Question: Required: Consider the disclosure note no. 33, and answer the following questions relating to 2019. a) What are the type of preferred shares outstanding? How

Required:

Consider the disclosure note no. 33, and answer the following questions relating to 2019.

a) What are the type of preferred shares outstanding? How many classes of preferred shares does the company issue, and what are the balances in dollar at the year-end?

b) What is the redemption option available to each type?

c) Write the details of conversion option available to the preferred shareholders.

d) What is the dividend payment plan for the preferred shareholders?

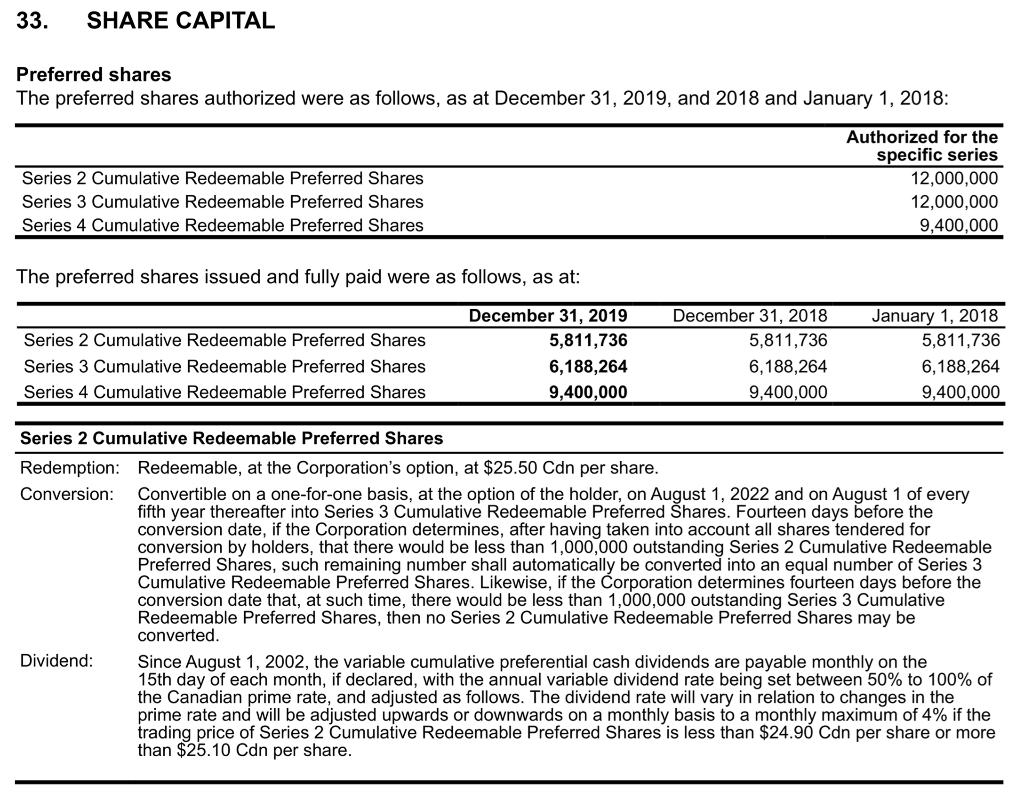

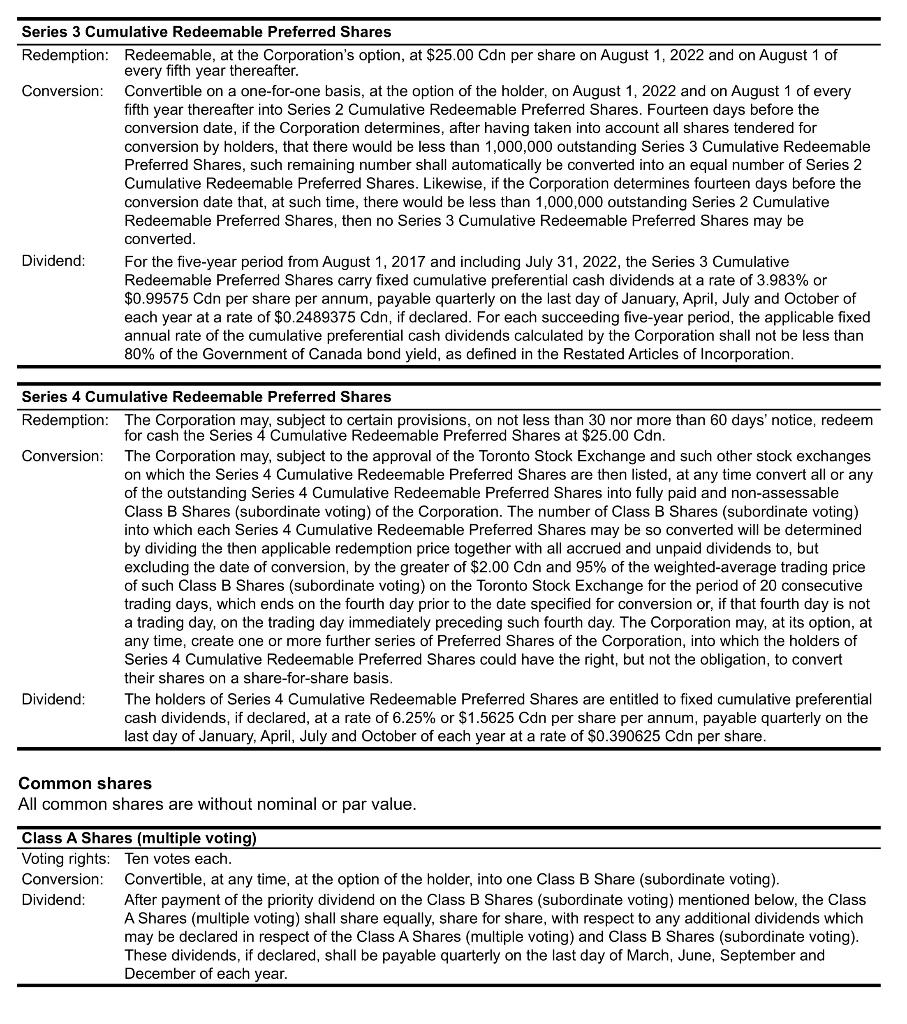

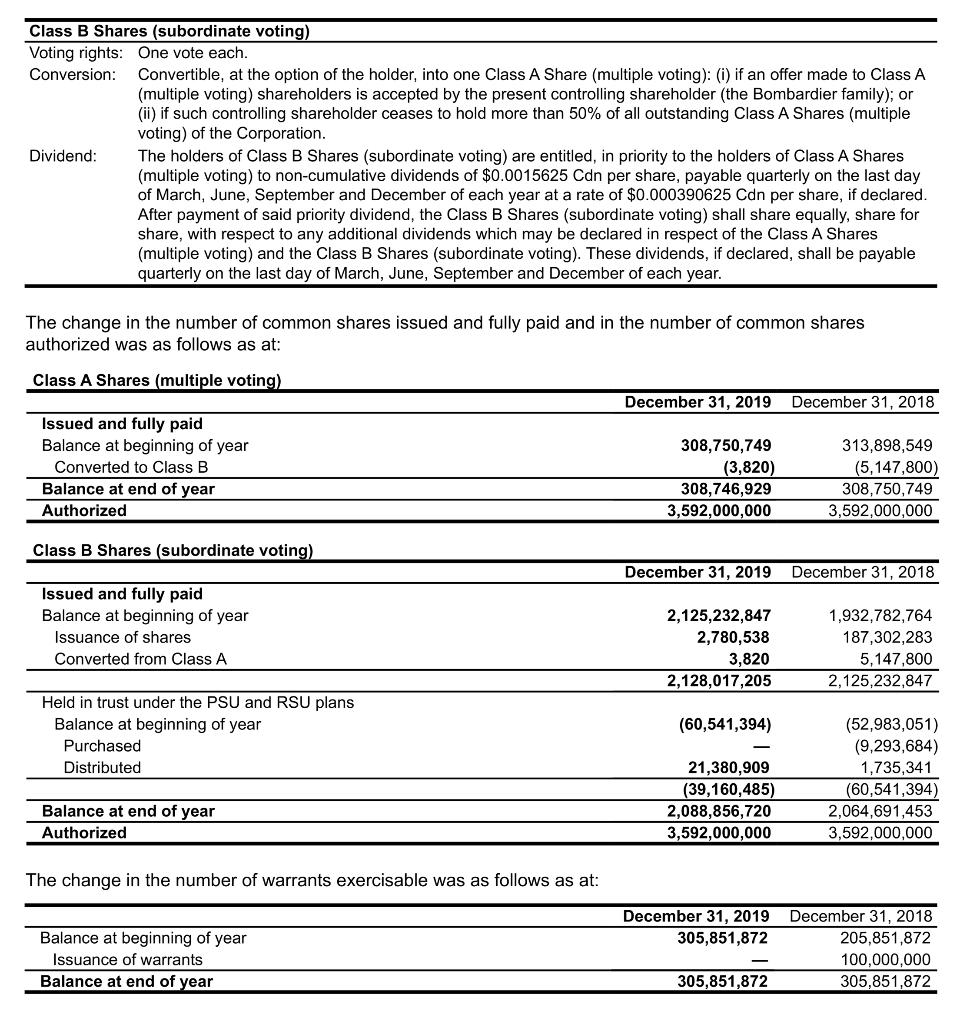

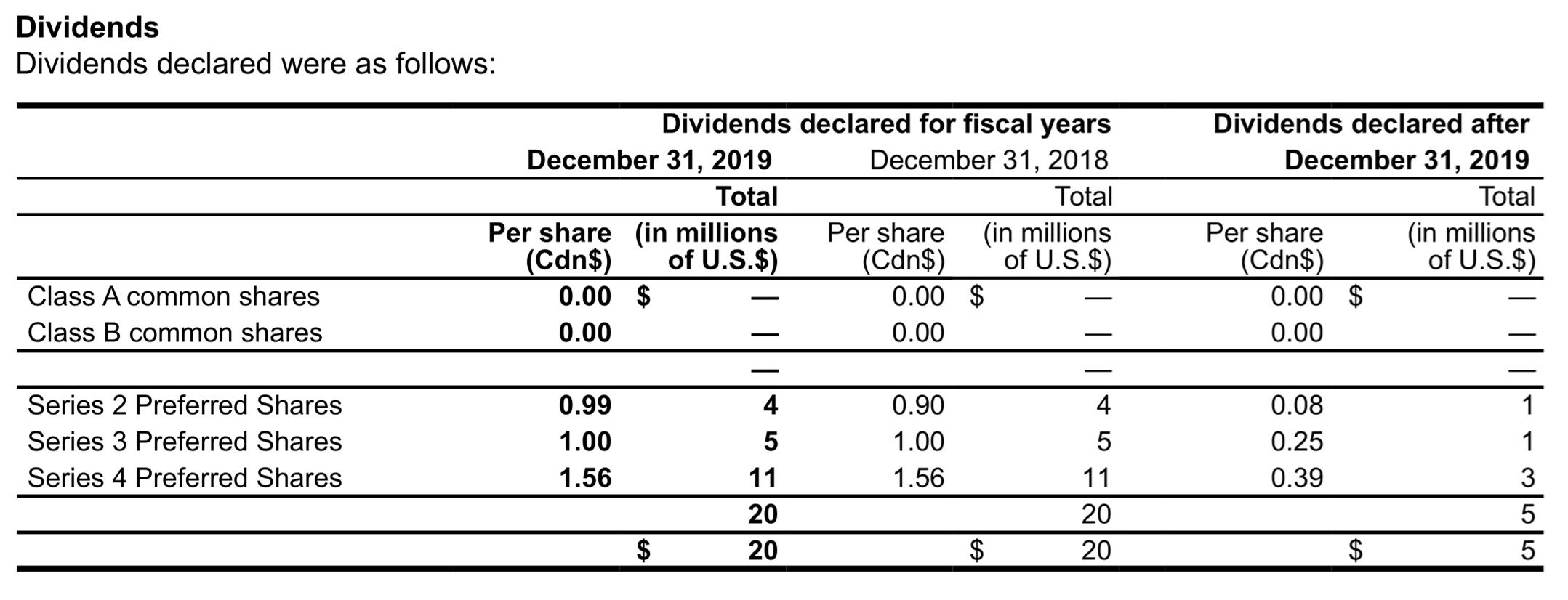

33. SHARE CAPITAL Preferred shares The preferred shares authorized were as follows, as at December 31, 2019, and 2018 and January 1, 2018: Authorized for the specific series Series 2 Cumulative Redeemable Preferred Shares 12,000,000 Series 3 Cumulative Redeemable Preferred Shares 12,000,000 Series 4 Cumulative Redeemable Preferred Shares 9,400,000 The preferred shares issued and fully paid were as follows, as at: Series 2 Cumulative Redeemable Preferred Shares Series 3 Cumulative Redeemable Preferred Shares Series 4 Cumulative Redeemable Preferred Shares December 31, 2019 5,811,736 6,188,264 9,400,000 December 31, 2018 5,811,736 6,188,264 9,400,000 January 1, 2018 5,811,736 6,188,264 9,400,000 Series 2 Cumulative Redeemable Preferred Shares Redemption: Redeemable, at the Corporation's option, at $25.50 Cdn per share. Conversion: Convertible on a one-for-one basis, at the option of the holder, on August 1, 2022 and on August 1 of every fifth year thereafter into Series 3 Cumulative Redeemable Preferred Shares. Fourteen days before the conversion date, if the Corporation determines, after having taken into account all shares tendered for conversion by holders, that there would be less than 1,000,000 outstanding Series 2 Cumulative Redeemable Preferred Shares, such remaining number shall automatically be converted into an equal number of Series 3 Cumulative Redeemable Preferred Shares. Likewise, if the Corporation determines fourteen days before the conversion date that, at such time, there would be less than 1,000,000 outstanding Series 3 Cumulative Redeemable Preferred Shares, then no Series 2 Cumulative Redeemable Preferred Shares may be converted. Dividend: Since August 1, 2002, the variable cumulative preferential cash dividends are payable monthly on the 15th day of each month, if declared, with the annual variable dividend rate being set between 50% to 100% of the Canadian prime rate, and adjusted as follows. The dividend rate will vary in relation to changes in the prime rate and will be adjusted upwards or downwards on a monthly basis to a monthly maximum of 4% if the trading price of Series 2 Cumulative Redeemable Preferred Shares is less than $24.90 Cdn per share or more than $25.10 Cdn per share. Series 3 Cumulative Redeemable Preferred Shares Redemption: Redeemable, at the Corporation's option, at $25.00 Cdn per share on August 1, 2022 and on August 1 of every fifth year thereafter. Conversion: Convertible on a one-for-one basis, at the option of the holder, on August 1, 2022 and on August 1 of every fifth year thereafter into Series 2 Cumulative Redeemable Preferred Shares. Fourteen days before the conversion date, if the Corporation determines, after having taken into account all shares tendered for conversion by holders, that there would be less than 1,000,000 outstanding Series 3 Cumulative Redeemable Preferred Shares, such remaining number shall automatically be converted into an equal number of Series 2 Cumulative Redeemable Preferred Shares. Likewise, if the Corporation determines fourteen days before the conversion date that, at such time, there would be less than 1,000,000 outstanding Series 2 Cumulative Redeemable Preferred Shares, then no Series 3 Cumulative Redeemable Preferred Shares may be converted, Dividend: For the five-year period from August 1, 2017 and including July 31, 2022, the Series 3 Cumulative Redeemable Preferred Shares carry fixed cumulative preferential cash dividends at a rate of 3.983% or $0.99575 Cdn per share per annum, payable quarterly on the last day of January, April, July and October of each year at a rate of $0.2489375 Cdn, if declared. For each succeeding five-year period, the applicable fixed annual rate of the cumulative preferential cash dividends calculated by the Corporation shall not be less than 80% of the Government of Canada bond yield, as defined in the Restated Articles of Incorporation. Series 4 Cumulative Redeemable Preferred Shares Redemption: The Corporation may, subject to certain provisions, on not less than 30 nor more than 60 days' notice, redeem for cash the Series 4 Cumulative Redeemable Preferred Shares at $25.00 Cdn. Conversion: The Corporation may, subject to the approval of the Toronto Stock Exchange and such other stock exchanges on which the Series 4 Cumulative Redeemable Preferred Shares are then listed, at any time convert all or any of the outstanding Series 4 Cumulative Redeemable Preferred Shares into fully paid and non-assessable Class B Shares (subordinate voting) of the Corporation. The number of Class B Shares (subordinate voting) into which each Series 4 Cumulative Redeemable Preferred Shares may be so converted will be determined by dividing the then applicable redemption price together with all accrued and unpaid dividends to, but excluding the date of conversion, by the greater of $2.00 Cdn and 95% of the weighted average trading price of such Class B Shares (subordinate voting) on the Toronto Stock Exchange for the period of 20 consecutive trading days, which ends on the fourth day prior to the date specified for conversion or, if that fourth day is not a trading day, on the trading day immediately preceding such fourth day. The Corporation may, at its option, at any time, create one or more further series of Preferred Shares of the Corporation, into which the holders of Series 4 Cumulative Redeemable Preferred Shares could have the right, but not the obligation, to convert their shares on a share-for-share basis. Dividend: The holders of Series 4 Cumulative Redeemable Preferred Shares are entitled to fixed cumulative preferential cash dividends, if declared, at a rate of 6.25% or $1.5625 Cdn per share per annum, payable quarterly on the last day of January, April, July and October of each year at a rate of $0.390625 Cdn per share. Common shares All common shares are without nominal or par value. Class A Shares (multiple voting) Voting rights: Ten votes each. Conversion: Convertible, at any time, at the option of the holder, into one Class B Share (subordinate voting). Dividend: After payment of the priority dividend on the Class B Shares (subordinate voting) mentioned below, the Class A Shares (multiple voting) shall share equally, share for share, with respect to any additional dividends which may be declared in respect of the Class A Shares (multiple voting) and Class B Shares (subordinate voting). These dividends, if declared, shall be payable quarterly on the last day of March, June, September and December of each year. Class B Shares (subordinate voting) Voting rights: One vote each. Conversion: Convertible, at the option of the holder, into one Class A Share (multiple voting): (i) if an offer made to Class A (multiple voting) shareholders is accepted by the present controlling shareholder (the Bombardier family); or (ii) if such controlling shareholder ceases to hold more than 50% of all outstanding Class A Shares (multiple voting) of the Corporation. Dividend: The holders of Class B Shares (subordinate voting) are entitled, in priority to the holders of Class A Shares (multiple voting) to non-cumulative dividends of $0.0015625 Cdn per share, payable quarterly on the last day of March, June, September and December of each year at a rate of $0.000390625 Cdn per share, if declared. After payment of said priority dividend, the Class B Shares (subordinate voting) shall share equally, share for share, with respect to any additional dividends which may be declared in respect of the Class A Shares (multiple voting) and the Class B Shares (subordinate voting). These dividends, if declared, shall be payable quarterly on the last day of March, June, September and December of each year. The change in the number of common shares issued and fully paid and in the number of common shares authorized was as follows as at: Class A Shares (multiple voting) December 31, 2019 December 31, 2018 Issued and fully paid Balance at beginning of year Converted to Class B Balance at end of year Authorized 308,750,749 (3,820) 308,746,929 3,592,000,000 313,898,549 (5,147,800) 308,750,749 3,592,000,000 Class B Shares (subordinate voting) December 31, 2019 December 31, 2018 Issued and fully paid Balance at beginning of year Issuance of shares Converted from Class A 2,125,232,847 2,780,538 3,820 2,128,017,205 1,932,782,764 187,302,283 5,147,800 2,125,232,847 Held in trust under the PSU and RSU plans Balance at beginning of year Purchased Distributed (60,541,394) 21,380,909 (39,160,485) 2,088,856,720 3,592,000,000 (52,983,051) (9,293,684) 1,735,341 (60,541,394 2,064,691,453 3,592,000,000 Balance at end of year Authorized The change in the number of warrants exercisable was as follows as at: December 31, 2019 305,851,872 Balance at beginning of year Issuance of warrants Balance at end of year December 31, 2018 205,851,872 100,000,000 305,851,872 305,851,872 Dividends Dividends declared were as follows: 5 Dividends declared for fiscal years December 31, 2019 December 31, 2018 Total Total Per share (in millions Per share (in millions (Cdn$) of U.S.$) (Cdn$) of U.S.$) 0.00 $ 0.00 $ 0.00 0.00 Dividends declared after December 31, 2019 Total Per share (in millions (Cdn$) of U.S.$) 0.00 $ 0.00 Class A common shares Class B common shares Series 2 Preferred Shares Series 3 Preferred Shares Series 4 Preferred Shares 0.99 1.00 1.56 4 5 11 20 20 0.90 1.00 1.56 1 1 4 5 11 20 20 0.08 0.25 0.39 lolow $ $ 5 33. SHARE CAPITAL Preferred shares The preferred shares authorized were as follows, as at December 31, 2019, and 2018 and January 1, 2018: Authorized for the specific series Series 2 Cumulative Redeemable Preferred Shares 12,000,000 Series 3 Cumulative Redeemable Preferred Shares 12,000,000 Series 4 Cumulative Redeemable Preferred Shares 9,400,000 The preferred shares issued and fully paid were as follows, as at: Series 2 Cumulative Redeemable Preferred Shares Series 3 Cumulative Redeemable Preferred Shares Series 4 Cumulative Redeemable Preferred Shares December 31, 2019 5,811,736 6,188,264 9,400,000 December 31, 2018 5,811,736 6,188,264 9,400,000 January 1, 2018 5,811,736 6,188,264 9,400,000 Series 2 Cumulative Redeemable Preferred Shares Redemption: Redeemable, at the Corporation's option, at $25.50 Cdn per share. Conversion: Convertible on a one-for-one basis, at the option of the holder, on August 1, 2022 and on August 1 of every fifth year thereafter into Series 3 Cumulative Redeemable Preferred Shares. Fourteen days before the conversion date, if the Corporation determines, after having taken into account all shares tendered for conversion by holders, that there would be less than 1,000,000 outstanding Series 2 Cumulative Redeemable Preferred Shares, such remaining number shall automatically be converted into an equal number of Series 3 Cumulative Redeemable Preferred Shares. Likewise, if the Corporation determines fourteen days before the conversion date that, at such time, there would be less than 1,000,000 outstanding Series 3 Cumulative Redeemable Preferred Shares, then no Series 2 Cumulative Redeemable Preferred Shares may be converted. Dividend: Since August 1, 2002, the variable cumulative preferential cash dividends are payable monthly on the 15th day of each month, if declared, with the annual variable dividend rate being set between 50% to 100% of the Canadian prime rate, and adjusted as follows. The dividend rate will vary in relation to changes in the prime rate and will be adjusted upwards or downwards on a monthly basis to a monthly maximum of 4% if the trading price of Series 2 Cumulative Redeemable Preferred Shares is less than $24.90 Cdn per share or more than $25.10 Cdn per share. Series 3 Cumulative Redeemable Preferred Shares Redemption: Redeemable, at the Corporation's option, at $25.00 Cdn per share on August 1, 2022 and on August 1 of every fifth year thereafter. Conversion: Convertible on a one-for-one basis, at the option of the holder, on August 1, 2022 and on August 1 of every fifth year thereafter into Series 2 Cumulative Redeemable Preferred Shares. Fourteen days before the conversion date, if the Corporation determines, after having taken into account all shares tendered for conversion by holders, that there would be less than 1,000,000 outstanding Series 3 Cumulative Redeemable Preferred Shares, such remaining number shall automatically be converted into an equal number of Series 2 Cumulative Redeemable Preferred Shares. Likewise, if the Corporation determines fourteen days before the conversion date that, at such time, there would be less than 1,000,000 outstanding Series 2 Cumulative Redeemable Preferred Shares, then no Series 3 Cumulative Redeemable Preferred Shares may be converted, Dividend: For the five-year period from August 1, 2017 and including July 31, 2022, the Series 3 Cumulative Redeemable Preferred Shares carry fixed cumulative preferential cash dividends at a rate of 3.983% or $0.99575 Cdn per share per annum, payable quarterly on the last day of January, April, July and October of each year at a rate of $0.2489375 Cdn, if declared. For each succeeding five-year period, the applicable fixed annual rate of the cumulative preferential cash dividends calculated by the Corporation shall not be less than 80% of the Government of Canada bond yield, as defined in the Restated Articles of Incorporation. Series 4 Cumulative Redeemable Preferred Shares Redemption: The Corporation may, subject to certain provisions, on not less than 30 nor more than 60 days' notice, redeem for cash the Series 4 Cumulative Redeemable Preferred Shares at $25.00 Cdn. Conversion: The Corporation may, subject to the approval of the Toronto Stock Exchange and such other stock exchanges on which the Series 4 Cumulative Redeemable Preferred Shares are then listed, at any time convert all or any of the outstanding Series 4 Cumulative Redeemable Preferred Shares into fully paid and non-assessable Class B Shares (subordinate voting) of the Corporation. The number of Class B Shares (subordinate voting) into which each Series 4 Cumulative Redeemable Preferred Shares may be so converted will be determined by dividing the then applicable redemption price together with all accrued and unpaid dividends to, but excluding the date of conversion, by the greater of $2.00 Cdn and 95% of the weighted average trading price of such Class B Shares (subordinate voting) on the Toronto Stock Exchange for the period of 20 consecutive trading days, which ends on the fourth day prior to the date specified for conversion or, if that fourth day is not a trading day, on the trading day immediately preceding such fourth day. The Corporation may, at its option, at any time, create one or more further series of Preferred Shares of the Corporation, into which the holders of Series 4 Cumulative Redeemable Preferred Shares could have the right, but not the obligation, to convert their shares on a share-for-share basis. Dividend: The holders of Series 4 Cumulative Redeemable Preferred Shares are entitled to fixed cumulative preferential cash dividends, if declared, at a rate of 6.25% or $1.5625 Cdn per share per annum, payable quarterly on the last day of January, April, July and October of each year at a rate of $0.390625 Cdn per share. Common shares All common shares are without nominal or par value. Class A Shares (multiple voting) Voting rights: Ten votes each. Conversion: Convertible, at any time, at the option of the holder, into one Class B Share (subordinate voting). Dividend: After payment of the priority dividend on the Class B Shares (subordinate voting) mentioned below, the Class A Shares (multiple voting) shall share equally, share for share, with respect to any additional dividends which may be declared in respect of the Class A Shares (multiple voting) and Class B Shares (subordinate voting). These dividends, if declared, shall be payable quarterly on the last day of March, June, September and December of each year. Class B Shares (subordinate voting) Voting rights: One vote each. Conversion: Convertible, at the option of the holder, into one Class A Share (multiple voting): (i) if an offer made to Class A (multiple voting) shareholders is accepted by the present controlling shareholder (the Bombardier family); or (ii) if such controlling shareholder ceases to hold more than 50% of all outstanding Class A Shares (multiple voting) of the Corporation. Dividend: The holders of Class B Shares (subordinate voting) are entitled, in priority to the holders of Class A Shares (multiple voting) to non-cumulative dividends of $0.0015625 Cdn per share, payable quarterly on the last day of March, June, September and December of each year at a rate of $0.000390625 Cdn per share, if declared. After payment of said priority dividend, the Class B Shares (subordinate voting) shall share equally, share for share, with respect to any additional dividends which may be declared in respect of the Class A Shares (multiple voting) and the Class B Shares (subordinate voting). These dividends, if declared, shall be payable quarterly on the last day of March, June, September and December of each year. The change in the number of common shares issued and fully paid and in the number of common shares authorized was as follows as at: Class A Shares (multiple voting) December 31, 2019 December 31, 2018 Issued and fully paid Balance at beginning of year Converted to Class B Balance at end of year Authorized 308,750,749 (3,820) 308,746,929 3,592,000,000 313,898,549 (5,147,800) 308,750,749 3,592,000,000 Class B Shares (subordinate voting) December 31, 2019 December 31, 2018 Issued and fully paid Balance at beginning of year Issuance of shares Converted from Class A 2,125,232,847 2,780,538 3,820 2,128,017,205 1,932,782,764 187,302,283 5,147,800 2,125,232,847 Held in trust under the PSU and RSU plans Balance at beginning of year Purchased Distributed (60,541,394) 21,380,909 (39,160,485) 2,088,856,720 3,592,000,000 (52,983,051) (9,293,684) 1,735,341 (60,541,394 2,064,691,453 3,592,000,000 Balance at end of year Authorized The change in the number of warrants exercisable was as follows as at: December 31, 2019 305,851,872 Balance at beginning of year Issuance of warrants Balance at end of year December 31, 2018 205,851,872 100,000,000 305,851,872 305,851,872 Dividends Dividends declared were as follows: 5 Dividends declared for fiscal years December 31, 2019 December 31, 2018 Total Total Per share (in millions Per share (in millions (Cdn$) of U.S.$) (Cdn$) of U.S.$) 0.00 $ 0.00 $ 0.00 0.00 Dividends declared after December 31, 2019 Total Per share (in millions (Cdn$) of U.S.$) 0.00 $ 0.00 Class A common shares Class B common shares Series 2 Preferred Shares Series 3 Preferred Shares Series 4 Preferred Shares 0.99 1.00 1.56 4 5 11 20 20 0.90 1.00 1.56 1 1 4 5 11 20 20 0.08 0.25 0.39 lolow $ $ 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts