31/18, an analysis of the accounts on the adjusted trial balance and discussions with company officials revealed the following information:

Accounts payable

$ 30,900

Accounts receivable

135,000

Accrued interest payable

1,500

Accumulated depreciation

270,000

Additional paid-in capital

400,000

Allowance for doubtful accounts

7,500

Cash

30,000

Common stock, $10 par

200,000

Dividend revenue

12,000

Dividends declared

43,500

Error in 2014 depreciation, taken in excess

60,000

General and administrative expenses

225,000

Interest expense

25,500

Inventory, 1/1/18

228,000

Inventory, 12/31/18

187,500

Loss on sale of assets of operations discontinued in 2017

90,000

Land

555,000

Machinery and equipment

675,000

Materials and supplies

60,000

Notes payable (maturity 7/1/23)

300,000

Patents

150,000

Purchase discounts

27,000

Purchases

963,000

Retained earnings, 1/1/18

435,000

Sales

1,650,000

Selling expenses

192,000

Trading securities

58,500

Unearned service revenue

36,600

Lanister has not yet accrued income tax expense; the applicable overall rate is 30%.

Required:

a) Prepare a multiple step income statement in good form for the year ended 12/31/18.

b) Prepare a separate statement of retained earnings for the same period.

c) Prepare a classified balance sheet at 12/31/18 in good form.

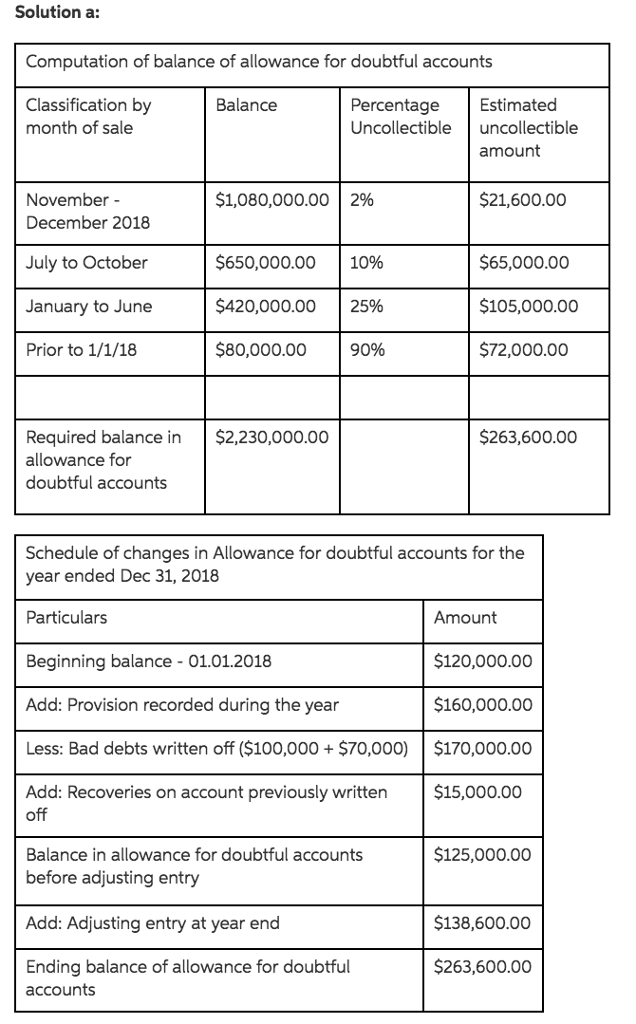

Solution a: Computation of balance of allowance for doubtful accounts Classification by month of sale Balance Percentage Estimated Uncollectible uncollectible amount November - $1,080,000.00 | 2% $21,600.00 December 2018 July to October January to June Prior to 1/1/18 $650,000.00 | 10% $420,000.00 | 25% $80,000.00 | 90% $65,000.00 $105,000.00 $72,000.00 Required balance in $2,230,000.00 allowance for doubtful accounts $263,600.00 Schedule of changes in Allowance for doubtful accounts for the year ended Dec 31, 2018 Particulars Beginning balance 01.01.2018 Add: Provision recorded during the year Less: Bad debts written off ($100,000$70,000) $170,000.00 Add: Recoveries on account previously written$15,000.00 Amount 120,000.00 160,000.00 Balance in allowance for doubtful accounts $125,000.00 before adjusting entry Add: Adjusting entry at year end Ending balance of allowance for doubtful $138,600.00 $263,600.00 accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts