Question: REQUIRED: Homework Chapter 7 Long Term Assets Saved Help Save McCoy's Fish House purchases a tract of land and an existing building for $870,000. The

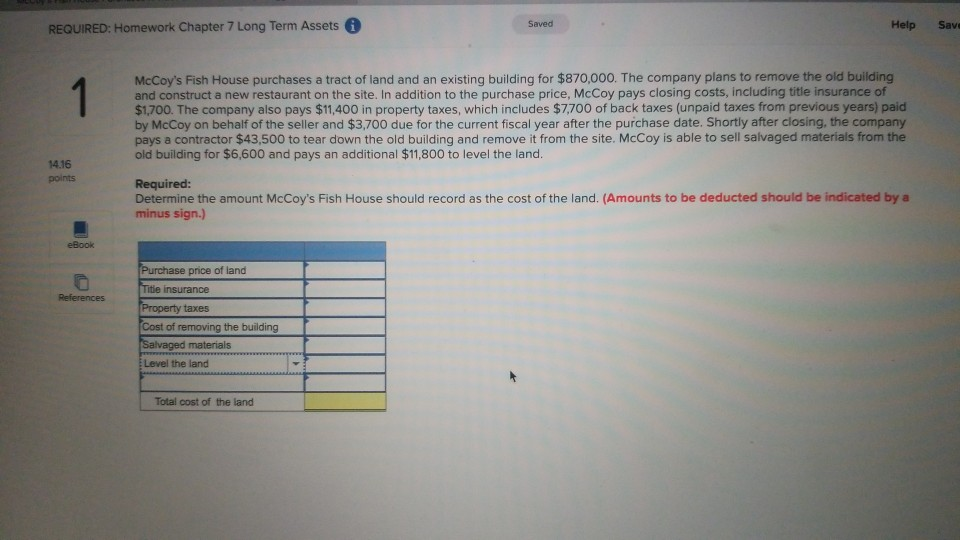

REQUIRED: Homework Chapter 7 Long Term Assets Saved Help Save McCoy's Fish House purchases a tract of land and an existing building for $870,000. The company plans to remove the old building and construct a new restaurant on the site. In addition to the purchase price, McCoy pays closing costs, including title insurance of $1,700. The company also pays $11,400 in property taxes, which includes $7,700 of back taxes (unpaid taxes from previous years) paid by McCoy on behalf of the seller and $3,700 due for the current fiscal year after the purchase date. Shortly after closing, the company pays a contractor $43,500 to tear down the old building and remove it from the site. McCoy is able to sell salvaged materials from the old building for $6,600 and pays an additional $11,800 to level the land. 14.16 points Required: Determine the amount McCoy's Fish House should record as the cost of the land. (Amounts to be deducted should be indicated by a minus sign.) eBook | References Purchase price of land Titie insurance Property taxes Cost of removing the building Salvaged materials Level the land Total cost of the land

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts