Question: Required A Required B Required C Required D Required E Required B d. Assume that Alex contributes $20,000 to his traditional 401(k) account this year,

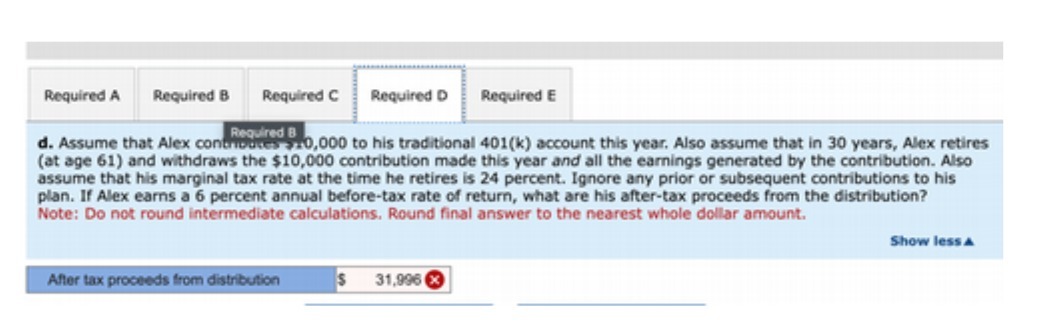

Required A Required B Required C Required D Required E Required B d. Assume that Alex contributes $20,000 to his traditional 401(k) account this year, Also assume that in 30 years, Alex retires (at age 61) and withdraws the $10,000 contribution made this year and all the earnings generated by the contribution. Also assume that his marginal tax rate at the time he retires is 24 percent. Ignore any prior or subsequent contributions to his plan. If Alex earns a 6 percent annual before-tax rate of return, what are his after-tax proceeds from the distribution? Note: Do not round intermediate calculations, Round final answer to the nearest whole dollar amount. Show less A After tax proceeds from distribution 31,996 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts