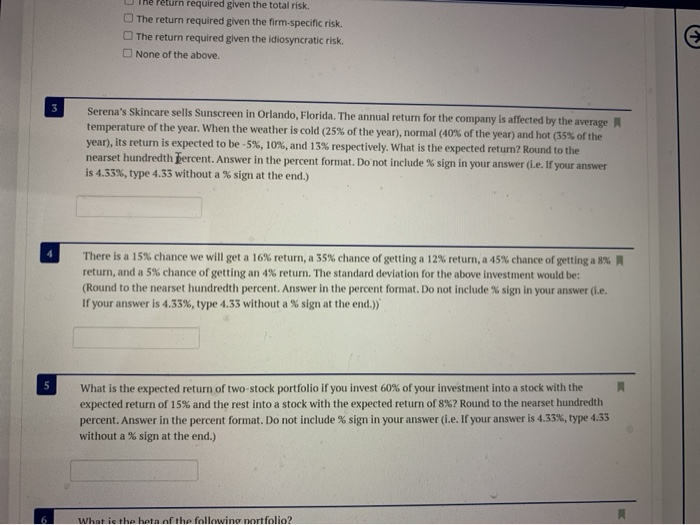

Question: required given the total risk. The return required given the firm-specific risk. The return required given the idiosyncratic risk. None of the above. Serena's Skincare

required given the total risk. The return required given the firm-specific risk. The return required given the idiosyncratic risk. None of the above. Serena's Skincare sells Sunscreen in Orlando, Florida. The annual return for the company is affected by the average temperature of the year. When the weather is cold (25% of the year), normal (40% of the year) and hot (35% of the year), its return is expected to be -5%, 10%, and 13% respectively. What is the expected return? Round to the nearset hundredth percent. Answer in the percent format. Do not include % sign in your answer i.e. If your answer is 4.33%, type 4.33 without a % sign at the end.) There is a 15% chance we will get a 16% return, a 35% chance of getting a 12% return, a 45% chance of getting a 8% return, and a 5% chance of getting an 4% return. The standard deviation for the above investment would be: (Round to the nearset hundredth percent. Answer in the percent format. Do not include % sign in your answer (.e. If your answer is 4.33%, type 4.33 without a % sign at the end.)) What is the expected return of two-stock portfolio if you invest 60% of your investment into a stock with the expected return of 15% and the rest into a stock with the expected return of 8%? Round to the nearset hundredth percent. Answer in the percent format. Do not include % sign in your answer i.e. If your answer is 4.33%, type 4.33 without a % sign at the end.) What is the beta of the following nortfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts