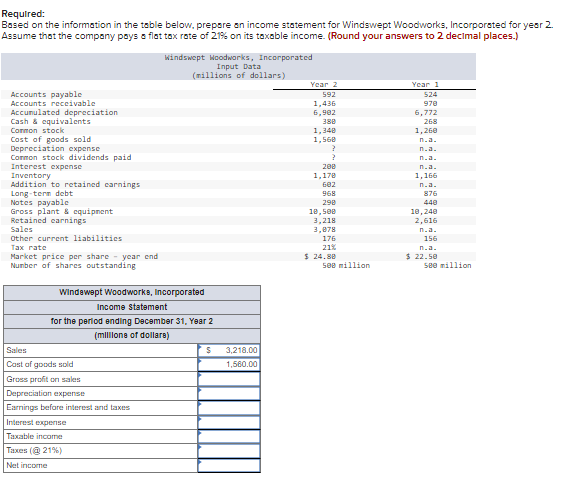

Question: Required: Based on the information in the table below, prepare an income statement for Windswept Woodworks, Incorporated for year 2. Assume that the company

Required: Based on the information in the table below, prepare an income statement for Windswept Woodworks, Incorporated for year 2. Assume that the company pays a flat tax rate of 21% on its taxable income. (Round your answers to 2 decimal places.) Accounts payable Accounts receivable Accumulated depreciation Cash & equivalents Common stock Cost of goods sold Depreciation expense Common stock dividends paid Interest expense Inventory Addition to retained earnings Long-term debt Notes payable Gross plant & equipment Retained earnings Sales Other current liabilities Tax rate Market price per share year end Number of shares outstanding Windswept Woodworks, Incorporated Income Statement for the period ending December 31, Year 2 (millions of dollars) Sales Cast of goods sold Windswept Woodworks, Incorporated Input Data (millions of dollars) Gross profit on sales Depreciation expense Earnings before interest and taxes Interest expense Taxable income Taxes (@21%) Net income $ 3,218.00 1,560.00 Year 2 592 1,436 6,902 388 1,348 1,568 ? ? 208 1,178 602 968 298 18,508 3,218 3,878 176 21% $ 24,80 500 million Year 1 524 978 6,772 268 1,260 n.a. n.a. n.a. n.a. 1,166 n.a. 876 448 10,240 2,616 n.a. 156 n.a. $ 22.50 580 million

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Based on the provided input data we can prepare the inc... View full answer

Get step-by-step solutions from verified subject matter experts