Question: Complete the income statement for the year 2020. Complete the balance sheet for the year 2020. Complete a cash flows statement for the operating

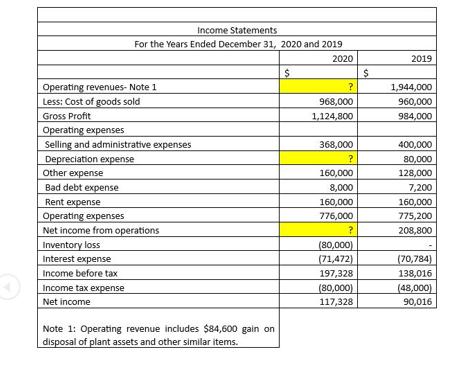

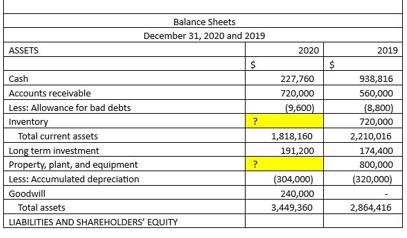

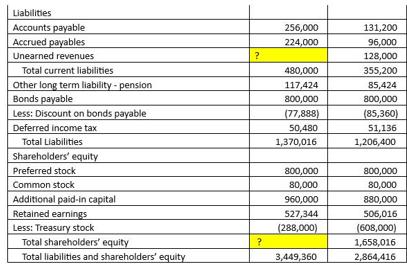

Complete the income statement for the year 2020. Complete the balance sheet for the year 2020. Complete a cash flows statement for the operating activities for the year 2020. Compute ratios that can be calculated from the data presented (2 years, trend, percentages etc.) Operating revenues-Note 1 Less: Cost of goods sold Gross Profit Income Statements For the Years Ended December 31, 2020 and 2019 2020 Operating expenses Selling and administrative expenses Depreciation expense Other expense Bad debt expense Rent expense Operating expenses Net income from operations Inventory loss Interest expense Income before tax Income tax expense Net income Note 1: Operating revenue includes $84,600 gain on disposal of plant assets and other similar items. $ ? 968,000 1,124,800 368,000 ? 160,000 8,000 160,000 776,000 ? (80,000) (71,472) 197,328 (80,000) 117,328 $ 2019 1,944,000 960,000 984,000 400,000 80,000 128,000 7,200 160,000 775,200 208,800 (70,784) 138,016 (48,000) 90,016 ASSETS Cash Accounts receivable Less: Allowance for bad debts Inventory Total current assets Long term investment Property, plant, and equipment Less: Accumulated depreciation Goodwill Balance Sheets December 31, 2020 and 2019 Total assets LIABILITIES AND SHAREHOLDERS' EQUITY $ ? ? 2020 227,760 720,000 (9,600) 1,818,160 191,200 (304,000) 240,000 3,449,360 $ 2019 938,816 560,000 (8,800) 720,000 2,210,016 174,400 800,000 (320,000) 2,864,416 Liabilities Accounts payable Accrued payables Unearned revenues Total current liabilities. Other long term liability-pension Bonds payable Less: Discount on bonds payable Deferred income tax Total Liabilities Shareholders' equity Preferred stock Common stock Additional paid-in capital Retained earnings Less: Treasury stock Total shareholders' equity Total liabilities and shareholders' equity ? ? 256,000 224,000 480,000 117,424 800,000 (77,888) 50,480 1,370,016 800,000 80,000 960,000 527,344 (288,000) 3,449,360 131,200 96,000 128,000 355,200 85,424 800,000 (85,360) 51,136 1,206,400 800,000 80,000 880,000 506,016 (608,000) 1,658,016 2,864,416

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Income Statement for the Year 2020 Income Statement For the Year Ended December 31 2020 Operating Re... View full answer

Get step-by-step solutions from verified subject matter experts