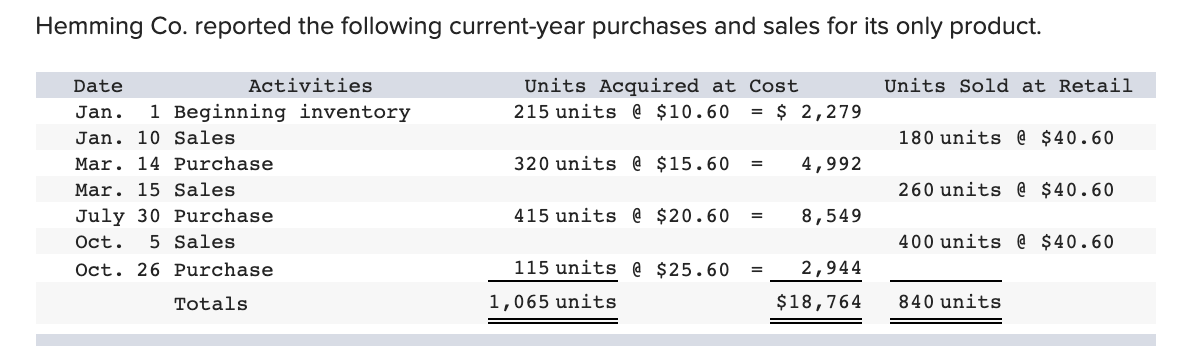

Question: Required : Hemming uses a perpetual inventory system. 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 2.

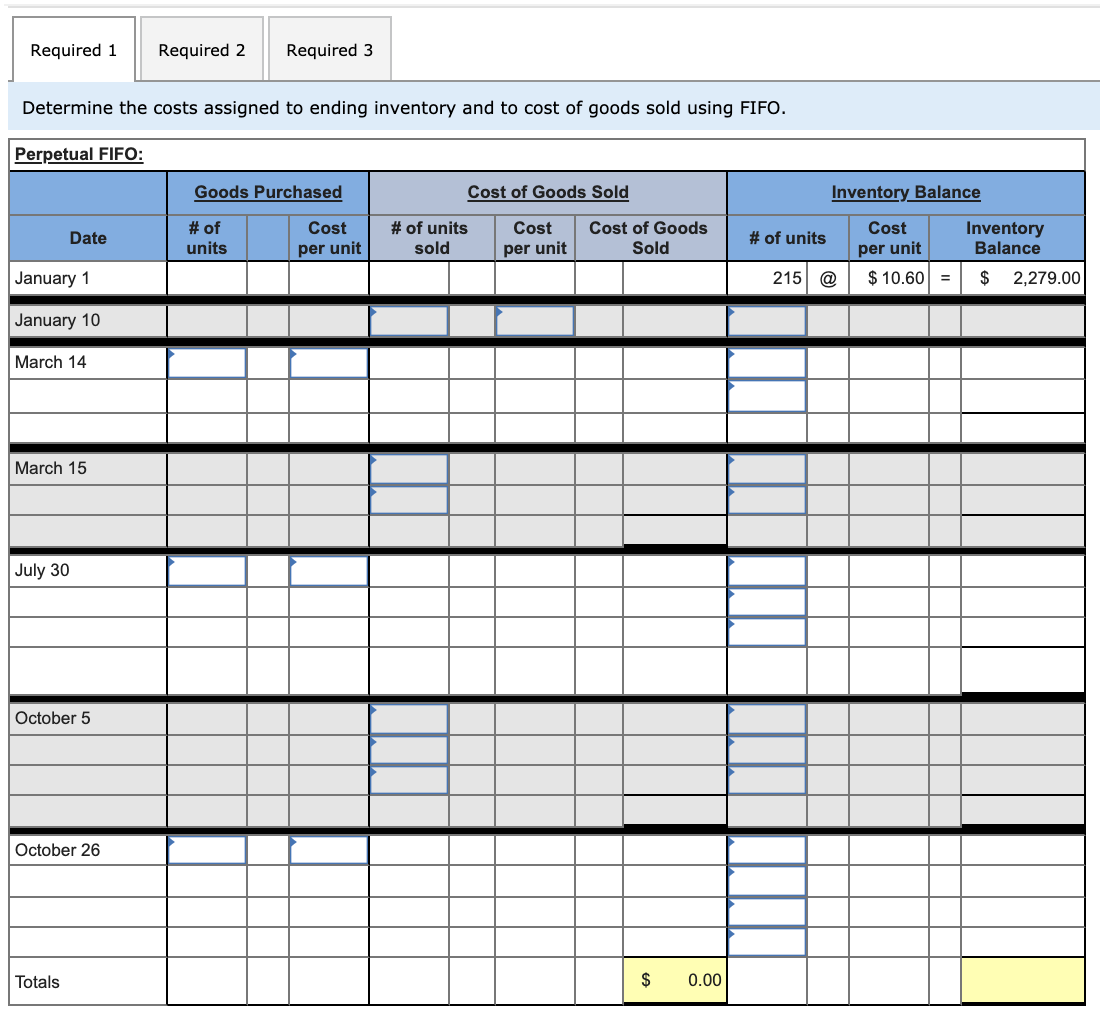

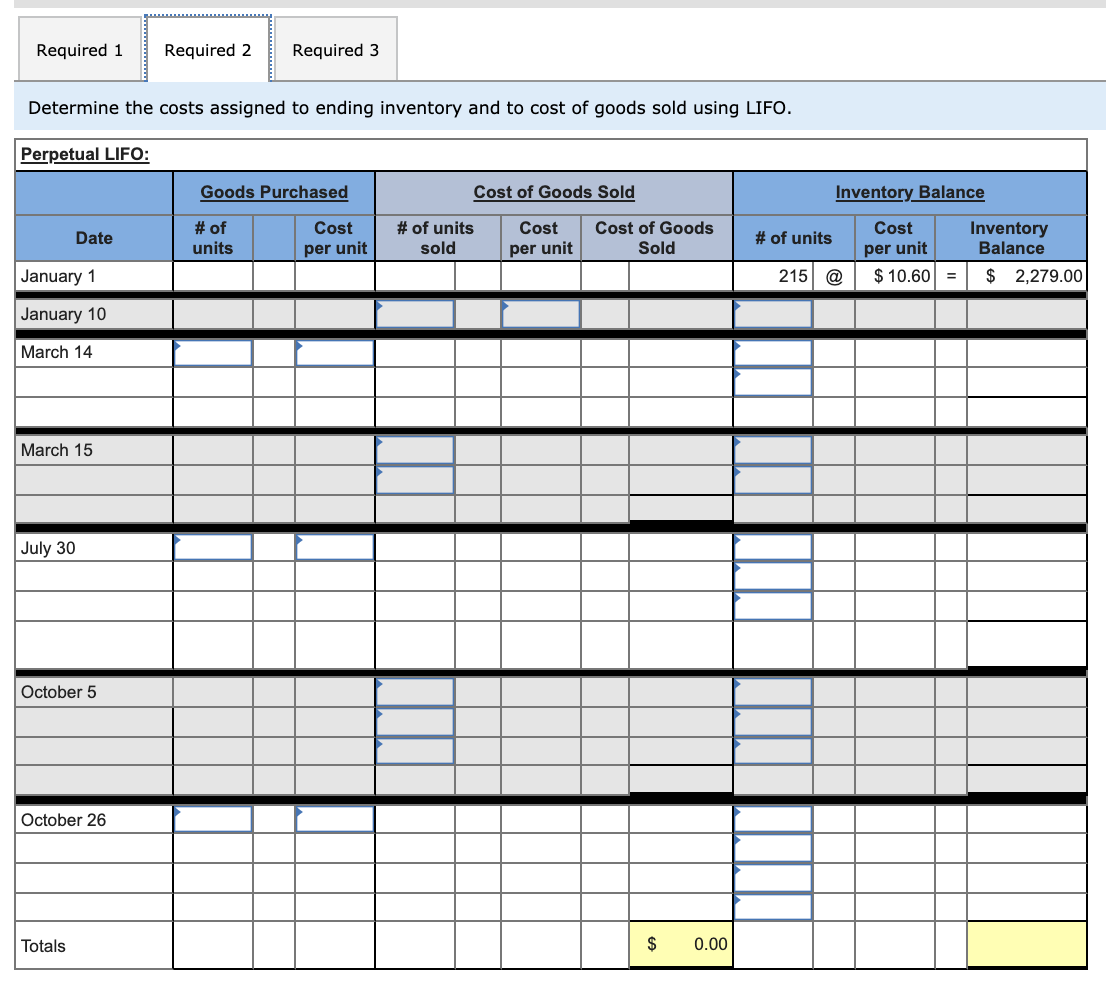

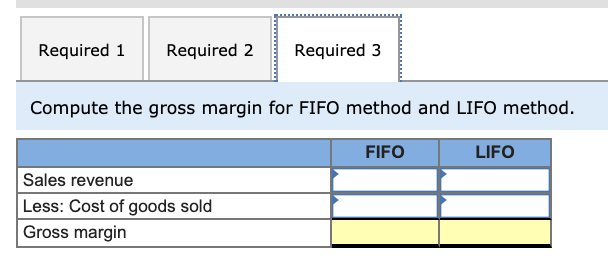

Required: Hemming uses a perpetual inventory system. 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross margin for FIFO method and LIFO method

Required 1 Required 2 Required 3 Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Perpetual FIFO: Goods Purchased Cost of Goods Sold Inventory Balance Date # of units Cost per unit # of units sold Cost per unit Cost of Goods Sold # of units Cost per unit Inventory Balance January 1 215 @ $ 10.60] = $ 2,279.00 January 10 March 14 March 15 July 30 October 5 October 26 Totals $ 0.00 Required 1 Required 2 Required 3 Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. Perpetual LIFO: Goods Purchased Cost of Goods Sold Inventory Balance Date # of units Cost per unit # of units sold Cost per unit Cost of Goods Sold # of units Cost per unit Inventory Balance January 1 215 @ $ 10.60 = $ 2,279.00 January 10 March 14 March 15 July 30 October 5 October 26 Totals $ 0.00 Required 1 Required 2 Required 3 Compute the gross margin for FIFO method and LIFO method. FIFO LIFO Sales revenue Less: Cost of goods sold Gross margin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts