Question: Required: b . Determine the expected amounts for ( 2 0 times 4 ) for each of the income statement items. Note:

Required:

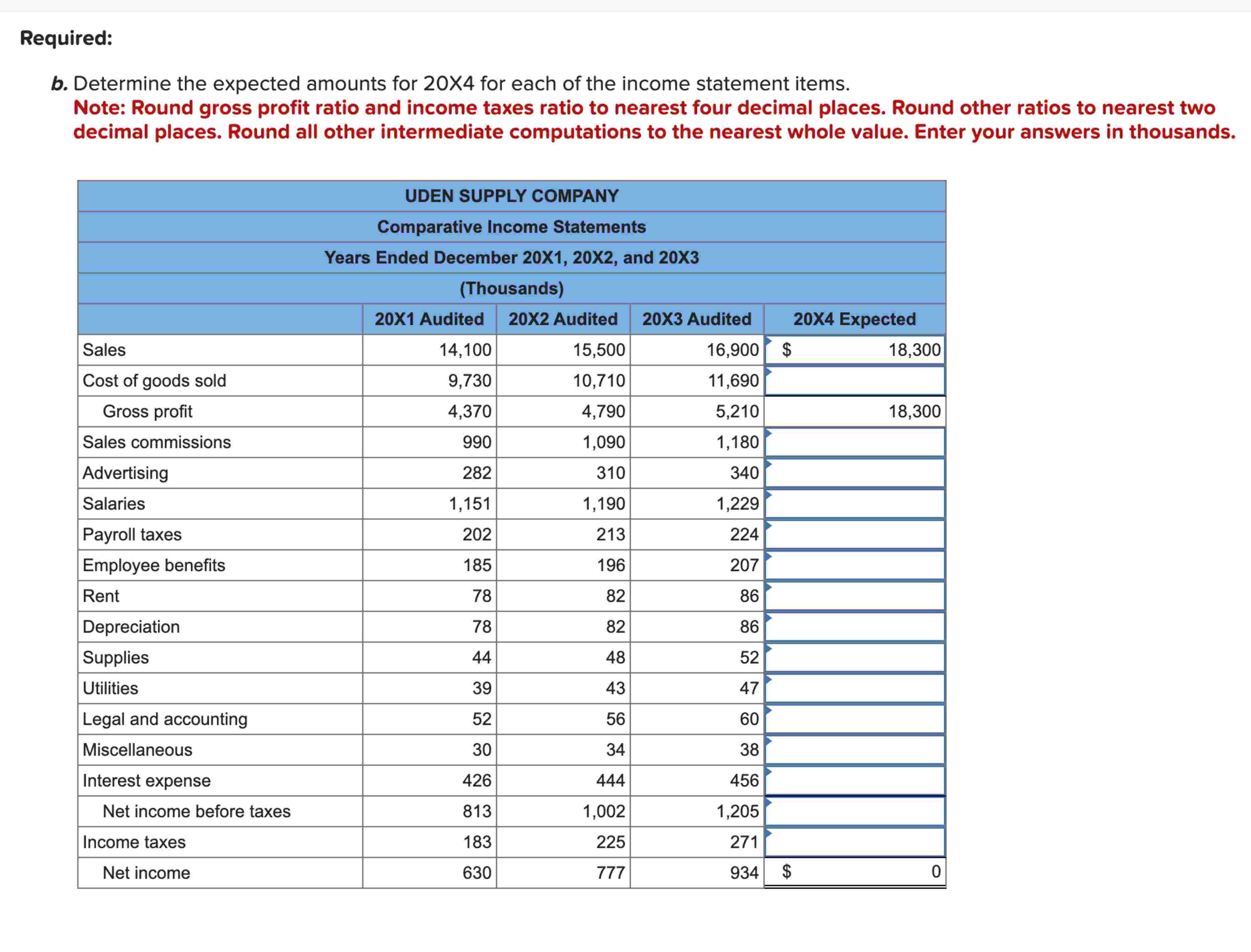

b Determine the expected amounts for times for each of the income statement items.

Note: Round gross profit ratio and income taxes ratio to nearest four decimal places. Round other ratios to nearest two decimal places. Round all other intermediate computations to the nearest whole value. Enter your answers in thousands.

begintabularcccccc

hline multicolumncUDEN SUPPLY COMPANY

hline multicolumncComparative Income Statements

hline multicolumncYears Ended December XX and X

hline multicolumncThousands

hline & X Audited & X Audited & X Audited & & cted

hline Sales & & & & $ &

hline Cost of goods sold & & & & &

hline Gross profit & & & & &

hline Sales commissions & & & & &

hline Advertising & & & & &

hline Salaries & & & & &

hline Payroll taxes & & & & &

hline Employee benefits & & & & &

hline Rent & & & & &

hline Depreciation & & & & &

hline Supplies & & & & &

hline Utilities & & & & &

hline Legal and accounting & & & & &

hline Miscellaneous & & & & &

hline Interest expense & & & & &

hline Net income before taxes & & & & &

hline Income taxes & & & & &

hline Net income & & & & $ &

hline

endtabular c Uden's unaudited financial statements for the current year show a percent gross profit rate. Assuming that this represents a misstatement from the amount that you developed as an expectation, calculate the estimated effect of this misstatement on net income before taxes for X

Note: Enter your answers in thousands.

Expected misstatement

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock