Question: REQUIRED: a) Prepare an Income Statement for the year ended 31 December 2020 for publication in accordance with IAS 1. [18 marks] b) Prepare a

REQUIRED: a) Prepare an Income Statement for the year ended 31 December 2020 for publication in accordance with IAS 1. [18 marks] b) Prepare a Statement of changes in equity for the year ended 31 December 2020 suitable for publication in accordance with IAS 1. [4 marks] c) Prepare a Statement of Financial Position as at 31 December 2020 in accordance with IAS 1. [12 marks] d) Calculate the following ratios for Alicante Ltd for the year ended 31 December 2020. i. Inventory turnover (times) ii. Return on Capital Employed iii. Gearing ratio iv. Current ratio v. Dividend yield vi. Price earnings ratio (times) [ 6 marks] [In case of decimal, give your answer to 2 decimal places]

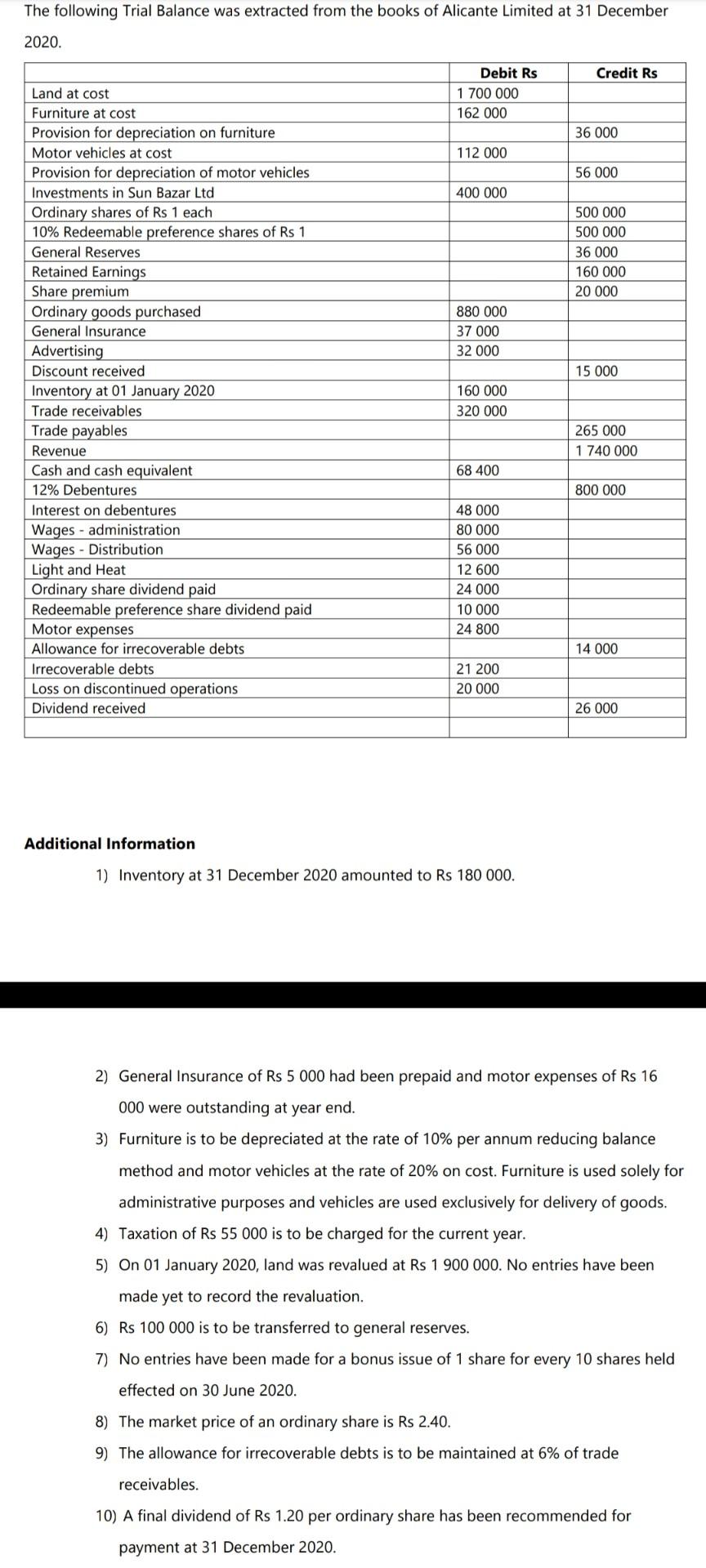

The following Trial Balance was extracted from the books of Alicante Limited at 31 December 2020. Credit Rs Debit Rs 1 700 000 162 000 36 000 112 000 56 000 400 000 500 000 500 000 36 000 160 000 20 000 880 000 37 000 32 000 15 000 Land at cost Furniture at cost Provision for depreciation on furniture Motor vehicles at cost Provision for depreciation of motor vehicles Investments in Sun Bazar Ltd Ordinary shares of Rs 1 each 10% Redeemable preference shares of Rs 1 General Reserves Retained Earnings Share premium Ordinary goods purchased General Insurance Advertising Discount received Inventory at 01 January 2020 Trade receivables Trade payables Revenue Cash and cash equivalent 12% Debentures Interest on debentures Wages - administration Wages - Distribution Light and Heat Ordinary share dividend paid Redeemable preference share dividend paid Motor expenses Allowance for irrecoverable debts Irrecoverable debts Loss on discontinued operations Dividend received 160 000 320 000 265 000 1 740 000 68 400 800 000 48 000 80 000 56 000 12 600 24 000 10 000 24 800 14 000 21 200 20 000 26 000 Additional Information 1) Inventory at 31 December 2020 amounted to Rs 180 000. 2) General Insurance of Rs 5 000 had been prepaid and motor expenses of Rs 16 000 were outstanding at year end. 3) Furniture is to be depreciated at the rate of 10% per annum reducing balance method and motor vehicles at the rate of 20% on cost. Furniture is used solely for administrative purposes and vehicles are used exclusively for delivery of goods. 4) Taxation of Rs 55 000 is to be charged for the current year. 5) On 01 January 2020, land was revalued at Rs 1 900 000. No entries have been made yet to record the revaluation. 6) Rs 100 000 is to be transferred to general reserves. 7) No entries have been made for a bonus issue of 1 share for every 10 shares held effected on 30 June 2020. 8) The market price of an ordinary share is Rs 2.40. 9) The allowance for irrecoverable debts is to be maintained at 6% of trade receivables. 10) A final dividend of Rs 1.20 per ordinary share has been recommended for payment at 31 December 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts