Question: Required: )How much from the above items should be capitalized to: 1) Building 2) Equipment 3) Furniture and fixtures b) How much from the above

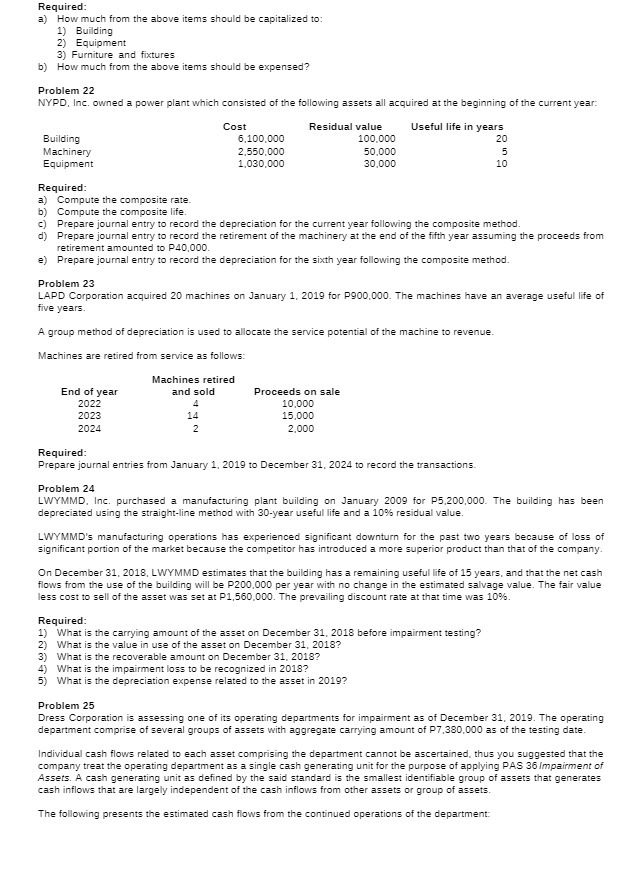

Required: )How much from the above items should be capitalized to: 1) Building 2) Equipment 3) Furniture and fixtures b) How much from the above items should be expensed? Problem 22 NYPD, Inc. owned a power plant which consisted of the following assets all acquired at the beginning of the current year: Cost Residual value Useful life in years Building 6,100,000 100.000 20 Machinery 2.550,000 50.000 Equipment 1,030,000 30,000 10 Required: a) Compute the composite rate. b) Compute the composite life. c) Prepare journal entry to record the depreciation for the current year following the composite method. Prepare journal entry to record the retirement of the machinery at the end of the fifth year assuming the proceeds from retirement amounted to P40,000. Prepare journal entry to record the depreciation for the sixth year following the composite method. Problem 23 LAPD Corporation acquired 20 machines on January 1, 2019 for P900.000. The machines have an average useful life of five years A group method of depreciation is used to allocate the service potential of the machine to revenue. Machines are retired from service as follows: Machines retired End of year and sold Proceeds on sale 2022 10,000 2023 14 15,000 2024 2 2.000 Required: Prepare journal entries from January 1. 2019 to December 31, 2024 to record the transactions. Problem 24 LWYMMD. Inc. purchased a manufacturing plant building on January 2009 for P5,200,000. The building has been depreciated using the straight-line method with 30-year useful life and a 10% residual value LWYMMD's manufacturing operations has experienced significant downturn for the past two years because of loss of significant portion of the market because the competitor has introduced a more superior product than that of the company. On December 31, 2018, LWYMMD estimates that the building has a remaining useful life of 15 years, and that the net cash flows from the use of the building will be P200.000 per year with no change in the estimated salvage value. The fair value less cost to sell of the asset was set at P1,560.000. The prevailing discount rate at that time was 10%. Required: 1) What is the carrying amount of the asset on December 31, 2018 before impairment testing? What is the value in use of the asset on December 31, 2018? What is the recoverable amount on December 31, 2018? What is the impairment loss to be recognized in 2018? What is the depreciation expense related to the asset in 2019? Problem 25 Dress Corporation is assessing one of its operating departments for impairment as of December 31, 2019. The operating department comprise of several groups of assets with aggregate carrying amount of P7.380,000 as of the testing date Individual cash flows related to each asset comprising the department cannot be ascertained, thus you suggested that the company treat the operating department as a single cash generating unit for the purpose of applying PAS 36 Impairment of Assets. A cash generating unit as defined by the said standard is the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or group of assets. The following presents the estimated cash flows from the continued operations of the department