Question: Required information Case Summary: Each day as you work in your company's credit department, you must evaluate the credit worthiness of new and existing customers.

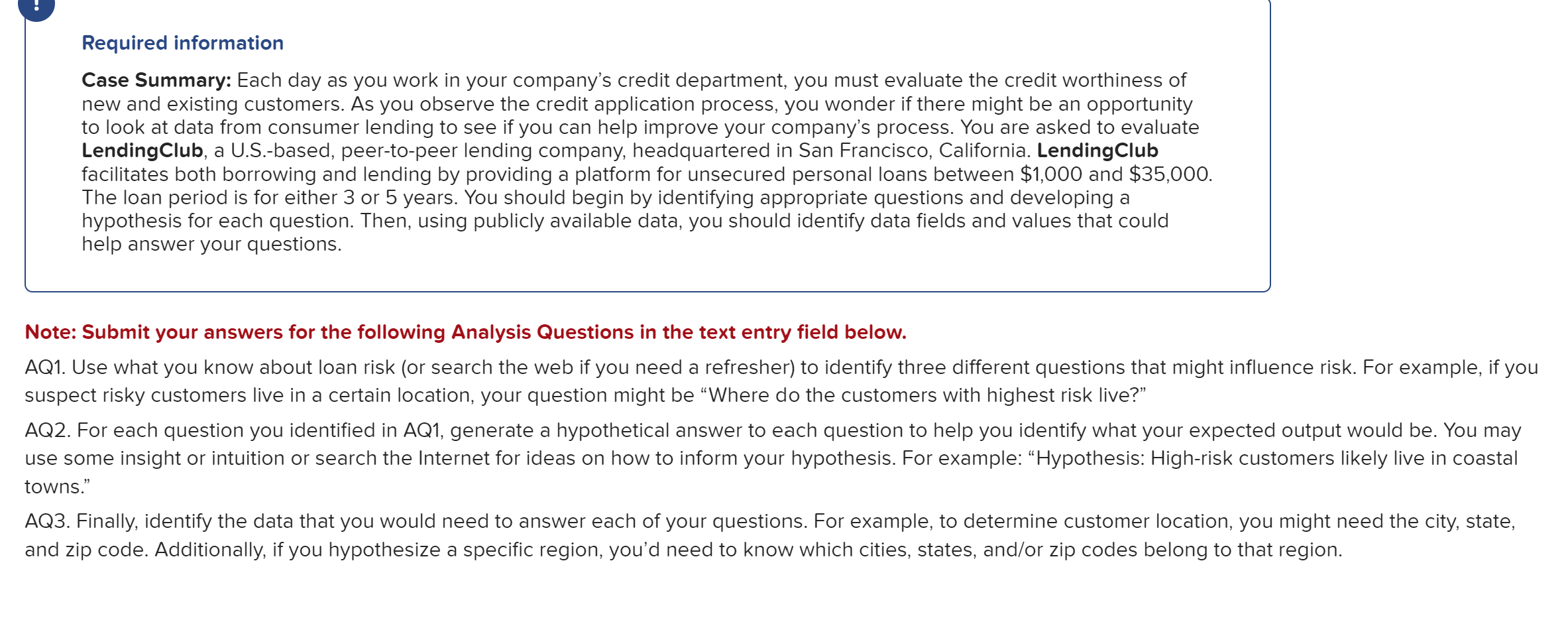

Required information Case Summary: Each day as you work in your company's credit department, you must evaluate the credit worthiness of new and existing customers. As you observe the credit application process, you wonder if there might be an opportunity to look at data from consumer lending to see if you can help improve your company's process. You are asked to evaluate LendingClub, a U.S.-based, peer-to-peer lending company, headquartered in San Francisco, California. LendingClub facilitates both borrowing and lending by providing a platform for unsecured personal loans between $1,000 and $35,000. The loan period is for either 3 or 5 years. You should begin by identifying appropriate questions and developing a hypothesis for each question. Then, using publicly available data, you should identify data fields and values that could help answer your questions. Note: Submit your answers for the following Analysis Questions in the text entry field below. AQ1. Use what you know about loan risk (or search the web if you need a refresher) to identify three different questions that might influence risk. For example, if you suspect risky customers live in a certain location, your question might be "Where do the customers with highest risk live?" AQ2. For each question you identified in AQ1, generate a hypothetical answer to each question to help you identify what your expected output woul use some insight or intuition or search the Internet for ideas on how to inform your hypothesis. For example: "Hypothesis: High-risk customers likely live in coastal towns." AQ3. Finally, identify the data that you would need to answer each of your questions. For example, to determine customer location, you might need the city, and zip code. Additionally, if you hypothesize a specific region, you'd need to know which cities, states, and/or zip codes belong to that region. Required information Case Summary: Each day as you work in your company's credit department, you must evaluate the credit worthiness of new and existing customers. As you observe the credit application process, you wonder if there might be an opportunity to look at data from consumer lending to see if you can help improve your company's process. You are asked to evaluate LendingClub, a U.S.-based, peer-to-peer lending company, headquartered in San Francisco, California. LendingClub facilitates both borrowing and lending by providing a platform for unsecured personal loans between $1,000 and $35,000. The loan period is for either 3 or 5 years. You should begin by identifying appropriate questions and developing a hypothesis for each question. Then, using publicly available data, you should identify data fields and values that could help answer your questions. Note: Submit your answers for the following Analysis Questions in the text entry field below. AQ1. Use what you know about loan risk (or search the web if you need a refresher) to identify three different questions that might influence risk. For example, if you suspect risky customers live in a certain location, your question might be "Where do the customers with highest risk live?" AQ2. For each question you identified in AQ1, generate a hypothetical answer to each question to help you identify what your expected output woul use some insight or intuition or search the Internet for ideas on how to inform your hypothesis. For example: "Hypothesis: High-risk customers likely live in coastal towns." AQ3. Finally, identify the data that you would need to answer each of your questions. For example, to determine customer location, you might need the city, and zip code. Additionally, if you hypothesize a specific region, you'd need to know which cities, states, and/or zip codes belong to that region

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts