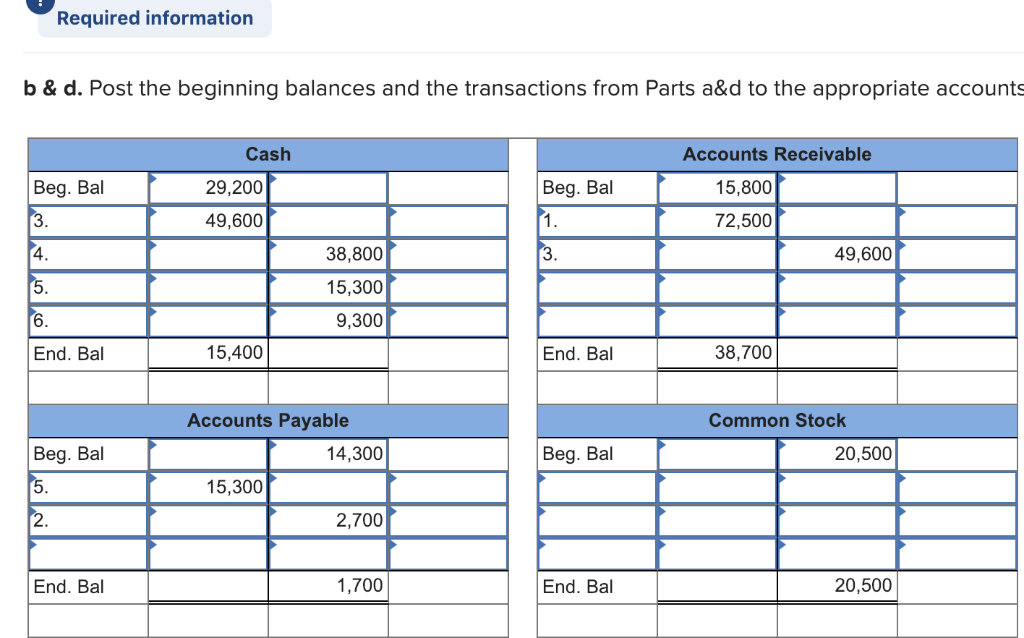

Question: Required information b & d. Post the beginning balances and the transactions from Parts a&d to the appropriate accounts Cash Accounts Receivable 29,200 49,600 Beg.

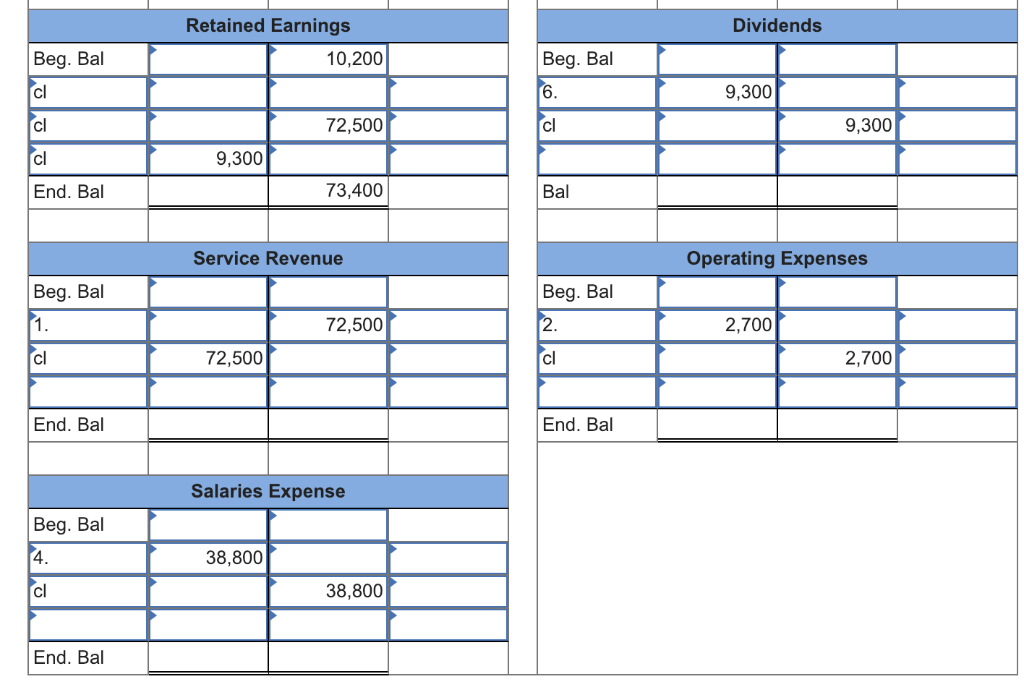

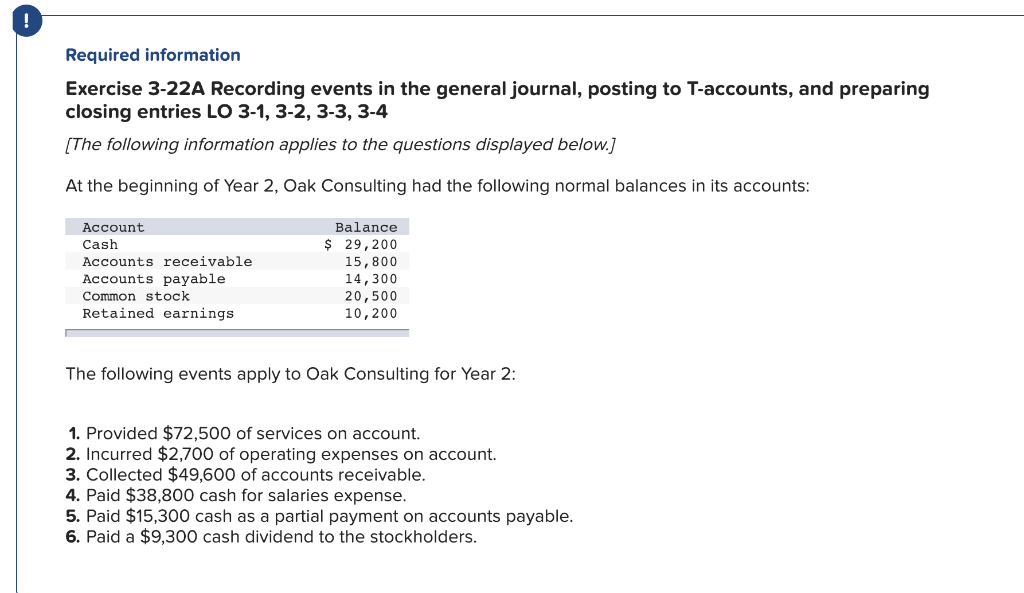

Required information b & d. Post the beginning balances and the transactions from Parts a&d to the appropriate accounts Cash Accounts Receivable 29,200 49,600 Beg. Bal Beg. Bal 15,800 72,500 38,800 15,300 9,300 4 49,600 End. Bal 15,400 End. Bal 38,700 Accounts Payable Common Stock Beg. Bal 14,300 Beg. Bal 20,500 15,300 2,700 End. Bal 1,700 End. Bal 20,500 Retained Earnings Dividends Beg. Bal cl cl cl End. Bal 10,200 Beg. Bal 9,300 72,500 cl 9,300 9,300 73,400 Bal Service Revenue Operating Expenses Beg. Bal Beg. Bal 72,500 2,700 cl 72,500 cl 2,700 End. Bal End. Bal Salaries Expense Beg. Bal 4 cl 38,800 38,800 End. Bal Required information Exercise 3-22A Recording events in the general journal, posting to T-accounts, and preparing closing entries LO 3-1, 3-2, 3-3, 3-4 The following information applies to the questions displayed below.] At the beginning of Year 2, Oak Consulting had the following normal balances in its accounts Account Cash Accounts receivable Accounts payable Common stock Retained earnings Balance 29,200 15,800 14,300 20,500 10,200 The following events apply to Oak Consulting for Year 2: 1. Provided $72,500 of services on account. 2. Incurred $2,700 of operating expenses on account. 3. Collected $49,600 of accounts receivable 4. Paid $38,800 cash for salaries expense 5. Paid $15,300 cash as a partial payment on accounts payable 6. Paid a $9,300 cash dividend to the stockholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts