Question: Required: A put option on a stock with a current price of $ 4 2 has an exercise price of $ 4 4 . The

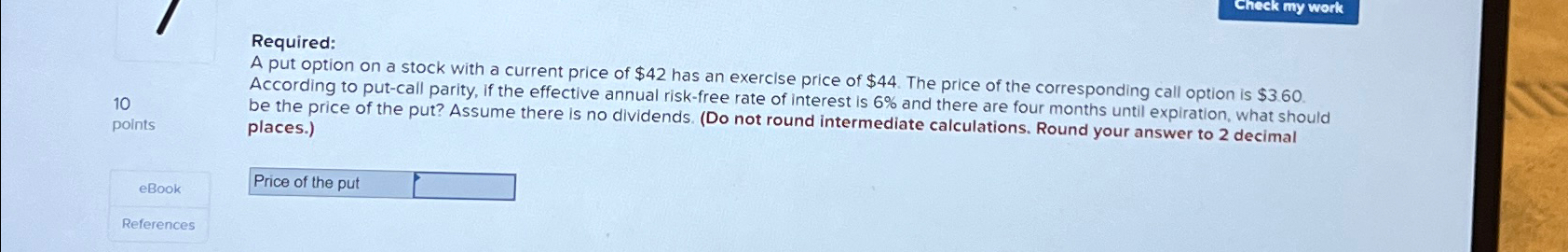

Required:

A put option on a stock with a current price of $ has an exercise price of $ The price of the corresponding call option is $ According to putcall parity, if the effective annual riskfree rate of interest is and there are four months until expiration, what should be the price of the put? Assume there is no dividends. Do not round intermediate calculations. Round your answer to decimal places.

Price of the put

References

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock