Question: ! Required information AH 6 - 4 Contribution Format Segmented Income Statements ( TDA ) LO 6 - 4 [ The following information applies to

Required information

AH Contribution Format Segmented Income Statements TDA LO

The following information applies to the questions displayed below.

Refer to the data in Exercise AH Assume Annie's Homemade Ice Cream divides its total mobile sales into three segments. The Corporate Subscriptions segment, which accounts for of mobile sales and has a variable expense ratio of refers to companies that purchase ice cream for their employees one day a month, every month of the year. The Food Truck segment, which accounts for of rnobile sales and has a variable expense ratio of includes selling ice cream at festivals, private venues, and locat microbreweries. The Catered Events segment, which accounts for of mobile sales and has a variable expense ratio of includes prepurchased ice cream deliveries for weddings, birthday parties, graduation parties, etc. All of the mobile sales' fixed expenses are common fixed expenses that could only be avoided by discontinuing all mobile sales.

Assume the Food Truck segment's total sales can be divided into three segmentsPrivate Venues, Festivals, and Microbreweriesas summarized in the visualizations below:

Food Truck Segment

Festivals

Private Venues

Microbreweries

Food Truck Segment Percent of Sales

Food Truck Sales and Variable Expenses

Rrev

of

Next

Requirement

Required:

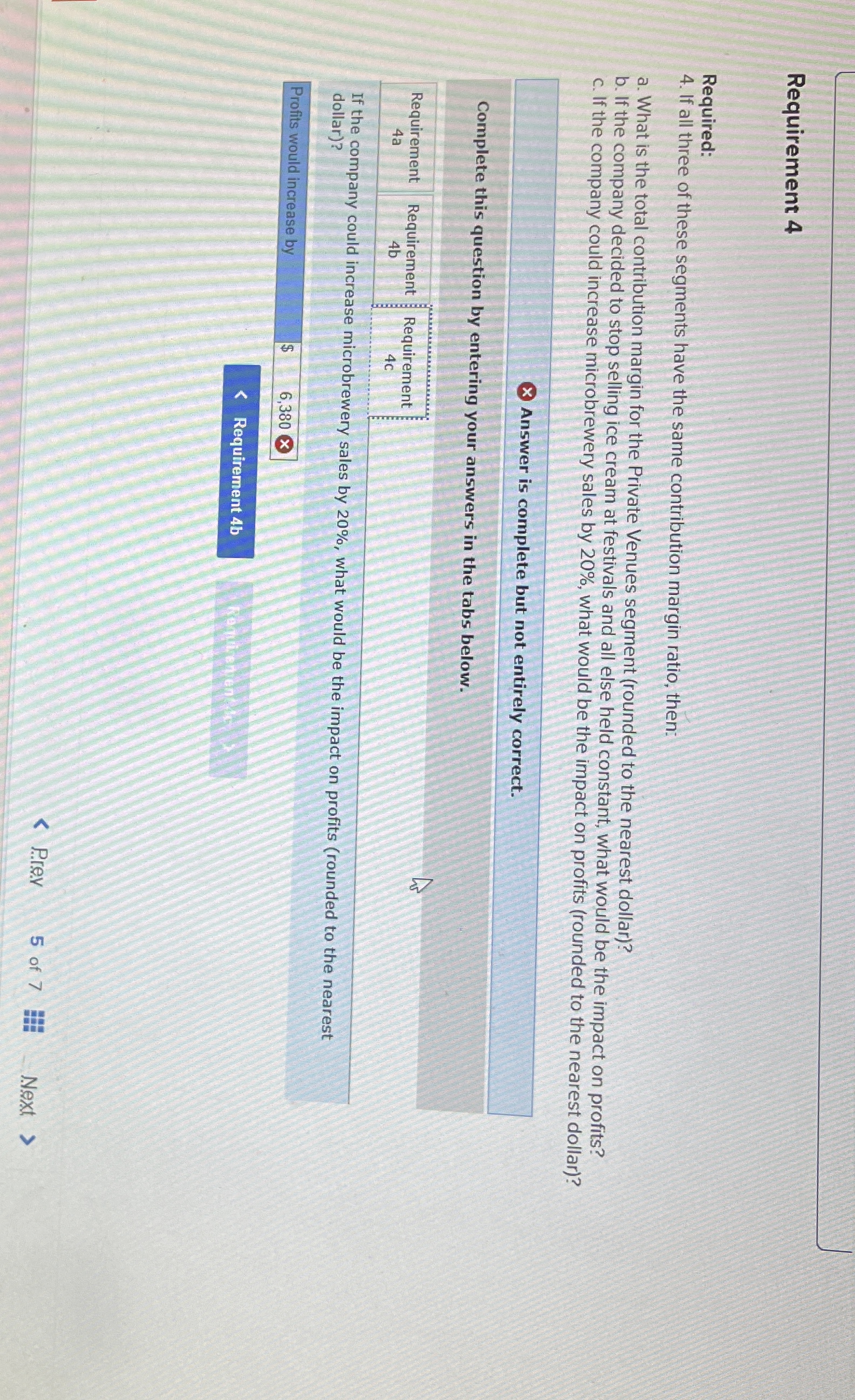

If all three of these segments have the same contribution margin ratio, then:

a What is the total contribution margin for the Private Venues segment rounded to the nearest dollar

b If the company decided to stop selling ice cream at festivals and all else held constant, what would be the impact on profits?

c If the company could increase microbrewery sales by what would be the impact on profits rounded to the nearest dollar

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Requirement

Requirement

Requirement

If the company could increase microbrewery sales by what would be the impact on profits rounded to the nearest dollar

Profits would increase by

$

Prey

of

Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock