Question: Required: a. Prepare a statement of cash flows (indirect method) for ABC Corporation. (25 marks) (Hint: Acquisition of ZZA company requires you to remove the

Required:

a. Prepare a statement of cash flows (indirect method) for ABC Corporation. (25 marks)

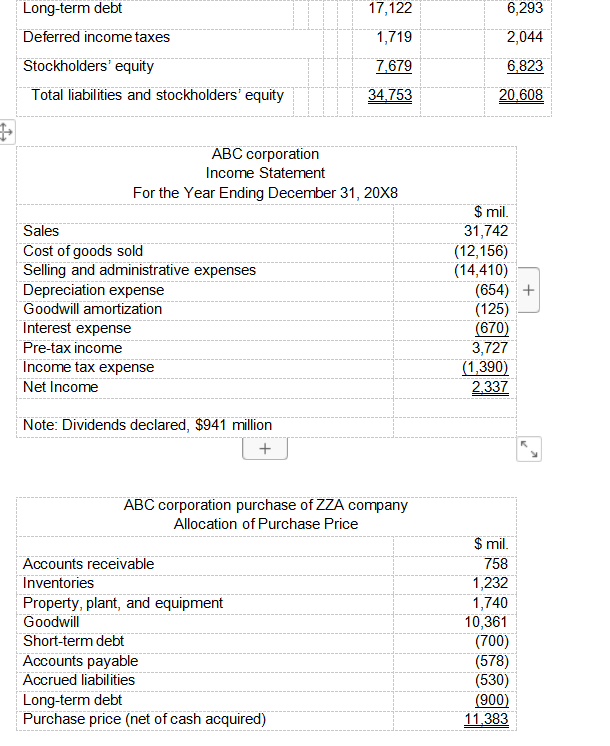

(Hint: Acquisition of ZZA company requires you to remove the assets acquired and liabilities incurred as a result of that acquisition from the balance sheet before computing changes used in preparing the statement of cash flows. ABC Corporation pays $11.383 billion for ZZA company, net of cash acquiredsee the Allocation of Purchase Price table.)

b. Based on your answer to (a), compute s free cash flow for Year 20X8. Discuss TWO (2) main points how free cash flow impacts the companys future earnings and financial condition.

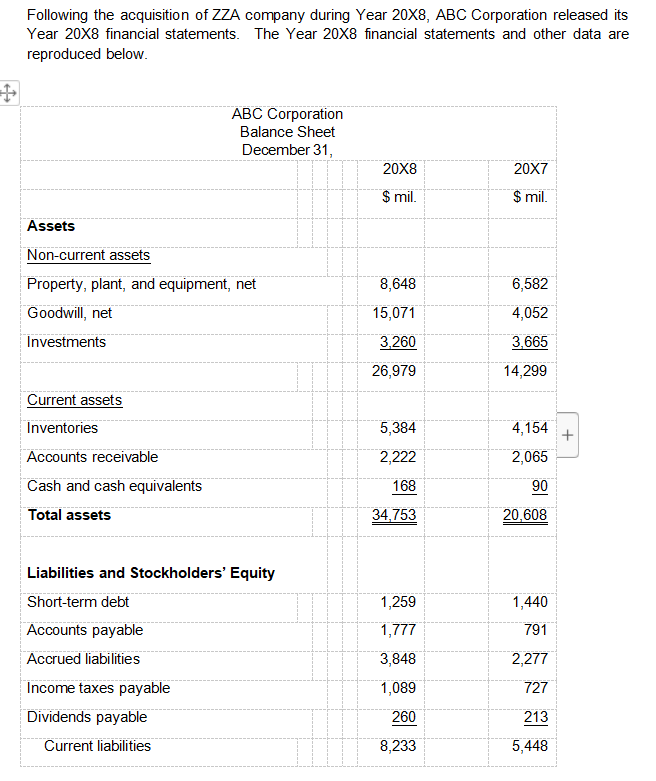

Following the acquisition of ZZA company during Year 20X8, ABC Corporation released its Year 20X8 financial statements. The Year 20X8 financial statements and other data are reproduced below. I ABC Corporation Balance Sheet December 31, 20X8 20X7 $ mil. $ mil. Assets Non-current assets Property, plant, and equipment, net Goodwill, net Investments 8,648 6,582 4,052 15,071 3,260 3,665 14,299 26,979 5,384 + Current assets Inventories Accounts receivable Cash and cash equivalents Total assets 2,222 4,154 2,065 90 168 34,753 20,608 1,440 1,259 1,777 791 Liabilities and Stockholders' Equity Short-term debt Accounts payable Accrued liabilities Income taxes payable Dividends payable Current liabilities 3,848 2,277 727 1,089 260 213 8,233 5,448 17,122 1,719 6,293 2,044 Long-term debt Deferred income taxes Stockholders' equity Total liabilities and stockholders' equity 7,679 6,823 34.753 20.608 I ABC corporation Income Statement For the Year Ending December 31, 20X8 $ mil. Sales Cost of goods sold Selling and administrative expenses Depreciation expense Goodwill amortization Interest expense Pre-tax income Income tax expense Net Income (12,156) (14,410) (654) + (125) (670) 3,727 (1,390) 2337 Note: Dividends declared, $941 million + ABC corporation purchase of ZZA company Allocation of Purchase Price $ mil. 758 Accounts receivable Inventories Property, plant, and equipment Goodwill Short-term debt Accounts payable Accrued liabilities Long-term debt Purchase price (net of cash acquired) 1,232 1,740 10,361 (700) (578) (530) (900) 11.383

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts