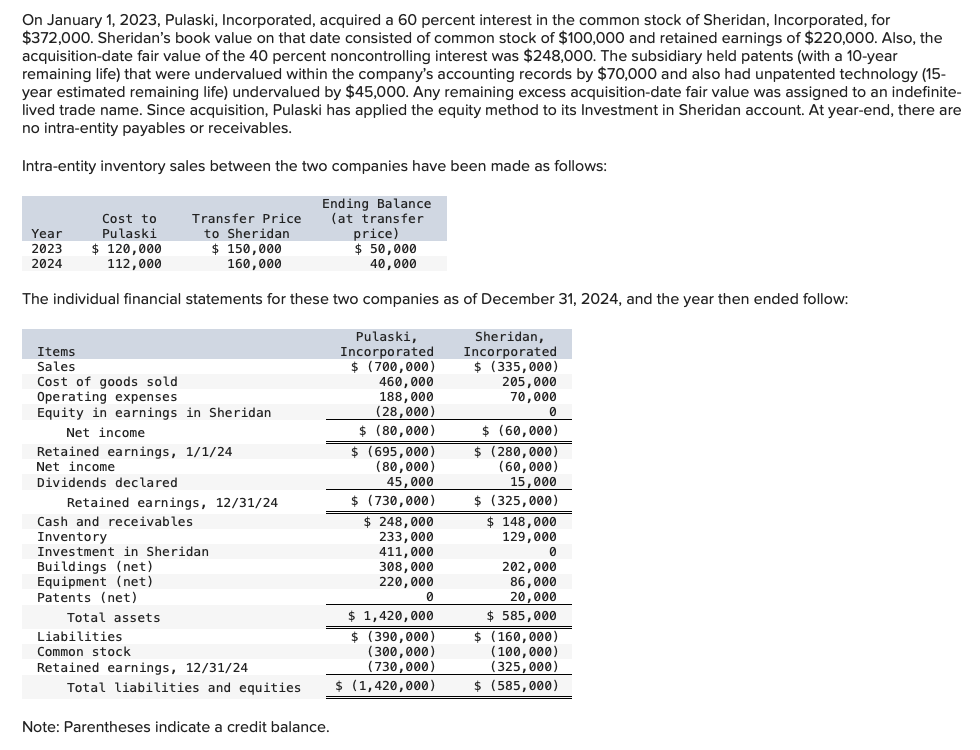

Question: Required: a . Show how Pulaski determined the ( $ 4 1 1 , 0 0 0 ) Investment in Sheridan account

Required:

a Show how Pulaski determined the $ Investment in Sheridan account balance. Assume that Pulaski defers percent of downstream intraentity profits against its share of Sheridan's income.

b Prepare a consolidated worksheet to determine appropriate balances for external financial reporting as of December

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Show how Pulaski determined the $ Investment in Sheridan account balance. Assume that Pulaski defers percent of downstream intraentity profits against its share of Sheridan's income.

Note: Amounts to be deducted should be indicated with a minus sign. Assessment Tool iFrame

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required B

Prepare a consolidated worksheet to determine appropriate balances for external financial reporting as of December

Note: For accounts where multiple consolidation entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Input all amounts as positive values.

Show less

begintabularlllllll

hline multicolumncPULASKI INCORPORATED, AND SHERIDAN, INCORPORATED

hline multicolumncConsolidation Worksheet

hline multicolumncFor Year Ending December

hline & & & multicolumncConsolidation Entries & &

hline Accounts & Pulaski & Sheridan & Debit & Credit & Noncontrolling Interest & Consolidated Totals

hline Sales & $ & $ & $ & & &

hline Cost of goods sold & & & & & &

hline Operating expenses & & & & & &

hline Equity in earnings of Sheridan & & & & & &

hline Separate company net income & $ & $ & & & &

hline Consolidated net income & & & & & &

hline To noncontrolling interest & & & & & &

hline To Pulaski, Incorporated & & & & & &

hline Retained earnings & & & & & &

hline Net income & & & & & &

hline Dividends declared & & & & & &

hline Retained earnings & $ & $ & & & &

hline Cash and receivables & $ & $ & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock