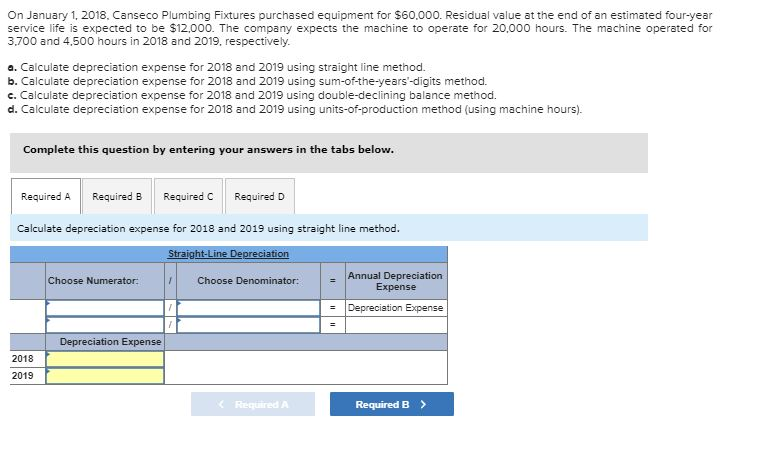

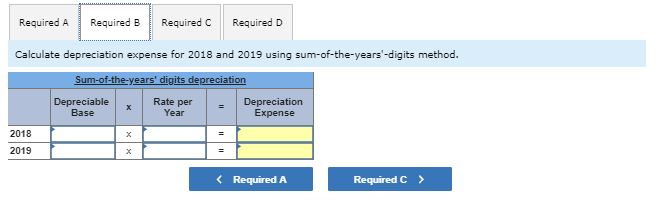

Question: Required A Required B Required Required D Calculate depreciation expense for 2018 and 2019 using sum-of-the-years'-digits method. Sum-of-the-years' digits depreciation Depreciable Rate per Year Depreciation

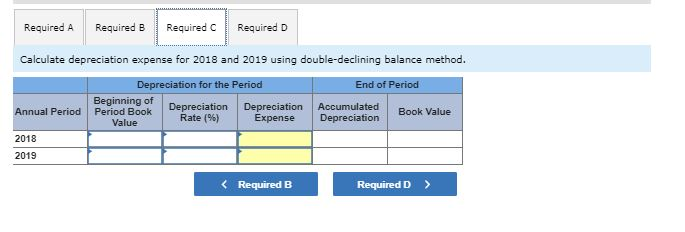

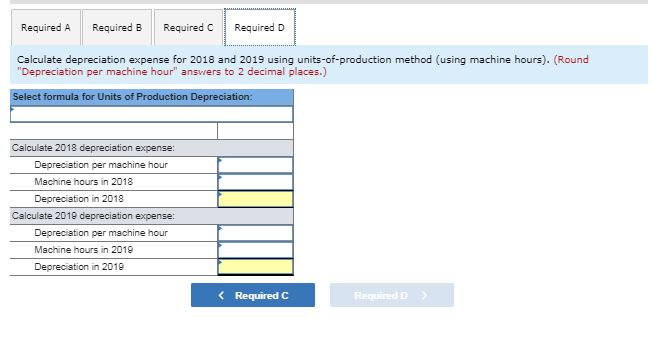

Required A Required B Required Required D Calculate depreciation expense for 2018 and 2019 using sum-of-the-years'-digits method. Sum-of-the-years' digits depreciation Depreciable Rate per Year Depreciation Expense Base 2018 2019 Required A Required B Required Required D Calculate depreciation expense for 2018 and 2019 using double-declining balance method. End of Period Depreciation for the Period Beginning of Depreciation Depreciation Period Book Rate(%) Expense Value Annual Period Accumulated Depreciation Book Value 2018 2019 Required A Required B Required Required D Calculate depreciation expense for 2018 and 2019 using units-of-production method (using machine hours). (Round "Depreciation per machine hour answers to 2 decimal places.) Select formula for Units of Production Depreciation: Calculate 2018 depreciation expense: Depreciation per machine hour Machine hours in 2018 Depreciation in 2018 Calculate 2019 depreciation expense: Depreciation per machine hour Machine hours in 2019 Depreciation in 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts