Question: Required: a) What is the estimated equation for the security market line (SML)? (3 marks) b) Calculate the funds required rate of return for the

Required:

a) What is the estimated equation for the security market line (SML)? (3 marks)

b) Calculate the funds required rate of return for the next period. (3 marks)

c) Suppose Mr. Lee, the president, receives a proposal for a new stock. The investment needed to take a position in the stock is $50 million, it will have an expected return of 15 percent, and its estimated beta coefficient is 2.0. Should the new stock be purchase? At what expected rate of return should the fund be indifferent to purchasing the stock? (2 marks)

d) If a companys beta were to double, would its expected return double? (2 marks)

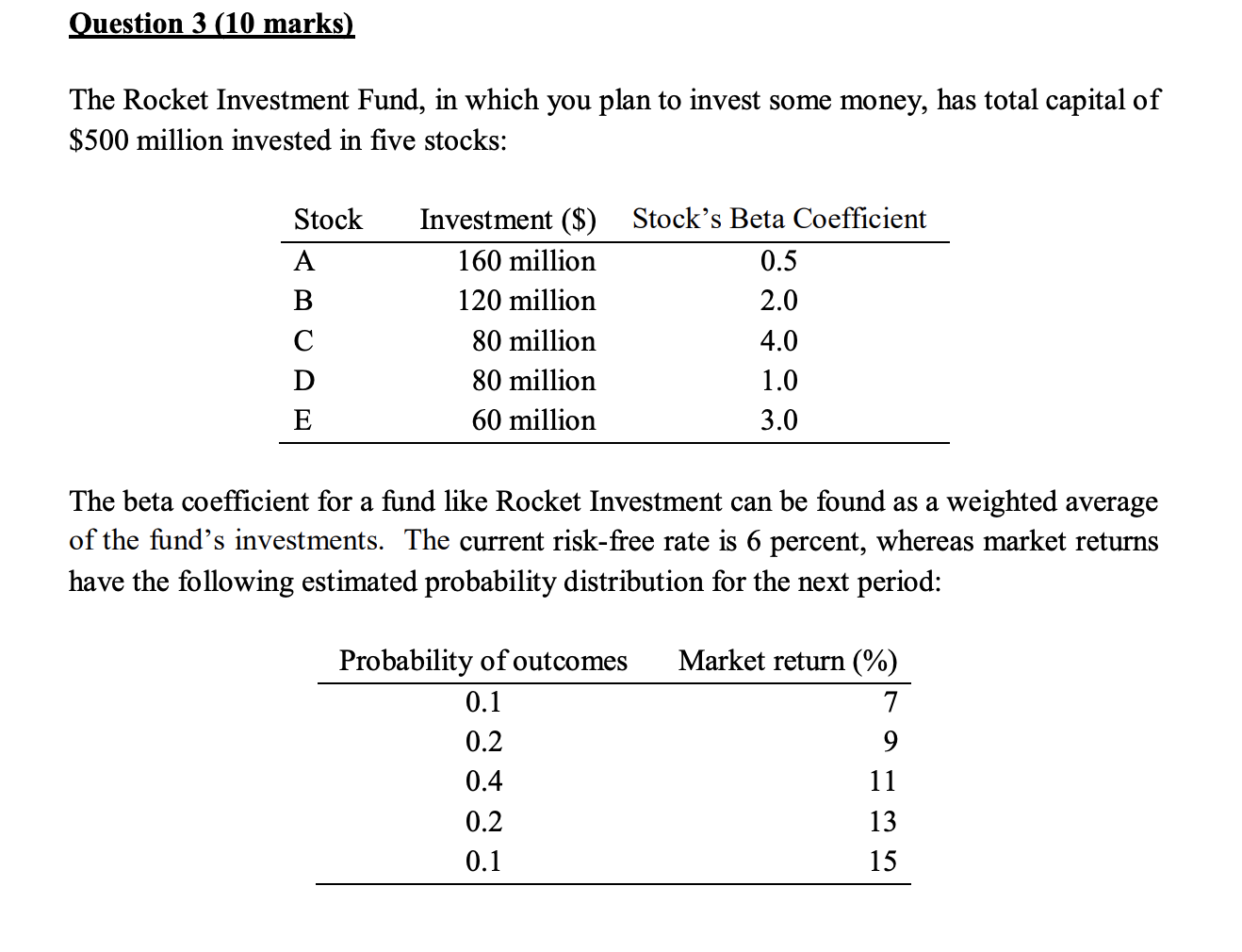

Question 3 (10 marks) The Rocket Investment Fund, in which you plan to invest some money, has total capital of $500 million invested in five stocks: Stock Investment ($) Stock's Beta Coefficient 160 million 0.5 A B 120 million 2.0 80 million 4.0 D 80 million 1.0 E 60 million 3.0 The beta coefficient for a fund like Rocket Investment can be found as a weighted average of the fund's investments. The current risk-free rate is 6 percent, whereas market returns have the following estimated probability distribution for the next period: Probability of outcomes 0.1 Market return (%) 7 0.2 9 0.4 11 0.2 13 0.1 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts