Question: Required: As a Management Accounting Team, Ms White has asked you to: Calculate the following variances for June: Materials price and quantity variances. Labour rate

Required:

As a Management Accounting Team, Ms White has asked you to:

- Calculate the following variances for June:

- Materials price and quantity variances.

- Labour rate and efficiency variances.

- Variable overhead spending and efficiency variances.

- Summarise the variances that your team calculated in (1) above by showing the net overall favourable or unfavourable variance for the month. What impact did these figures have on the companys income statement? Show your calculations.

Select the two most significant variances that your team calculated in (1) above. Explain to Ms. White the possible causes of these variances.

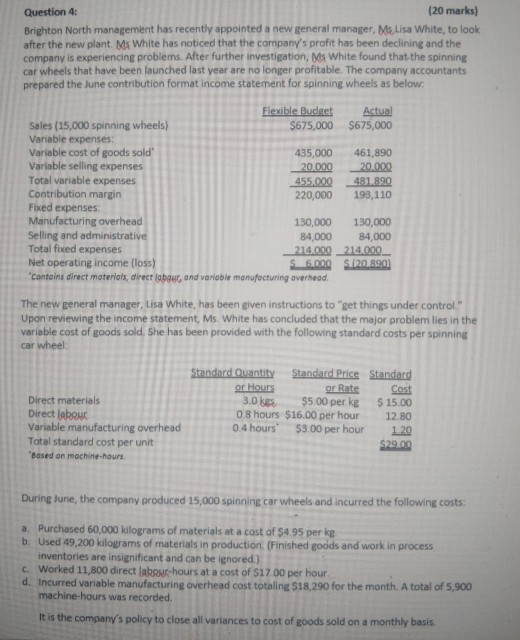

Question 4: (20 marks) Brighton North management has recently appointed a new general manager, Ms Lisa White, to look after the new plant. Me White has noticed that the company's profit has been declining and the company is experiencing problems. After further investigation, Ms White found that the spinning car wheels that have been launched last year are no longer profitable. The company accountants prepared the June contribution format income statement for spinning wheels as below. Flexible Budget Actual Sales (15,000 spinning wheels) $675,000 $675,000 Variable expenses Variable cost of goods sold' 435,000 461,890 Variable selling expenses 20.000 20.000 Total variable expenses 455.000 481 890 Contribution margin 220,000 193,110 Fixed expenses Manufacturing overhead 130,000 130,000 Selling and administrative 84,000 84,000 Total fixed expenses 214,000 214.000 Net operating income (loss) S6.000 S.120.890) "contains direct materials, direct igbour and variable manufacturing overhead The new general manager, Lisa White, has been given instructions to get things under control." Upon reviewing the income statement, Ms. White has concluded that the major problem lies in the variable cost of goods sold. She has been provided with the following standard costs per spinning car wheel Standard Quantity Standard Price Standard or Hours or Rate Cost Direct materials 3.0 kes $5.00 per kg $ 15.00 Direct labour 0.8 hours $16.00 per hour 12.80 Variable manufacturing overhead 0.4 hours $3.00 per hour 1.20 Total standard cost per unit $29.00 Based on machine-hours During June, the company produced 15,000 spinning car wheels and incurred the following costs: a. Purchased 60,000 kilograms of materials at a cost of $4.95 per ke b. Used 49,200 kilograms of materials in production (Finished goods and work in process inventories are insignificant and can be ignored.) Worked 11,800 direct labour-hours at a cost of $17.00 per hour. d. Incurred variable manufacturing overhead cost totaling $18,290 for the month. A total of 5,900 machine-hours was recorded. It is the company's policy to close all variances to cost of goods sold on a monthly basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts