Question: A. What is the project's payback (time)? Please use cumulative cash flow (list your table) to find it B. Assuming the project has average risk,

A. What is the project's payback (time)? Please use cumulative cash flow (list your table) to find it

B. Assuming the project has average risk, What is its NPV

C. What is the project's IRR?

D. Based on your answers B) and C), is it a project worth investing? Why?

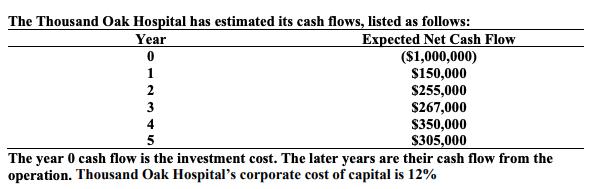

The Thousand Oak Hospital has estimated its cash flows, listed as follows: Expected Net Cash Flow ($1,000,000) $150,000 Year 0 1 2 3 4 5 $255,000 $267,000 $350,000 $305,000 The year 0 cash flow is the investment cost. The later years are their cash flow from the operation. Thousand Oak Hospital's corporate cost of capital is 12%

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

A The payback period is considered as the time length required to cover the amount of initial investment on the project Thus the cumulative cash flow ... View full answer

Get step-by-step solutions from verified subject matter experts