Question: Required: Critically evaluate the loan request outlined below and recommend whether you would lend the requested amount. Your answer must indicate the relevant facts of

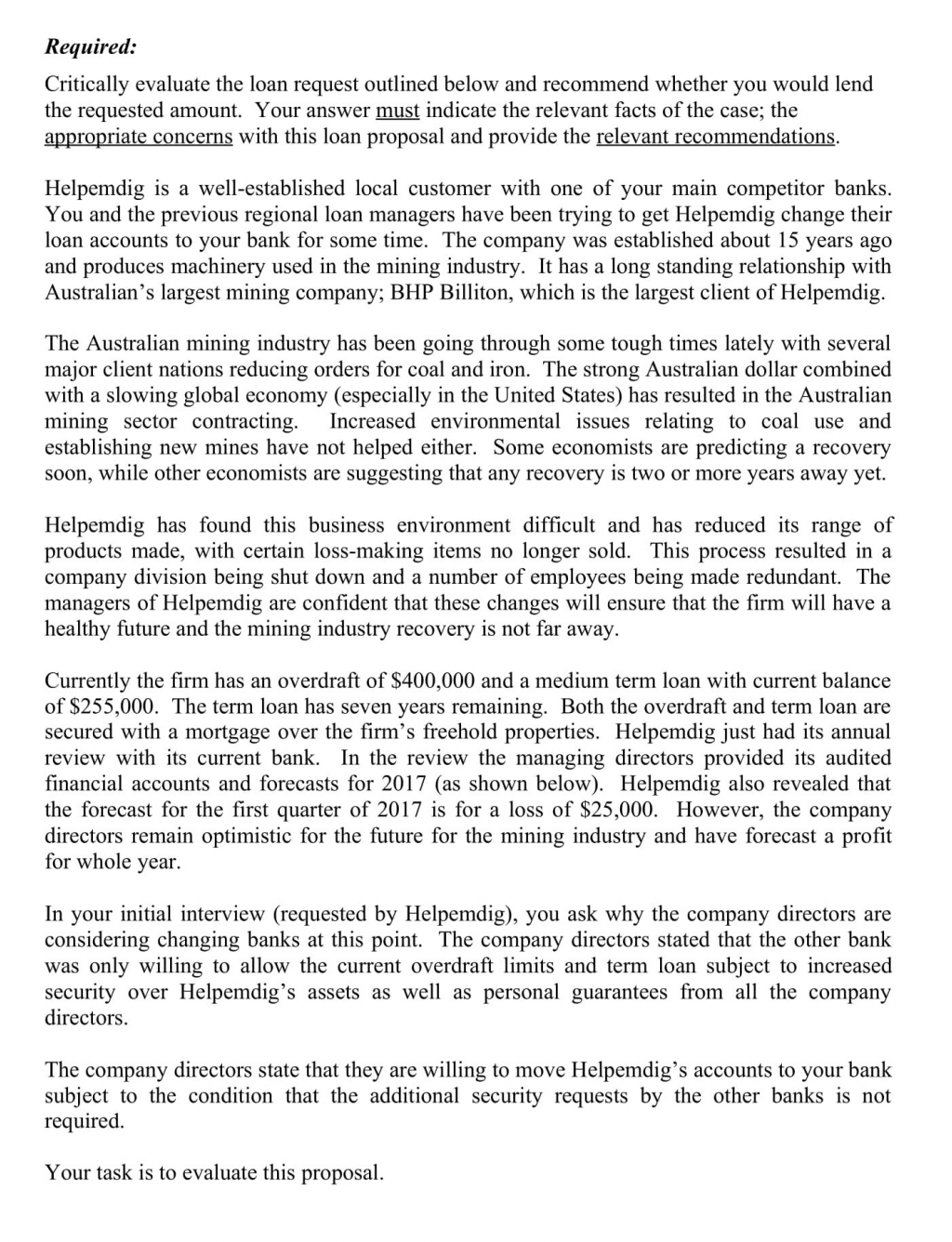

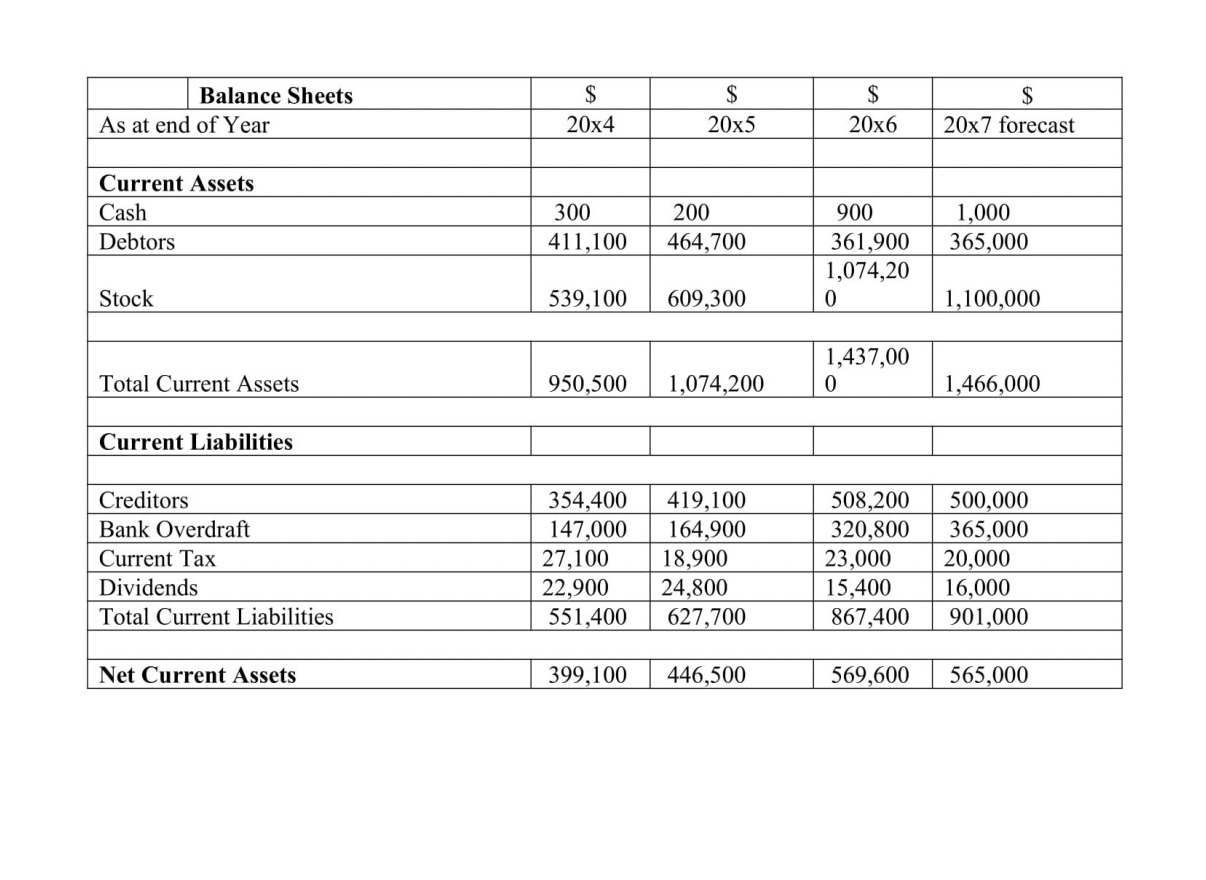

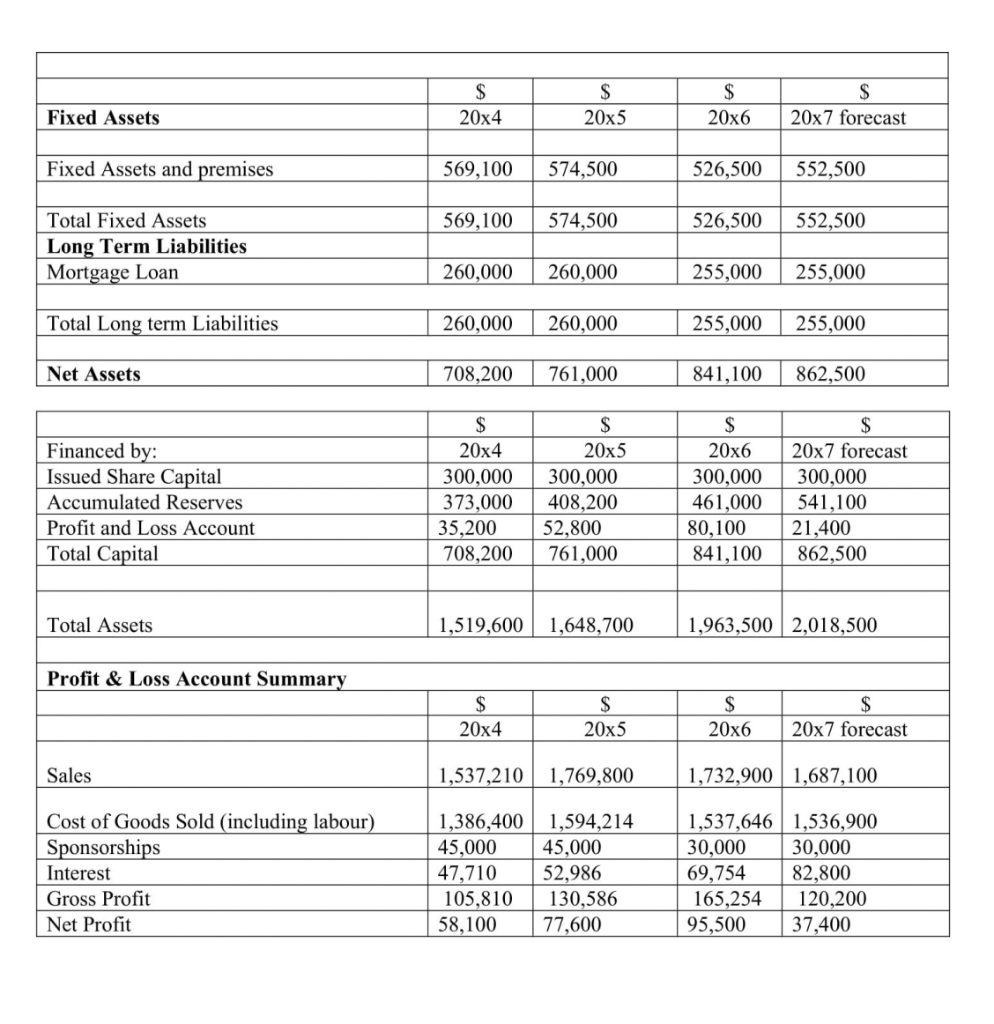

Required: Critically evaluate the loan request outlined below and recommend whether you would lend the requested amount. Your answer must indicate the relevant facts of the case; the appropriate concerns with this loan proposal and provide the relevant recommendations. Helpemdig is a well-established local customer with one of your main competitor banks. You and the previous regional loan managers have been trying to get Helpemdig change their loan accounts to your bank for some time. The company was established about 15 years ago and produces machinery used in the mining industry. It has a long standing relationship with Australian's largest mining company; BHP Billiton, which is the largest client of Helpemdig. The Australian mining industry has been going through some tough times lately with several major client nations reducing orders for coal and iron. The strong Australian dollar combined with a slowing global economy (especially in the United States) has resulted in the Australian mining sector contracting. Increased environmental issues relating to coal use and establishing new mines have not helped either. Some economists are predicting a recovery soon, while other economists are suggesting that any recovery is two or more years away yet. Helpemdig has found this business environment difficult and has reduced its range of products made, with certain loss-making items no longer sold. This process resulted in a company division being shut down and a number of employees being made redundant. The managers of Helpemdig are confident that these changes will ensure that the firm will have a healthy future and the mining industry recovery is not far away. Currently the firm has an overdraft of $400,000 and a medium term loan with current balance of $255,000. The term loan has seven years remaining. Both the overdraft and term loan are secured with a mortgage over the firm's freehold properties. Helpemdig just had its annual review with its current bank. In the review the managing directors provided its audited financial accounts and forecasts for 2017 (as shown below). Helpemdig also revealed that the forecast for the first quarter of 2017 is for a loss of $25,000. However, the company directors remain optimistic for the future for the mining industry and have forecast a profit for whole year. In your initial interview (requested by Helpemdig), you ask why the company directors are considering changing banks at this point. The company directors stated that the other bank was only willing to allow the current overdraft limits and term loan subject to increased security over Helpemdig's assets as well as personal guarantees from all the company directors. The company directors state that they are willing to move Helpemdig's accounts to your bank subject to the condition that the additional security requests by the other banks is not required. Your task is to evaluate this proposal. \begin{tabular}{|l|r|r|r|r|} \hline Ratios and other information & 201 & 205 & 206 & 207 forecast \\ \hline & & & & \\ \hline Current Ratio 1 to & 1.72 & 1.71 & 1.66 & 1.63 \\ \hline Acid Test 1 to & 0.75 & 0.74 & 0.42 & 0.41 \\ \hline Credit Given (days) & 97.61 & 95.84 & 76.23 & 78.97 \\ \hline Credit Taken (days) & 93.30 & 95.95 & 120.63 & 118.75 \\ \hline Stock Turnover (days) & 128.01 & 125.66 & 226.26 & 237.98 \\ \hline Gross margin & 6.9% & 7.4% & 9.5% & 7.1% \\ \hline Net margin & 3.8% & 4.4% & 5.5% & 2.2% \\ \hline Interest Cover (times) & 2.22 & 2.46 & 2.37 & 1.45 \\ \hline Net Gearing \% per \$1 of equity & 108% & 111% & 129% & 130% \\ \hline Net working assets to sales % & 26% & 25% & 33% & 33% \\ \hline Retained Profits to sales & 2.3% & 3.0% & 4.6% & 1.3% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts