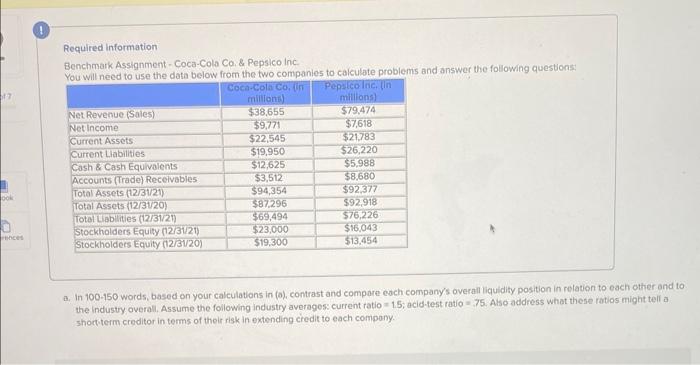

Question: Required information Benchmark Assignment-Coca-Cola Co. & Pepsico Inc. You will need to use the data below from the two companies to calculate problems and

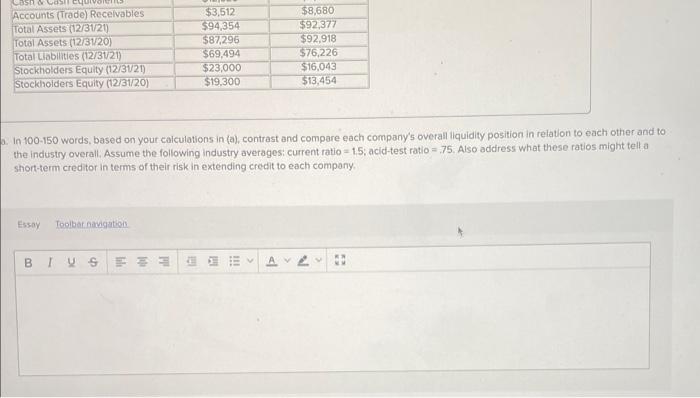

Required information Benchmark Assignment-Coca-Cola Co. & Pepsico Inc. You will need to use the data below from the two companies to calculate problems and answer the following questions: Coca-Cola Co. (in Pepsico Inc. (in 17 millions) millions) Net Revenue (Sales) $38,655 $79,474 Net Income $9,771 $7,618 Current Assets $22,545 $21,783 Current Liabilities $19,950 $26,220 Cash & Cash Equivalents $12,625 $5,988 Accounts (Trade) Receivables $3,512 $8,680 ook Total Assets (12/31/21) $94,354 $92,377 Total Assets (12/31/20) $87,296 $92,918 Total Liabilities (12/31/21) $69,494 $76,226 Stockholders Equity (12/31/21) $23,000 $16,043 rences Stockholders Equity (12/31/20) $19,300 $13,454 a. In 100-150 words, based on your calculations in (a), contrast and compare each company's overall liquidity position in relation to each other and to the industry overall. Assume the following industry averages: current ratio 1.5; acid-test ratio 75. Also address what these ratios might tell a short-term creditor in terms of their risk in extending credit to each company. Cash & Cas Accounts (Trade) Receivables Total Assets (12/31/21) $3,512 $8,680 $94,354 $92,377 Total Assets (12/31/20) $87,296 $92,918 Total Liabilities (12/31/21) $69,494 $76,226 Stockholders Equity (12/31/21) $23,000 $16,043 Stockholders Equity (12/31/20) $19,300 $13,454 In 100-150 words, based on your calculations in (a), contrast and compare each company's overall liquidity position in relation to each other and to the industry overall. Assume the following industry averages: current ratio = 1.5; acid-test ratio = 75. Also address what these ratios might tell a short-term creditor in terms of their risk in extending credit to each company. Essay Toolbar navigation BIVS AL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts