Question: Required: Identify each cost as either a product cost or a period cost. If a product cost, classify it as direct materials, direct labor, or

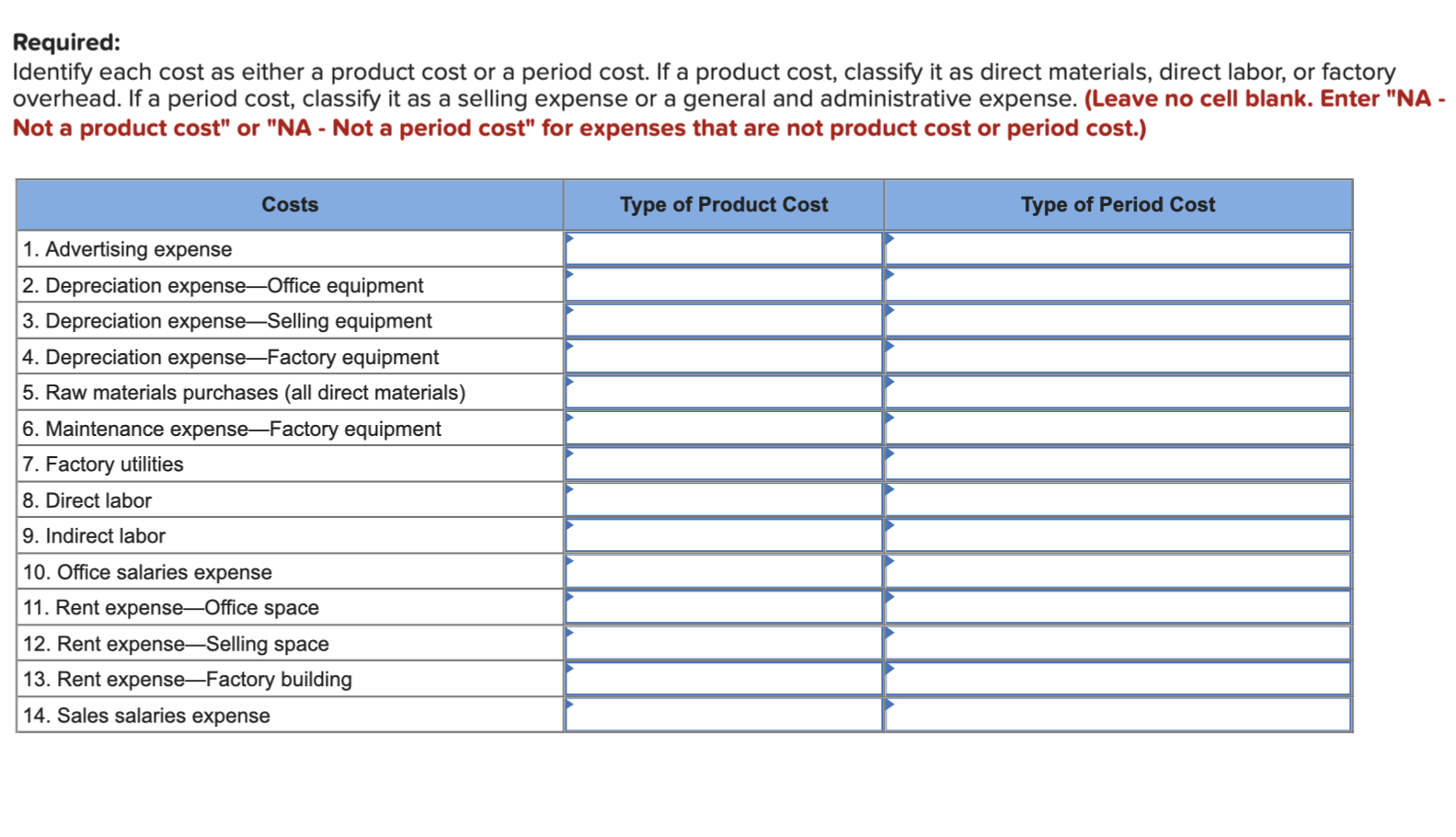

Required: Identify each cost as either a product cost or a period cost. If a product cost, classify it as direct materials, direct labor, or factory overhead. If a period cost, classify it as a selling expense or a general and administrative expense. (Leave no cell blank. Enter "NA - Not a product cost" or "NA - Not a period cost" for expenses that are not product cost or period cost.) - Costs Type of Product Cost Type of Period Cost 1. Advertising expense 2. Depreciation expense-Office equipment 3. Depreciation expense-Selling equipment 4. Depreciation expenseFactory equipment 5. Raw materials purchases (all direct materials) 6. Maintenance expenseFactory equipment 7. Factory utilities 8. Direct labor 9. Indirect labor 10. Office salaries expense 11. Rent expense-Office space 12. Rent expense-Selling space 13. Rent expense-Factory building 14. Sales salaries expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts