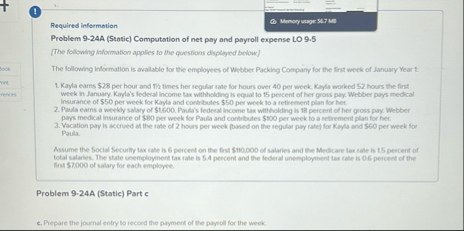

Question: Required infermation Mancor vasy tity un Problem 9 - 2 4 A ( 5 tatic ) Computation of net pay and payroll expense LO 9

Required infermation

Mancor vasy tity un

Problem A tatic Computation of net pay and payroll expense LO

The following information applies to the questions displiged below

The following information is avalable for the employees of Webber Packing Company for the finst week of January Year t: week in January, Kiyla's federal income lax withholding is equal to percent of her gross pay. Webber pays medical insurance of $ per week for Kayla and contrlbutes $ per week lo a retirement plan for hec.

Pada earns a weekly salary of $ Paula's federal income tax withlholding is is percent of her gross pay. Whbber

Vacation payy is accrued at the rate of hours per week foased on the regular pay ratelfor kayla and per weck for Paula. tolal salables. The state unemployment tax rate is percent and the federal unemployment tas rate is perceet of the Srst $ of salary for each employee.

Problem A Static Part

c Piepare the journal entry to recond the payment of the payeoll for the week.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock