Question: Required information AH 1 4 - 4 Net Present Value Analysis, Least - Cost Decision, Uncertain Cash Flows LO 1 4 - 2 , LO

Required information

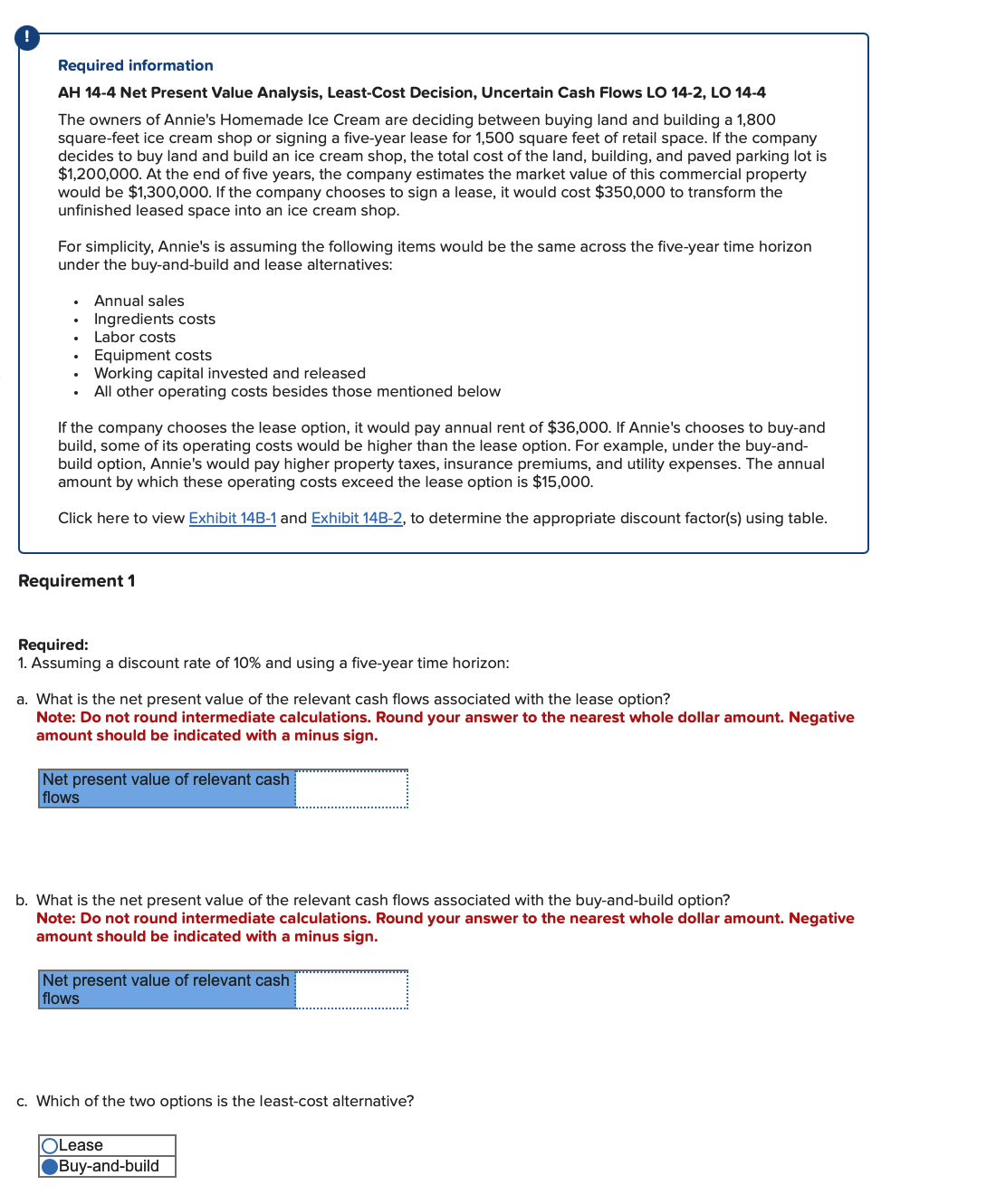

AH Net Present Value Analysis, LeastCost Decision, Uncertain Cash Flows LO LO

The owners of Annie's Homemade Ice Cream are deciding between buying land and building a

squarefeet ice cream shop or signing a fiveyear lease for square feet of retail space. If the company

decides to buy land and build an ice cream shop, the total cost of the land, building, and paved parking lot is

$ At the end of five years, the company estimates the market value of this commercial property

would be $ If the company chooses to sign a lease, it would cost $ to transform the

unfinished leased space into an ice cream shop.

For simplicity, Annie's is assuming the following items would be the same across the fiveyear time horizon

under the buyandbuild and lease alternatives:

Annual sales

Ingredients costs

Labor costs

Equipment costs

Working capital invested and released

All other operating costs besides those mentioned below

If the company chooses the lease option, it would pay annual rent of $ If Annie's chooses to buyand

build, some of its operating costs would be higher than the lease option. For example, under the buyand

build option, Annie's would pay higher property taxes, insurance premiums, and utility expenses. The annual

amount by which these operating costs exceed the lease option is $

Click here to view Exhibit B and Exhibit B to determine the appropriate discount factors using table.

Requirement

Required:

Assuming a discount rate of and using a fiveyear time horizon:

a What is the net present value of the relevant cash flows associated with the lease option?

Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. Negative

amount should be indicated with a minus sign.

Net present value of relevant cash

flows

b What is the net present value of the relevant cash flows associated with the buyandbuild option?

Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. Negative

amount should be indicated with a minus sign.

Net present value of relevant cash

flows

c Which of the two options is the leastcost alternative?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock