Question: Required in problem above (Exercise 8-2) : Prepare the statement of cost of goods manufactured for the 6-month period ended June 30, 2018. Under the

Required in problem above (Exercise 8-2) :

- Prepare the statement of cost of goods manufactured for the 6-month period ended June 30, 2018.

- Under the non-cost and periodic inventory systems, prepare the following end of the period:

a. Adjusting and closing entries to set up the raw materials used.

b. Adjusting and closing entries to set up the cost of goods manufactured.

c. Adjusting and closing entries to set up the cost of goods sold.

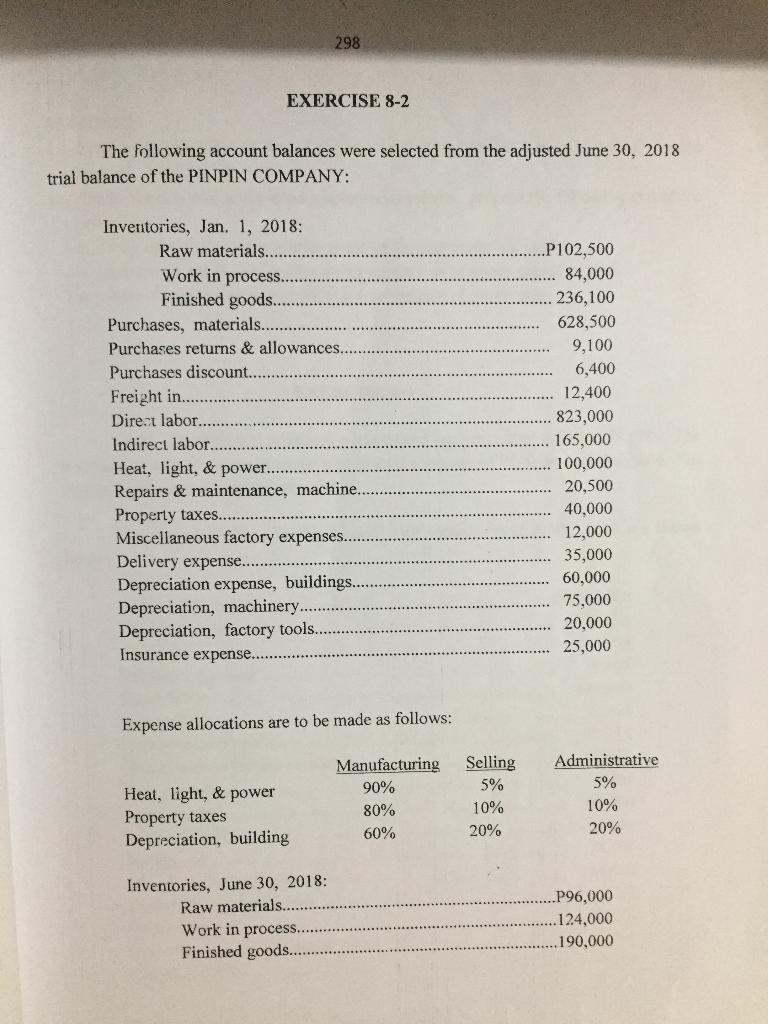

298 EXERCISE 8-2 The following account balances were selected from the adjusted June 30, 2018 trial balance of the PINPIN COMPANY: Inventories, Jan. 1. 2018: Raw materials. Work in process. Finished goods..... Purchases, materials.......... Purchases returns & allowances. Purchases discount.... Freight in...... Direct labor.. Indirect labor... Heat, light, & power.... Repairs & maintenance, machine... Property taxes... Miscellaneous factory expenses.. Delivery expense.... Depreciation expense, buildings.... Depreciation, machinery. Depreciation, factory tools. Insurance expense....... P102,500 84,000 236,100 628,500 9,100 6,400 12,400 823,000 165,000 100,000 20,500 40,000 12,000 35,000 60.000 75.000 20.000 25,000 Expense allocations are to be made as follows: Administrative 5% Heat, light, & power Property taxes Depreciation, building Manufacturing 90% 80% 60% Selling 5% 10% 20% 10% 20% Inventories, June 30, 2018: Raw materials. Work in process.. Finished goods.... ..P96,000 124,000 .190,000 298 EXERCISE 8-2 The following account balances were selected from the adjusted June 30, 2018 trial balance of the PINPIN COMPANY: Inventories, Jan. 1. 2018: Raw materials. Work in process. Finished goods..... Purchases, materials.......... Purchases returns & allowances. Purchases discount.... Freight in...... Direct labor.. Indirect labor... Heat, light, & power.... Repairs & maintenance, machine... Property taxes... Miscellaneous factory expenses.. Delivery expense.... Depreciation expense, buildings.... Depreciation, machinery. Depreciation, factory tools. Insurance expense....... P102,500 84,000 236,100 628,500 9,100 6,400 12,400 823,000 165,000 100,000 20,500 40,000 12,000 35,000 60.000 75.000 20.000 25,000 Expense allocations are to be made as follows: Administrative 5% Heat, light, & power Property taxes Depreciation, building Manufacturing 90% 80% 60% Selling 5% 10% 20% 10% 20% Inventories, June 30, 2018: Raw materials. Work in process.. Finished goods.... ..P96,000 124,000 .190,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts