Question: Required information Appendix A Continuing Payroll Project: Wayland Custom Woodworking (3 Months, Part 1) [The following information applies to the questions displayed below) Wayland Custom

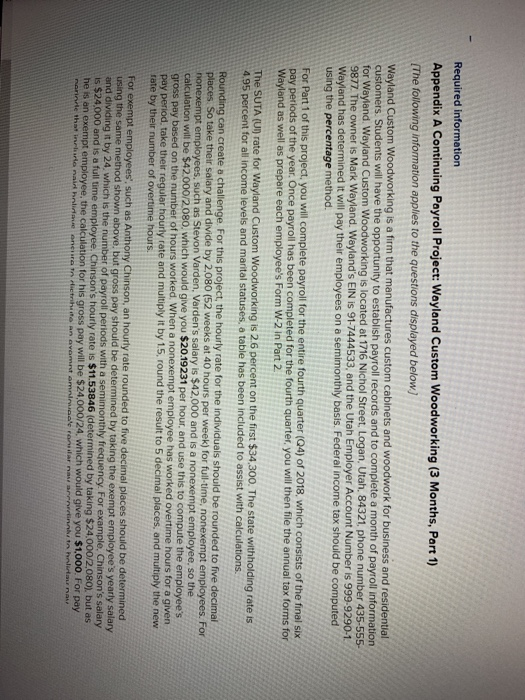

Required information Appendix A Continuing Payroll Project: Wayland Custom Woodworking (3 Months, Part 1) [The following information applies to the questions displayed below) Wayland Custom Woodworking is a firm that manufactures custom cabinets and woodwork for business and residential customers. Students will have the opportunity to establish payroll records and to complete a month of payroll information for Wayland, Wayland Custom Woodworking is located at 1716 Nichol Street, Logan, Utah, 84321 phone number 435-555 9877. The owner is Mark Wayland. Wayland's EIN IS 91-7444533, and the Utah Employer Account Number is 999-9290-1 Wayland has determined it will pay their employees on a semimonthly basis. Federal income tax should be computed using the percentage method. For Part 1 of this project, you will complete payroll for the entire fourth quarter (Q4) of 2018, which consists of the final six pay periods of the year. Once payroll has been completed for the fourth quarter, you will then file the annual tax forms for Wayland as well as prepare each employee's Form W-2 in Part 2 The SUTA (UI) rate for Wayland Custom Woodworking is 2.6 percent on the first $34,300. The state withholding rate is 4.95 percent for all income levels and marital statuses, a table has been included to assist with calculations Rounding can create a challenge. For this project, the hourly rate for the individuals should be rounded to five decimal places So take their salary and divide by 2,080 (52 weeks at 40 hours per week) for full-time, nonexempt employees. For nonexempt employees, such as Stevon Varden, Varden's salary is $42.000 and is a nonexempt employee, so the calculation will be $42.000/2.080, which would give you $20.19231 per hour, and use this to compute the employee's gross pay based on the number of hours worked. When a nonexempt employee has worked overtime hours for a given pay period, take their regular hourly rate and multiply it by 1.5, round the result to 5 decimal places, and multiply the new rate by their number of overtime hours. For exempt employees', such as Anthony Chinson, an hourly rate rounded to five decimal places should be determined using the same method shown above, but gross pay should be determined by taking the exempt employee's yearly salary and dividing it by 24, which is the number of payroll periods with a semimonthly frequency. For example. Chinson's salary is $24,000 and is a full time employee, Chinson's hourly rate is $11.53846 (determined by taking $24.000/2.080), but as he is an exempt employee, the calculation for his gross pay will be $24,000/24, which would give you $1.000. For pay nerite that in ta nair holi oneranderio nam omninusale onlar na retinit halua Required information Appendix A Continuing Payroll Project: Wayland Custom Woodworking (3 Months, Part 1) [The following information applies to the questions displayed below) Wayland Custom Woodworking is a firm that manufactures custom cabinets and woodwork for business and residential customers. Students will have the opportunity to establish payroll records and to complete a month of payroll information for Wayland, Wayland Custom Woodworking is located at 1716 Nichol Street, Logan, Utah, 84321 phone number 435-555 9877. The owner is Mark Wayland. Wayland's EIN IS 91-7444533, and the Utah Employer Account Number is 999-9290-1 Wayland has determined it will pay their employees on a semimonthly basis. Federal income tax should be computed using the percentage method. For Part 1 of this project, you will complete payroll for the entire fourth quarter (Q4) of 2018, which consists of the final six pay periods of the year. Once payroll has been completed for the fourth quarter, you will then file the annual tax forms for Wayland as well as prepare each employee's Form W-2 in Part 2 The SUTA (UI) rate for Wayland Custom Woodworking is 2.6 percent on the first $34,300. The state withholding rate is 4.95 percent for all income levels and marital statuses, a table has been included to assist with calculations Rounding can create a challenge. For this project, the hourly rate for the individuals should be rounded to five decimal places So take their salary and divide by 2,080 (52 weeks at 40 hours per week) for full-time, nonexempt employees. For nonexempt employees, such as Stevon Varden, Varden's salary is $42.000 and is a nonexempt employee, so the calculation will be $42.000/2.080, which would give you $20.19231 per hour, and use this to compute the employee's gross pay based on the number of hours worked. When a nonexempt employee has worked overtime hours for a given pay period, take their regular hourly rate and multiply it by 1.5, round the result to 5 decimal places, and multiply the new rate by their number of overtime hours. For exempt employees', such as Anthony Chinson, an hourly rate rounded to five decimal places should be determined using the same method shown above, but gross pay should be determined by taking the exempt employee's yearly salary and dividing it by 24, which is the number of payroll periods with a semimonthly frequency. For example. Chinson's salary is $24,000 and is a full time employee, Chinson's hourly rate is $11.53846 (determined by taking $24.000/2.080), but as he is an exempt employee, the calculation for his gross pay will be $24,000/24, which would give you $1.000. For pay nerite that in ta nair holi oneranderio nam omninusale onlar na retinit halua

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts