Question: Required: Based on the information below, prepare a Statement of Cash in good form. Prepare the Statement of Cash for December 31, 2022. Identify if

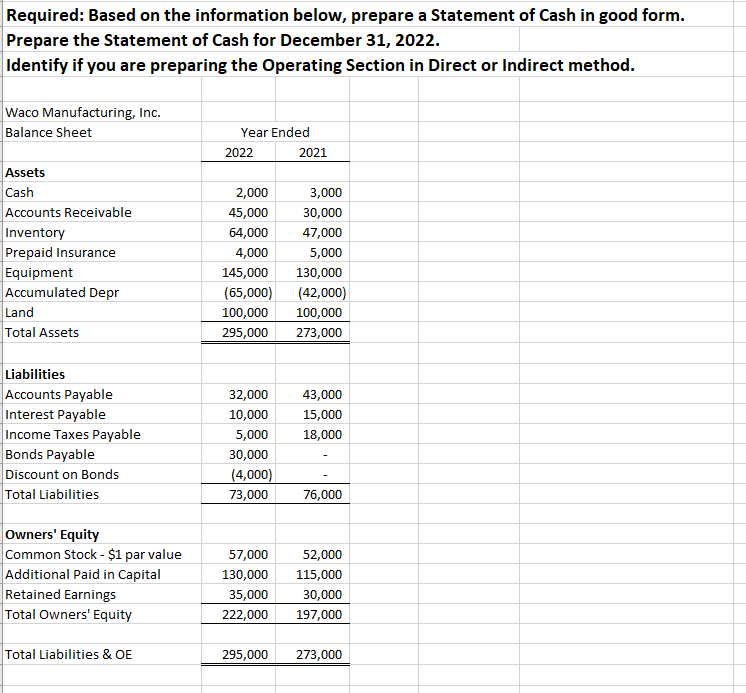

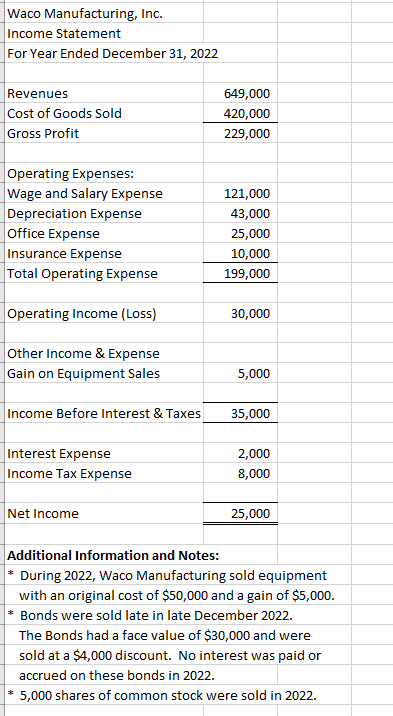

Required: Based on the information below, prepare a Statement of Cash in good form. Prepare the Statement of Cash for December 31, 2022. Identify if you are preparing the Operating Section in Direct or Indirect method. Waco Manufacturing, Inc. \begin{tabular}{|l|r|r|} \hline Balance Sheet & \multicolumn{2}{|c|}{ Year Ended } \\ \hline & 2022 & 2021 \\ \hline Assets & & \\ \hline Cash & 2,000 & 3,000 \\ \hline Accounts Receivable & 45,000 & 30,000 \\ \hline Inventory & 64,000 & 47,000 \\ \hline Prepaid Insurance & 4,000 & 5,000 \\ \hline Equipment & 145,000 & 130,000 \\ \hline Accumulated Depr & (65,000) & (42,000) \\ \hline Land & 100,000 & 100,000 \\ \hline Total Assets & 295,000 & 273,000 \\ \hline \hline \end{tabular} Liabilities \begin{tabular}{|l|r|c|} \hline Accounts Payable & 32,000 & 43,000 \\ \hline Interest Payable & 10,000 & 15,000 \\ \hline Income Taxes Payable & 5,000 & 18,000 \\ \hline Bonds Payable & 30,000 & - \\ \hline Discount on Bonds & (4,000) & - \\ \hline Total Liabilities & 73,000 & 76,000 \\ \hline \end{tabular} Owners' Equity \begin{tabular}{|l|r|r|} \hline Common Stock - \$1 par value & 57,000 & 52,000 \\ \hline Additional Paid in Capital & 130,000 & 115,000 \\ \hline Retained Earnings & 35,000 & 30,000 \\ \hline Total Owners' Equity & 222,000 & 197,000 \\ \hline & & \\ \hline Total Liabilities \& OE & 295,000 & 273,000 \\ \hline \hline \end{tabular} Waco Manufacturing, Inc. Income Statement For Year Ended December 31, 2022 \begin{tabular}{|l|r|} \hline Revenues & 649,000 \\ \hline Cost of Goods Sold & 420,000 \\ \hline Gross Profit & 229,000 \end{tabular} Operating Expenses: \begin{tabular}{|l|r|} \hline Wage and Salary Expense & 121,000 \\ \hline Depreciation Expense & 43,000 \\ \hline Office Expense & 25,000 \\ \hline Insurance Expense & 10,000 \\ \hline Total Operating Expense & 199,000 \\ \hline \end{tabular} Operating Income (Loss) 30,000 Other Income \& Expense Gain on Equipment Sales 5,000 Income Before Interest \& Taxes 35,000 Interest Expense Income Tax Expense Net Income 25,000 Additional Information and Notes: * During 2022, Waco Manufacturing sold equipment with an original cost of $50,000 and a gain of $5,000. * Bonds were sold late in late December 2022. The Bonds had a face value of $30,000 and were sold at a $4,000 discount. No interest was paid or accrued on these bonds in 2022. * 5,000 shares of common stock were sold in 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts